Vietnamese firms advised to rescue themselves as soaring dollar hurts export

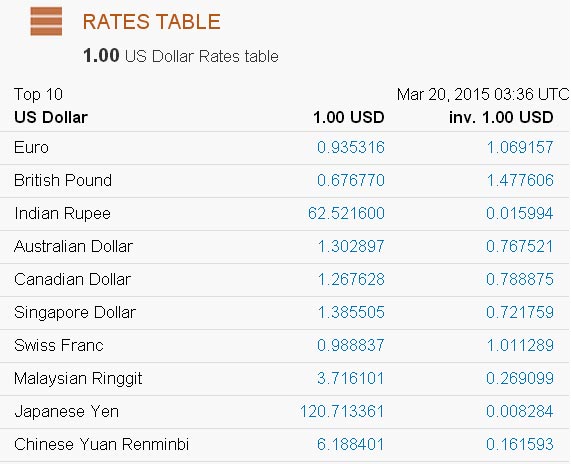

The U.S. dollar value has soared against the euro, yen, British pound, as well as Australian and Singaporean dollars, sending importers in these countries to either cut orders or ask for lower prices, according to Vietnamese exporters.

Forex rates between the U.S. dollar and other currencies. Source: x-rates.com

“Prices of exports to the EU have declined 5 to 10 percent compared to last year and businesses could only find buyers if they agree to reduce quotes,” said Duong Ngoc Minh, general director of Hung Vuong JSC, a major catfish exporter.

Seafood shipments dropped up to 30 percent in the first two months of this year from a year earlier, Minh said, adding “the situation will remain like this for a long time.”

Nguyen Van Kich, general director of Kafatex JSC, another seafood exporter based in the southern province of Hau Giang, said he has to constantly update price information from the U.S. market to adjust the company’s business plan and price quotations accordingly.

Kafatex mainly ships products to Japan and the EU, and all payments are made in U.S. dollars.

“Customers in the EU now have to pay nearly EUR1 million for a $1 million order instead of EUR900,000 as before,” he said.

The depreciation of the euro against the dollar has increased the prices of imported seafood in the EU, but the importers there could not hike selling prices to make up for the disparity as it will dismay local consumers, Kich said.

“The importers thus reduced orders, asked for lower prices, or stopped buying from Vietnamese firms to look for cheaper sources,” he added.

“We have to accept their price cut requests otherwise we don’t know what to do with the products.”

Many Vietnamese cashew businesses also have had to cut export prices to maintain orders.

“Prices of shipments to the EU have been slashed by two percent, while the cut for exports to Singapore and Australia is five percent compared to earlier this year,” said Nguyen Duc Thanh, general director of Tanimex Long An.

The U.S. is the only market where the company’s export remains stable, Thanh added.

The exchange rate between the Vietnamese dong and U.S. dollar remains stable, surging slightly by only 0.5-0.6 percent compared to late last week, as quoted by many state-run and joint-stock commercial banks on Monday.

The price of the greenback quoted at state-run Vietcombank, often considered the benchmark for other joint-stock commercial banks, rose VND125 per dollar to VND21,450-21,510 for bid and ask, respectively.

The dong was devalued by one percent to VND21,458 to the dollar on January 7.

Self rescue

Although the soaring dollar is causing difficulties for the export activities of Vietnamese businesses, Minh from the Hung Vuong JSC said the firms have to find a solution on their own instead of waiting for a government policy.

“Other competitors of Vietnam such as Thailand, India, Indonesia, and Ecuador are exporting at lower prices, so Vietnamese firms have to try to cut production costs and input expenses to increase competitiveness,” he said.

Nguyen Chi Trung, director of Gia Dinh Co. Ltd., a shoemaker in Ho Chi Minh City, also said the foreign exchange rate is not the only factor that matters in competition among exporters.

“Such issues as increasing labor productivity or ensuring timely delivery seem more important than the [exchange] rate,” he said.

Tran Ngoc Tho, dean of finance at Can Tho University, said businesses should focus on “things within their control” to enhance their performance and production, instead of “issues they cannot control such as the foreign exchange rate.”

“Businesses are advised to keep all their focus on improving production, product quality, and marketing campaigns at this time,” he said.

“Besides waiting for the State Bank of Vietnam to resolve the foreign exchange issue, no one but the businesses themselves can solve their own problems to increase their competitiveness.”

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Latest News

More News

- Veterinary drugmakers seek time and cost-saving policies (April 24, 2024 | 11:36)

- Crucial small business arena to receive reduced CIT boost (April 24, 2024 | 11:12)

- Gaw Capital bets on “China plus one” opportunities in Vietnam (April 24, 2024 | 09:00)

- Softening demand to limit 2024 trade (April 24, 2024 | 08:00)

- FPT partners with NVIDIA to shape the future of AI and Cloud on global scale (April 23, 2024 | 18:07)

- Beverage giant SABECO thirsty for $190 million profit this year (April 23, 2024 | 17:47)

- US government hosts AI workshop in Ho Chi Minh City with key partners (April 23, 2024 | 15:09)

- FPT sees strong growth in first quarter (April 23, 2024 | 14:49)

- Female influence still to be attained (April 23, 2024 | 10:59)

- Vietnamese plastic firms to cash in on global demand (April 23, 2024 | 09:00)

Mobile Version

Mobile Version