VNPT’s transformational restructuring

|

| Prime Minister Nguyen Xuan Phuc lauded VNPT's successful restructuring |

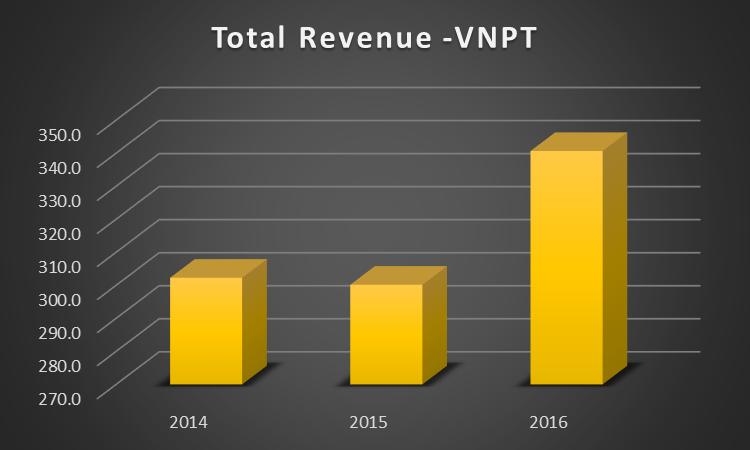

Substantial revenue

During the three years between 2014 and 2016 VNPT carried out vigorous restructuring in accordance with Decree No. 888/QD-TTg dated June 10, 2014 issued by the Prime Minister. The company was asked to rearrange its apparatus of 3600 staff members and promote professionalism, originality and efficiency. VNPT was also ordered to change units, apply new business models and management methods, as well as establish three main corporations in network infrastructure (VNPT-Net), telecommunications services (VNPT- Vinaphone), and communications (VNPT- Media).

At the same time, VNPT had to ensure that business remains stable, keeping its market share and ensuring the lives of its workers. VNPT had not only successfully completed the restructuring of the entire company in accordance with the demands and timeline proposed by the government, but has produced impressive performance in its manufacturing and trading activities that many state corporations aspire to achieve.

In details, in the past three years (between 2014 and 2016), VNPT Corporation’s consolidated revenue reached $6.8 trillion, increasing by an average 4.3 per cent annually, while reporting a consolidated profit of $450 million, increasing by 25 per cent annually. These revenue and profit figures do not include figures from MobiFone, VNPost, Posts and Telecommunications Institute of Technology, and Central Post Office, because these agencies had been separated from VNPT.

Profit before tax was $115.6 million in 2014, $155.9 million in 2015, and $182.2 million in 2016.

Previously, during 2011-2015, the total profit was $538 million, with an average growth rate of 2.1 per cent per year. Between 2013 and 2015, the average growth rate was 17.9 per cent per year.

“In conclusion, during the last three consecutive years (2014 to 2016), VNPT’s total profit increased by more than 20 per cent per year. The corporation’s total profit has tripled thanks to restructuring in the right direction,” said Pham Duc Long, VNPT general director.

The positive results of VNPT’s restructuring have been acknowledged by Prime Minister Nguyen Xuan Phuc at a meeting in August 2016. The prime minister was highly appreciative of the restructuring process, saying in a short period of time VNPT had produced spectacular results and conjured up a great business management apparatus, improved service quality, as well as increased revenue and profit.

Rookies take the lead

Contributing the most to the corporation’s impressive manufacturing and trading operations were the “products” of the restructuring process: core, specialised, and professional businesses operating according to the new business model. It was these companies that brought about new energy, more revenue, and huge profit for VNPT.

The most typical example is VNPT VinaPhone. In 2016, the company earned a revenue of $1.6 billion with a profit of $48.3 million. “Newbie” VNPT Technology achieved impressive results from exporting telecommunication products with a revenue of $141.6 million and profit of $12.1 million. VNPT Media earned a revenue of $64 million with $5.2 million in profit in 2016.

VNPT has also divested from non-core businesses. However, the stagnating stock market, along with low liquidity and the lack of interest from investors, influenced the pace of divestment.

By the end of 2016, VNPT has divested entirely from 15 subsidiaries, with a divestiture value of 31 per cent of the target ($26.5 million from $88.1 million). The revenue earned from the process was $46 million, which is 174 per cent of the initial investment in VNPT’s ledger.

Long said that VNPT’s divestment from non-core or inefficient businesses have faced many difficulties and challenges due to the lack of flexible regulations on divestiture and the bleak conditions in the financial market. For example, VNPT has five item categories that have completed the procedures for public auction but failed to garner sufficient interest from investors.

In essence, VNPT has finished the restructuring process and is operating with much higher efficiency. These positive results will be both the foundation and the motivation for VNPT to continue with the divestment process, while simultaneously equitising the parent company by 2020.

|  |

Production and trade results of VNPT during 2014-2016

(Source: Document No. 2836/VNPT –KHDT dated June 1, 2017, disclosing the results of the implementation of the production, trade, investment, and development plan in the last three years. Unit: million USD)

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Latest News

More News

- State corporations poised to drive 2026 growth (February 03, 2026 | 13:58)

- Why high-tech talent will define Vietnam’s growth (February 02, 2026 | 10:47)

- FMCG resilience amid varying storms (February 02, 2026 | 10:00)

- Customs reforms strengthen business confidence, support trade growth (February 01, 2026 | 08:20)

- Vietnam and US to launch sixth trade negotiation round (January 30, 2026 | 15:19)

- Digital publishing emerges as key growth driver in Vietnam (January 30, 2026 | 10:59)

- EVN signs key contract for Tri An hydropower expansion (January 30, 2026 | 10:57)

- Vietnam to lead trade growth in ASEAN (January 29, 2026 | 15:08)

- Carlsberg Vietnam delivers Lunar New Year support in central region (January 28, 2026 | 17:19)

- TikTok penalised $35,000 in Vietnam for consumer protection violations (January 28, 2026 | 17:15)

Mobile Version

Mobile Version