Tax reform and transfer pricing

|

New regulations

One of the intentions of MoF is to adopt and implement the Organization for Economic Co-operation and Development’s (OECD) base erosion profit shifting (BEPS) recommendations on transfer pricing (TP) as they are relevant to Vietnam, with the release of the latest version of the draft TP decree on October 26, 2016. This decree will also aim to prevent the loss of tax revenue, so diligent enforcement is expected once approved before the end of the year, with potential effect from January 1, 2017.

The reform intends to modernise the TP regime beyond the review of contractual arrangements, to an analysis of the substance linked to value creation. It is expected that tax authorities may consider contractual arrangements before reviewing the actual transactions based on business facts and substance, in order to reduce the burden of proof for taxpayers. The draft decree also introduces and enhances a number of principles and rules, including the substance over form principle, measures for the comparability of related-party transactions against independent transactions (the arm’s length requirement), and consideration of development, enhancement, maintenance, protection, and exploitation (DEMPE) functions with respect to intangibles. The application of such principles will enable the tax authorities to disregard or re-characterise related-party transactions in instances when those transactions result in reduced tax revenue.

Additional guidance for tax deduction of inter-group service fees and inter-company loan interest expenses is also expected in the new decree, since these types of intercompany transactions are widely recognised as profit-shifting tools used in complex international tax planning. Similarly, an increased level of review is expected for local companies performing royalty payments related to the use of intangibles which may not be appropriate related to intermediate or semi-finished goods. These transactions may be considered as harmful tax practices by the General Department of Taxation (GDT).

The draft decree, for the first time, introduces new reporting and documentation requirements in line with OECD’s recommendations under BEPS Action 13, re-examining TP documentation, such as the master file, the local file, and country-by-country reporting. This is besides for revised annual disclosure requirements, which have been already finalised in countries with strong business ties to Vietnam, such as many of the member countries in the European Union, Japan, South Korea, and China.

Basically, the master file, the local file, and country-by-country reporting will create way more transparency between taxpayers and tax authorities beyond the boundaries of Vietnam. For the first time, tax authorities will – via the master file and country-by-country report – have a good view of where value is created, and in which tax jurisdictions multinationals make profits and pay taxes.

The contemporaneous documentation requirement is clearer and stricter in the draft decree than under current rules. In particular, the draft decree states that the documentation must be available before the corporate tax return’s filing date, which raises concerns regarding the lack of financial information on comparable companies to enable year-on-year benchmarking analysis. Additional guidance and clarification around this critical point is expected from MoF in the final decree. It is expected that the latest year comparables’ data can be used where the current year’s data is not yet available at the time of preparing the master file and local file, and corporate tax return filing.

Clearer bases have been given for the tax authorities’ presumptive assessment in instances of taxpayer failures to have or provide documentation. Similarly, the use of secret comparables is being considered for tax risk assessments by GDT, with consideration for the use of commercial databases and public information to prevail in case of a proposed tax assessment during a TP audit. However, in some TP audit cases, where taxpayers fail to submit the forms or the TP documentation within the statutory timeline, the tax authorities would have absolute power to assess the price and/or profits of the taxpayers based on their secret comparables.

Certain thresholds are also provided for exemption from the documentation rules (but submission of a declaration of related-party transactions is still required), such as the taxpayer’s annual revenue not exceeding VND50 billion ($2.27 million) and the total value of the related-party transactions not exceeding VND30 billion ($1.36 million), or in a case where the taxpayer has concluded an Advance Pricing Agreement (APA) with tax authorities.

In addition, thresholds of profit margin for some specific industries have been proposed, which would raise some concerns regarding benchmarking analysis for purposes of establishing such a threshold. There is also the question of whether or not in practice the local tax authorities would use such a threshold to make TP adjustments for taxpayers, even when they have TP documentation.

|

Impacts on multinationals and local corporations

More than ever, multinationals and subsidiaries in Vietnam are required to be much more diligent about their TP arrangements and prepare for the imminent enforcement of the new decree. They must also ensure consistency with mandatory filing requirements from parent companies in accordance with BEPS regulations of their country of residence, and in connection with trade agreements previously signed with Vietnam.

The decree is also applicable to Vietnamese corporations having related party transactions, especially cross-border transactions with overseas related parties.

For many multinationals, this will be a significant and fundamental change from their historic TP practices. They should be prepared to extend documentation compliance efforts to review their TP policies and strategies, and prepare pro-active defence plans to navigate the contemporary tax framework in Vietnam.

Vietnam-based subsidiary parts of multinational groups will be required to revise their current TP policies with coherent, consistent, and more evident alignment of substance and value creation to distinguish the entrepreneurial role of parent or holding companies. They must also be more transparent about their connection with intangible ownership, risks assumed and controlled, and relevant transactions for the local file. This is particularly true for those with transactions with preferential regimes, for which the risk may rely on potential re-characterisation of entities or transactions – which could result in double-taxation.

This represents a serious issue for the multinational groups, given the expected time-consuming process to deal with competent authority divisions in Vietnam. It will require further international tax analysis beyond TP and into relevant tax treaties, if any are available for the respective country of origin for the parent or holding company.

Time to prepare

Companies should consider conducting a comprehensive risk assessment and readiness analysis for the regulatory change, to understand their particular impact, and adherences or differences of their current TP policies with the new regulations and beyond. The new regulations also intend to prevent treaty abuse, address challenges arising from the digital economy, and most importantly counter perceived harmful tax practices.

Navigating the proliferation of BEPS-driven requirements with a limited budget will require a careful, risk-based approach to reduce the likelihood of challenges, limit potential double taxation, and align tax goals with business objectives, especially since new rules always raise interpretation issues.

Forward-thinking companies should embrace the tax reforms and regulatory changes to use their TP policies as strategic tools for business operation and supply chain decisions in Vietnam, as well as for global tax planning.

Once implemented, GDT should enhance its capacity building and maintain interaction with relevant international organisations such as OECD, the World Bank Group, and the G20 Development Working Group (DWG) to enforce the new decree in a manner that results in efficiency. This is especially important in instances where income may go untaxed, but also should enable businesses investing in Vietnam under non-harmful tax practices to ease the administrative burden when operating in the country.

An overview of BEPS, and Vietnam’s responses

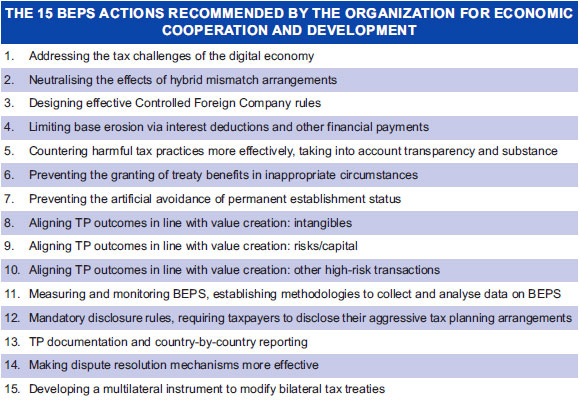

On October 5, 2015, OECD issued a final package of reports in connection with its action plan to address BEPS, as well as a plan for follow-up work and a timetable for implementation. OECD’s BEPS action plan, which was launched in July 2013 and endorsed by the G20, includes 15 key areas for identifying and curbing aggressive tax planning and practices, and modernising the international tax system.

Many countries have already adopted or are poised to adopt changes to their international tax systems based on OECD’s recommendations. While implementation and timing will vary across borders, this final OECD release marks a crucial shift from the recommendation and consultation phase of BEPS to legislation and implementation.

GDT has recently established a steering committee, led by its director general Bui Van Nam, to work on the different BEPS actions. These include TP, treaty abuses, permanent establishments, addressing tax challenges raised by the digital economy, and limiting base erosion via interest deductions. While Vietnam’s fiscal

authorities embracing changes in line with international tax reforms is welcomed, it is important to note that measures to protect the tax base need to be implemented in tandem with tax administration reforms, including capacity building, tax risk management, and tax dispute resolution.

By Hoang Thuy Duong-Partner in charge of Integrated International Tax at KPMG in Vietnam

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Latest News

More News

- KPMG launches tariff modeller in Vietnam to navigate US tariff risks (July 29, 2025 | 12:11)

- Removing hidden barriers to unlock ASEAN trade (June 29, 2025 | 11:31)

- New report charts path for Vietnam’s clinical trial growth (May 21, 2025 | 08:58)

- TTC Agris strengthens market position with investment in Bien Hoa Consumer JSC (May 19, 2025 | 10:14)

- World Bank to help SBV build shared database for banking industry (April 09, 2025 | 08:55)

- New trade alliances and investment hubs are redefining global power dynamics (April 03, 2025 | 17:00)

- ACCA and KPMG forge path for business leaders to pioneer ESG excellence (March 07, 2025 | 10:09)

- VietBank signs MoU with KPMG (February 26, 2025 | 18:47)

- Warrick Cleine MBE: an honour for services to British trade and investment in Vietnam (December 31, 2024 | 20:16)

- KPMG report offers fresh insight into leveraging AI (December 24, 2024 | 09:23)

Mobile Version

Mobile Version