Vietnam’s new financial policies spur market growth

Financial sector development and SOE equitisation were among the key issues high on the agenda

At last week’s Vietnam Global Investment Forum, co-hosted by Euromoney and the Ministry of Planning and Investment, a number of key issues were brought to the discussion panels. Issues including the country’s accelerating growth, outlook for foreign direct investment, Vietnam’s equity update, financial sector development, state-owned enterprise equitisation, real estate, agricultural investment, and financing infrastructure and power development were discussed.

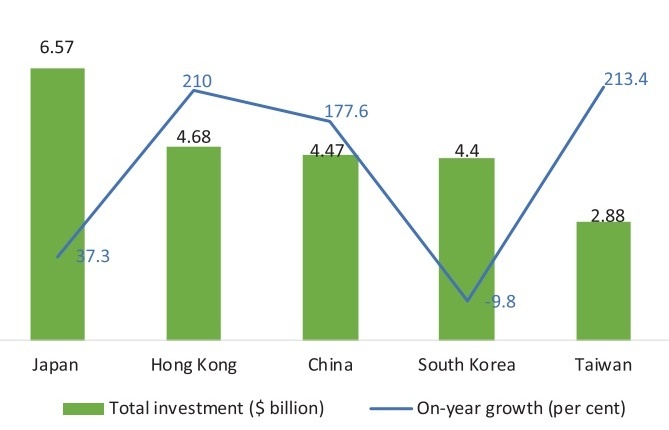

Prime Minister Nguyen Tan Dung The Vietnamese economy is entering a new cycle characterised by macro-economic stability, higher growth and low inflation. The country is also heading towards the sustainable development goals and a GDP growth rate of 6.5-7 per cent between 2016 and 2020. Trade volume is expected to increase by 12-15 per cent per annum, and amount to $600 billion by 2020. The well-being of 90 million Vietnamese will be further improved. Purchasing power and market size will be on the rise. By the end of 2015, GDP per capita is expected to reach $2,200 or equal to over $5,600 on the PPP basis. To date, the total registered foreign direct investment in Vietnam is around $270 billion with over 19,000 operating projects by investors from 105 countries and territories; $135 billion have been disbursed. A number of MNCs, many of which come from Europe, are very successful in Vietnam. ...This forum takes place when the world and the Vietnamese economy are facing both opportunities and challenges. As the government is making every effort to fully tap into the economic potential of Vietnam, foreign businesses are welcome to do business in Vietnam on a long-term basis. Vietnam always stresses that your success is our success. |

In his opening remarks, Prime Minister Nguyen Tan Dung stressed that while Vietnam’s financial market was rather modest in terms of scale and quality, the country had worked to improve its financial market policies and add more suitable products and services in line with international requirements.

“We have put in place regulations to expand the room for foreign investors to participate in the Vietnamese securities markets, invest in government and corporate bonds,” said Dung.

“Foreign ownership in securities firms has been lifted from 49 per cent to 100 per cent together with other provisions more favourable to foreign investors,” he added.

“The removal of the foreign ownership limit (FOL) is one of the most significant and important things to happen to the market since 2006,” said Kevin Snowball, CEO of PXP Vietnam Asset Management.

According to Snowball, Vietnam is an emerging market whose inflation has been well controlled at the ground level. The trade deficit has been rather small, thanks to many of the country’s great efforts, which subsequently translates into a magnet for capital inflows and facilitates stock market development.

“The FOL removal, however, is not effective as yet, as we are still waiting for the conditional sector list. Once we get what the conditional sectors are, we will have a clearer idea of which companies will have no limit on investment,” Snowball noted, adding that many foreign investors would be coming to Vietnam to explore the opportunities to invest in local companies, and in turn, bolstering the SOE equitisation process.

Regarding this issue, according to the prime minister, Vietnam has so far equitised nearly 90 per cent of the 12,000 SOEs over the past 20 years and in the last four years alone, 350 SOEs have carried out their initial public offerings (IPOs). The government has also stressed that there would be more SOEs going public in the time to come, consequently adding up many opportunities for foreign investors in Vietnam.

Tony Shale, CEO of Euromoney Institutional Investor in Asia, spoke of Vietnam as an attractive market in Asia that had managed to obtain “an impressive economic growth of 6.28 per cent” in this year’s first half.

Statistics show that the local economy is in fact entering a new growth cycle supported by macro-economic stability, and low inflation. The country is also heading towards its sustainable development goals and a gross domestic product growth rate of 6.5-7 per cent between 2016 and 2020. Trade volume is also expected to increase by 12-15 per cent per annum, and bolster up to $600 billion by 2020.

This year, the local economy is expected to expand by 6.5 per cent, the highest level since 2011.

Many important legal documents have come into force, including the Laws on Investment, Enterprise, Housing, and Real Estate Business, In addition, other laws are also being drafted and will likely be put into practice in 2016, providing additional incentives for foreign investors.

| Prime Minister celebrates the fruits of unyielding determination at global forum

The Vietnam Global Investment Forum took place today with a resounding success. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Latest News

More News

- Planning for 30 airports to complete by 2025 (April 15, 2024 | 16:56)

- MPI calls for high-tech, green energy cooperation from Washington investors (April 10, 2024 | 15:33)

- Vietnam's economic growth expected to pick up in 2024 (April 09, 2024 | 15:16)

- European business confidence at highest since 2022 (April 08, 2024 | 09:55)

- Where is environmental governance in FDI attraction? (April 08, 2024 | 09:45)

- 2024 is expected to see fiercer competition in FMCG (April 04, 2024 | 16:53)

- Vietnamese startups bag $35.7 million in first quarter of 2024 (April 02, 2024 | 16:40)

- Investors increasingly optimistic about manufacturing sector (April 01, 2024 | 14:51)

- Soaring German investments are testament to trust in Vietnam (April 01, 2024 | 09:52)

- Prime Minister works with Japan Business Federation (March 29, 2024 | 08:00)

Mobile Version

Mobile Version