M&A in banking unlikely to pick up soon

|

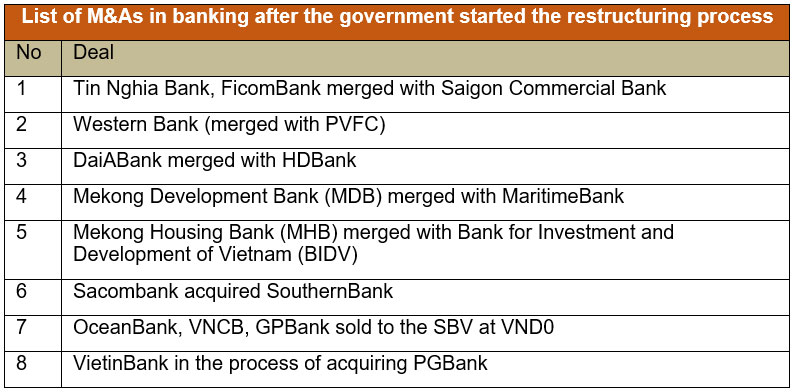

According to Le Minh Hung, governor of the State Bank of Vietnam (SBV), the government has recently made a few steps aiming to accelerate the restructuring of the banking system and dealing with bad debts, but there are many prevailing issues.

The deadline for application of Basel II is coming soon, putting pressure on small banks, especially those that have not been able to raise capital in the past few years. such as Saigonbank. and banks that have a capital verging on the required minimum of VND3 trillion ($132 million). Experts in the field said that in order to survive, small banks have only one solution, which is M&A.

Bach An Vien, head of research at KIS Securities, said that currently bad debts are being resolved and banks’ operations are stabilising, with most failing banks having been sold at VND0 to the SBV. Therefore, there are not many M&A on the horizon in the banking sector.

Le Anh Tuan, head of research at Dragon Capital, said that M&A in banking in the next period will not be as exciting as it used to be because domestic investors do not have enough money to buy banks, while it is difficult to attract foreign investors to buy banks due to the foreign ownership limit.

Moreover, the bad debt issue persists. Vincent Conti, economist of S&P Asia, said at HSBC’s March 23 conference on Vietnam’s economic outlook for 2017 that lending is very high. The country has a history of high inflation and instability. Government debt is also high and increasing. He prescribed that Vietnam should push the resolution of bad debts.

|

Meanwhile, Vietnam Asset Management Company is like a warehouse holding bad debts without doing anything to resolve them. It only took the bad debts off banks’ balance sheets for five years at most. Pham Hong Hai, CEO of HSBC Vietnam, said Vietnam does not use the state budget to resolve bad debts, so banks still have to allocate finances for this themselves. Economist Can Van Luc earlier said that one of the key ways to resolve bad debts is to have a legal framework to establish a debt market.

| RELATED CONTENTS: | |

| Vietnamese banks’ growth unsustainable | |

| Basel II inevitable for Vietnamese banks | |

| SBV announces compulsory M&A for weak banks | |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Latest News

More News

- SSC steps up engagement with FTSE Russell on market reforms (February 09, 2026 | 17:33)

- IFC considers $50m trade finance guarantee facility for Nam A Bank (February 09, 2026 | 17:28)

- Hoa Phat Agricultural Development debuts shares on HSX (February 06, 2026 | 14:00)

- Vietcap’s VAD 2026 draws strong global investor turnout (February 06, 2026 | 13:30)

- New rules ease foreign access to Vietnam equities (February 05, 2026 | 17:29)

- 0.1 per cent tax proposed on each transfer of digital assets (February 05, 2026 | 17:27)

- Ministry of Finance tightens policy delivery at start of year (February 05, 2026 | 17:26)

- Vietnam steps up market reforms as FTSE Russell reviews upgrade progress (February 05, 2026 | 17:20)

- 2025 profits mixed amid strong energy and farming results (February 05, 2026 | 17:18)

- Cashless payments hit 28 times GDP in 2025 (February 04, 2026 | 18:09)

Mobile Version

Mobile Version