Towards completing vietnam’s legal framework on ppp

However, due to an unsuccessful track record, the shortcomings of the country’s current legal regime are still present. This article takes a look at the significant changes and shortcomings under the new Draft, as well as examines international practice in the field as a basis for devising recommendations to form a more comprehensive and efficient system for PPPs.

Illustration photo

I. KEY HIGHLIGHTS OF THE UPCOMING REGULATIONS ON PPP

1. Governing scope

In comparison with the current regulations, the Draft supplements provisions to govern the management and procedures of state participation in PPP projects. Under these new provisions, the preparation, approval and disbursement of state funds to implement PPP projects must comply with the current regulations on managing state funds spent on development investment, as well as regulations on managing and using state property.

However, in order for the purpose and nature of investment projects attracting participation of public and private sectors to be consistent with international practice, the Draft is devised with specific preparation, approval and implementation mechanisms. These include preparation and approval for the list of projects, report of the pre-feasibility and feasibility study, mechanisms for selecting investors, and the implementation, supervision, management, settlement and transfer of the project.

2. General Definition of Investment under PPP form and the particular forms of project contracts

According to international custom, there is no unified definition of PPP projects. The forms of contract applied in PPP projects are various and subject to the need and conditions of private capital mobilization in each period. The United Nations defines PPP as innovative methods used by the public sector to contract with the private sector, who bring their capital and their ability to deliver projects on time and to budget, while the public sector retains the responsibility to provide these services to the public in a way that benefits the public and delivers economic development and an improvement in the quality of life.(1)

Based on the definition of BOT, BTO and BT provided under Decree No. 108/2009/ND-CP, the Draft stipulates that investment in the form of a PPP constitutes a form of investment under which the contract is signed between a competent state agency and an investor to build, renovate, upgrade, expand, manage and operate the infrastructure projects or to provide services in specific fields provided in the Draft.

In addition to the forms of BOT, BTO and BT defined under Decree No. 108/2008/ND-CP, the Draft provides some other forms of project contracts which are designed based on model project contracts of other countries, including:

- Build – Own – Operate (BOO);

- Design - Build – Finance – Maintain – Operate – Transfer (DBFMOT);

- Build – Finance – Operate – Maintain (BFOM); and

- Operate – Maintain (O&M).

3. Investment sectors in PPP form

Under the current PPP regime, sectors eligible for investment under a PPP form include:

- roads, road bridges, road tunnels and ferry landings;

- railways, railway bridges and railway tunnels;

- urban transport;

- airports, seaports and river ports;

- clean water supply systems;

- power plants;

- healthcare;

- environment (waste treatment plants); and other projects on development of infrastructure and provision of public services under the Prime Minister's decisions.(2)

In addition to the sectors above, the Draft provides an expanded list of sectors under which projects may be eligible for PPP funding. These include:

- education, training, sports infrastructure and working offices for state agencies;

- information technology, telecommunications infrastructure and agricultural production infrastructure; and

- public housing, leisure centers and cemetery infrastructure.

1 United Nations Economic Commission for Europe, Guide Book In Promoting Good Governance In Public Private Partnerships, ECE/CECI/4, United Nations, 2008.

2 Article 4, Decision No. 71/2010/QD-TTg Promulgating the Regulations on Pilot Investment for Public-Private Partnership Forms dated November 09, 2010.

4. Government contribution

The current PPP regime sets the maximum proportion of government contribution at 30%.

This ceiling amount is abolished under the Draft, which now maintains two positions on the maximum level of government contribution allowable. The first is that the State can contribute a maximum of 49% of the total investment capital. The second is that there no statutory limit on government contribution.

The proposal to abolish the statutory limit on government contribution towards PPP projects altogether has recently been approved by the authorized agency. Accordingly, state participation will be determined on the basis of the specific financial plan of each project.3

5. The expenses allocated from the State Budget

Under the current system, the State covers the expenses for making and announcing lists of projects and selecting investors, as well as expenses for formulating and appraising project feasibility study reports.

According to the Draft, in addition to those expenses, further expenses allocated from the State Budget will be allocated for preparing and managing the project, formulating and appraising the pre-feasibility study report, and inspecting the quality, value and practical conditions of the work.

The new Draft also allows for reimbursement to private sector investors for the cost of project proposals by the selected investor in cases where their proposals are rejected.

II. ISSUES TO BE ADDRESSED

1. Government’s guarantee

Under the Draft, the basic provisions for investment incentives and investor support have been carried forward from the current regulations on PPP. Accordingly, the investment incentives and support, guarantee of obligations for investors, right to mortgage assets, assurance for provision of public services and right to dispute resolution that are currently in force have been maintained in the Draft.

However, the investment guarantee and support mechanisms have still been unable to provide and foster a transparent investment environment to inspire investor confidence. There are three main reasons for this:

First, regarding the balance between foreign currencies and domestic currencies, the Government simply ensures that the money demand is equal to the money supply. The Government does not fix the exchange rate to hedge against exchange rate fluctuations.(4)

3 Clause 1(d), Notice No. 28/TB-VBCP dated January 21, 2014 on the Conclusion of Deputy Prime Minister Hoang Trung Hai – Head of the Steering Committee on Public-Private Partnerships.

4 Clause 1(g), Notice No. 28/TB-VBCP dated January 21, 2014 on the Conclusion of Deputy Prime Minister Hoang Trung Hai – Head of the Steering Committee on Public-Private Partnerships.

Second, the Government’s guarantee of revenue will only be considered in specific cases based on the financial plans of the projects.(5)

Third and most important, the Government disregards political factors affecting the project implementation. Events that arise out of political reasons are almost always beyond the investors’ control and may lead to unexpected (and adverse) implications. Therefore, as the head of the country’s political environment, the Government should take into account political risks in PPPs. For this reason, it is recommended that stabilization clauses in PPP contracts are acknowledged.

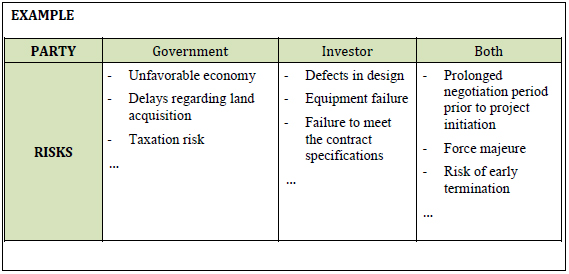

2. Risk Allocation

In addition to political risks, the balance of PPP contracts also unveils the relationship between the public sector and the private sector in terms of risk allocation.

Risk allocation is one of the most common concerns expressed by foreign investors entering a partnership with the State. This is unsurprising, as the Government often neglects to properly assign the risks between the parties.

The issue, therefore, is how are the parties able to manage risk in a specific project contract ?

In practice, the Government will often attempt to pass all the risks onto the investors. The investors, in turn, generally accept these risks but then seek to extend the completion schedule to raise expenses. Consequently, it can be said that PPPs in Vietnam lack contractual balance and fail to precisely reflect the nature of the partnership model.

Articles 1, 17, 20 and 36 of the Draft stipulate that the rights, obligations and risk allocation of the public partner and the private partner must be clarified. Despite this stipulation, there is still a discernible failure in the risk management stages.

Therefore, in order to address the matter of identification, classification and allocation of risks in PPPs, Vietnam should consider the approach of other jurisdictions and adopt a reasonable approach by these countries’ legislation and experts.

5 Clause 1(g), Notice No. 28/TB-VBCP dated January 21, 2014 on the Conclusion of Deputy Prime Minister Hoang Trung Hai – Head of the Steering Committee on Public-Private Partnerships.

6 Merna, A. and Smith, N.J. (1996), Guide to the Preparation and Evaluation of Build – Own – Operate – Transfer Project Tenders, Asia Law & Practice Ltd, Hong Kong, China.

III. RISK ALLOCATION FROM AN INTERNATIONAL PERSPECTIVE– IMPLICATIONS FOR VIETNAM

1. Risk Classification

Empirical experience shows that the risks vary in terms of the criteria from classification, and differs depending on the size, nature and form of the contracts of the specific PPP projects.

Generally, the risks can be separated into two categories: global risks and elemental risks.6 These risks are then further categorized. Global risk can be divided into four sections: political risk, legal risk, commercial risk and environmental risk. Elemental risks capture the risks associated with elements of the project – e.g., implementation risk and operational risk and, for some projects, financial risk and revenue risk. Elemental risks are more likely to be controlled or managed by the project team.(7)

2. Principle of Risk Allocation

There are three methods to handling risks arising out of or in relation to PPP projects: sharing risks, retaining risks and transferring risks. Sharing risks means the risks are distributed between the parties. Retaining risks means each party is to suffer from the loss caused due to the retained risks. Transferring risks means a party transfers risks to the other party to minimize the loss on its side.(8)

Malaysian experience affirms that “the optimal sharing of risks [is where] risk is allocated to the party who is best able to manage it”.(9) Thus, it has been suggested that risks affected by political elements (e.g., public inquiries, approvals and regulatory barriers), finance (e.g., inflation and interest rate shifts) and the legal environment (e.g., enactment or repeal of statute and directives) should be retained by governments, whereas the risks controllable or manageable by the project team should be retained by investors. Risks arising out of supply and demand should be shared between the parties.(10)

Furthermore, under the European approach, decisions concerning the treatment of PPPs stipulate that a private partner will be assumed to bear the balance of the PPP risk if it bears most of the construction risk, and either most of the availability risk (also referred to as performance risk) or most of the demand risk.(11) Construction risk covers events such as late delivery, low standards, additional costs, technical deficiencies and other external negative effects. Availability risk relates to the ability of the private partner to deliver the agreed volume and quality of service. Demand risk covers the impact of the business cycle, market trends, competition and technological progress on the continued need for the service. Changes in demand due to changes in government policy are excluded .(12)

The European approach can be construed as being more likely to impose the obligation to bear risks on private partners based on the factors raised in relation to the performance of projects.

On the contrary, the public partner normally bears the availability risk and demand risk. Under the circumstances of availability risk, the Government will be assumed not to bear such risk if it is entitled to apply penalties if the private partner does not meet the required quality standards. As for demand risk, the Government will be assumed to bear such risk if it is obliged to ensure a given level of payment to the partner independent of the effective level of demand expressed by the final user.

Hence, a principle of risk management can be generalized as follows:

- The Government should handle the risks arising from macro conditions.

- The investors should handle specific project risks.

- Both the Government and the investors should share the risks under both their control.(13)

7 Norazian Mohamad Yusuwan (2009), Risk Management Practices amongst Quantity Surveyor (Qs) in Malaysian Construction Industry, RMIIDKP/i/OOI, p. 12.

8 Charoenpornpattana, S. and Minato, T. (1999), Privatization-induced Risks: State-owned Transportation Enterprises in Thailand, in Proceedings of Joint CIB Symposium on Profitable Partnership in Construction Procurement (London: E & FN Spon).

9 Public-Private Partnership Unit, Prime Minister Department, Public – Private Partnership (PPP) Guidelines, Clause 2(2)(viii).

10 Liu, X. P., and Wang, S. Q. (2006), Risk Allocation Principle and Framework for PPP Projects, Construction Economics, 2(1), pp. 59-63.

11 Statistical Office of the European Communities, New Decision of Eurostat on Deficit and Debt: Treatment of Public-Private Partnerships, press release STAT/04/18 dated 11 February 2004, p. 1

12 Editorial, Public Private Partnerships: The Challenges and Opportunities for Delivering Public Services in the 21st Century, 2010 Eur. Pub. Private Partnership L. Rev. 1 2010, pp. 10-11.

13 Huynh Thi Thuy Giang (2012), PPP in development of Road Infrastructure in Vietnam, Ho Chi Minh City University of Economics, p. 30.

3. Implication for Vietnam and recommendations

As the Draft is currently just a framework for PPP activity, further decrees and instructions are expected to come into play after new PPP regulations are issued. However, at a minimum, Government guarantees and risk management should be considered as key factors in the country’s steps towards attracting and promoting PPP investment.

In light of influential texts by scholars of numerous jurisdictions and the approach taken by Malaysia and Europe, Vietnam should consider the following recommended action plan:

First, the principle of risk allocation should be adopted, which provides that the party with the capacity to control or manage the risk has the obligation to bear them.

Second, this principle of risk allocation should be certified and clarified not only in regulations, but also in the PPP contracts.

Third, in order to further ensure the balance in project contracts between the Government and the investors, the Government must make a firm investment guarantee and support regime for the investors.

Dr. Le Net

Tran Ngoc Linh Tam

This article was prepared by LNT & Partners Lawyers: Dr. Le Net and Associate Tran Ngoc Linh Tam for customer’s reference only, it is not a legal opinion for any particular case. Any query, please contact our lawyers

( Net.le@LNTpartners.com ) for further information and consultation.

Click here to download (PDF file):

>> Legal Briefing October 2013

>> Legal Briefing December 2013

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Latest News

More News

- The wider benefits of digital signatures in e-transactions (April 18, 2022 | 11:31)

- Interpreting new real estate statutes (August 23, 2021 | 09:20)

- Mitigating procedural delays in pharmaceutical market (July 12, 2021 | 13:00)

- Pros of sandbox regulation for fintech (July 09, 2019 | 13:36)

- Wind power barriers need removing (April 02, 2019 | 09:55)

- Advice for foreign home ownership (November 16, 2015 | 08:37)

- Revised legal framework benefits foreign investors (October 26, 2015 | 07:36)

- Important documents regulating bank guarantee (September 19, 2015 | 11:11)

- Law Changes Open up Opportunities in Property Sector But Questions Remain (September 04, 2015 | 11:27)

- Decree eases constraints (July 27, 2015 | 08:48)

Mobile Version

Mobile Version