What does HSC expect from loss-making Vinasun?

|

| 2018 is the fourth consecutive year that Vinasun approves lower business targets |

HSC has just announced buying 7.2 million shares of Vietnam Sun Corporation (Vinasun, code: VNS), equalling 10.61 per cent. It held only 8 VNS shares before.

The transaction took place on May 25, when GIC Private Limited sold a total of 5.4 million VNS shares on the Ho Chi Minh City Stock Exchange (HSX). This Singaporean investment fund fully divested Vinasun at only 40 per cent of the original purchasing price, losing approximately VND120 billion ($5.3 million) in four years.

At the average price of VND14,000 apiece, HSC is estimated to spend over VND100 billion ($4.4 million) becoming a large shareholder of Vinasun.

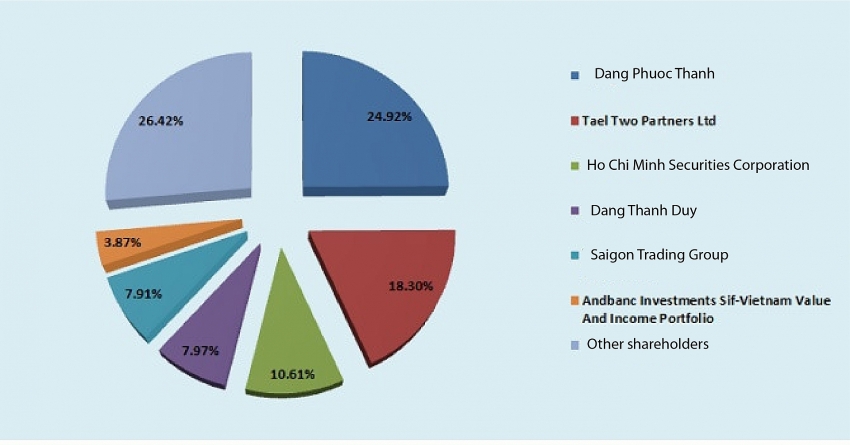

After this “low-cost” transaction, HSC became the third largest shareholder of Vinasun, behind chairman Dang Phuoc Thanh and his family (35 per cent) and Singaporean investment fund TAEL Two Partners Ltd. (18.3 per cent).

As a securities corporation, HSC’s investment may be based on the expectation of recovering VNS after it hits rock bottom. However, HSC may be an intermediate unit of another investor.

|

| Major shareholders of Vinasun |

HSC’s investment came as the taxi firm slipped into the red and its stock fell sharply. From the VND36,000 height in 2014, VNS has dropped to around VND14,000, losing 60 per cent of its share value.

In 2018, Vinasun approved lower business targets for the fourth consecutive year, with VND2.16 trillion ($95.2 million) in revenue, down VND1.07 trillion ($47 million) compared to the actual revenue from last year. Net revenue from taxi services and franchising is expected at VND2 trillion ($88 million), and the remaining revenue will come from the liquidation of assets.

The sharply reduced targets are due to the competition with ride-hailing services, in light of which Vinasun also forecast after-tax profit to halve against last year, falling to VND95 billion ($4.2 million), the lowest over the last nine years.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- The generics industry: unlocking new growth drivers (February 04, 2026 | 17:39)

- Vietnam ready to increase purchases of US goods (February 04, 2026 | 15:55)

- Steel industry faces challenges in 2026 (February 03, 2026 | 17:20)

- State corporations poised to drive 2026 growth (February 03, 2026 | 13:58)

- Why high-tech talent will define Vietnam’s growth (February 02, 2026 | 10:47)

- FMCG resilience amid varying storms (February 02, 2026 | 10:00)

- Customs reforms strengthen business confidence, support trade growth (February 01, 2026 | 08:20)

- Vietnam and US to launch sixth trade negotiation round (January 30, 2026 | 15:19)

- Digital publishing emerges as key growth driver in Vietnam (January 30, 2026 | 10:59)

- EVN signs key contract for Tri An hydropower expansion (January 30, 2026 | 10:57)

Tag:

Tag:

Mobile Version

Mobile Version