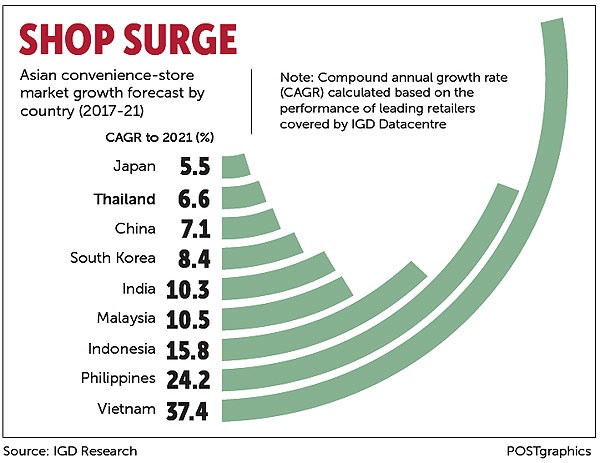

Vietnam leads Asia for growth in convenience store

|

| Asian convenience-store market growth forecast by country (2017-2021).-Photo IGD Research |

It is followed by the Philippines and Indonesia, the Bangkok Post reported.

Asia’s grocery market is the largest in the world, with a predicted 6.3 per cent compound annual growth rate up to 2021. Its size is forecast to reach US$4.8 trillion by 2021, equivalent to Europe and North America combined.

In the convenience channel, IGD has forecast high double-digit compound annual growth over the next four years in Việt Nam (37.4 per cent), the Philippines (24.2 per cent) and Indonesia (15.8 per cent).

Nick Miles, head of Asia-Pacific at IGD, said: “The retail markets in these three countries are gradually shifting from traditional to modern trade and there are several factors driving this -- positive economic outlook, significant increase in GDP per capita, deregulated markets encouraging more foreign investment and rapidly changing shopper habits.

Referring to the particularly strong growth tipped for Việt Nam, Miles said: “Convenience stores in Việt Nam have become popular destinations for young consumers to shop and hang out, as the stores provide them with an air-conditioned environment, well-organised shelves and seating areas, high quality products, and, in some stores, free Wi-Fi. It is also easier to get licenses for stores under 500sq m, which is why retailers have been expanding to gain market share.”

Việt Nam, the Philippines and Indonesia, according to IGD, share some characteristics that make their convenience markets ripe for growth.

These three markets are predominantly driven by an increase in store numbers. For example, the number of convenience-stores operated by the top five retailers in the Philippines has more than doubled in the last five years and retailers are shifting their focus from the capital to more provincial areas.

Asia’s convenience market has traditionally been dominated by Japanese retailers. However, there have been more market consolidations and partnerships, and most noticeably, domestic players such as VinMart in Việt Nam and SM Retail in the Philippines have been scaling up their operations.

Apart from the modern convenience store format, local operators, such as Indonesia’s Indomaret and Dairy Farm’s Wellcome format in the Philippines, have a neighbourhood mini-supermarket model, which better caters to local needs. These mini-supermarkets are typically between 150 to 300sq.m and are located in residential areas.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Latest News

More News

- EVN launches major power infrastructure projects nationwide (December 19, 2025 | 18:17)

- VAL inaugurates second production line to meet domestic animal feed demand (December 19, 2025 | 16:37)

- Sun Group pioneers urban tram system in Phu Quoc (December 19, 2025 | 15:00)

- Top 10 notable events of Vietnam’s industry and trade sector in 2025 (December 19, 2025 | 14:00)

- Seven major projects launched to drive Hanoi’s next growth phase (December 19, 2025 | 14:00)

- Rare, beautiful, sustainable: the mark of iconic real estate (December 19, 2025 | 08:00)

- Mondelez Kinh Do - a chapter of purpose-led leadership in Vietnam (December 18, 2025 | 09:44)

- VNPAY services receive the highest-level PCI DSS international security certificates for six consecutive years (December 17, 2025 | 23:47)

- F&N deepens investment in Vinamilk (December 17, 2025 | 09:00)

- Long-term capital seen as key hurdle to green growth (December 16, 2025 | 08:00)

Mobile Version

Mobile Version