Equity market: who dares wins

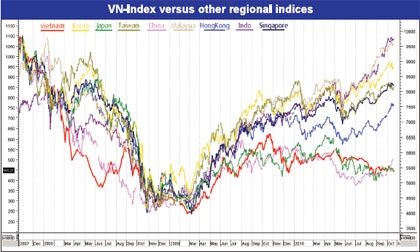

In 2010, as forecasted by reputed global research houses, the Asia-Pacific region and other emerging markets have recorded impressive growths.

Except for Japan which has faced deflation risks for years, only Vietnam and China have been left behind. Compared to Korea, Singapore, Indonesia, Taiwan and Hong Kong, the VN-Index has suffered a 30-40 per cent pull-back.

Depending upon the methodology and sources of information, the price-to-earnings (P/E) ratio of Vietnam’s equity market is estimated at the range of 10x-15x, which is not much lower than the others.

However, there are a number of unique characteristics that have distorted the calculations. Some 5 per cent of the biggest companies by market capitalisation such as VCB, BVH, CTG, HAG and VI normally carry high P/E valuations compared to averages.

Together, they account for approximately 50 per cent of the market size and many stocks have very little liquidity despite the reasonable market size. Therefore, the price is well maintained at a ‘premium’. Due to the scarceness of supply, the value is easily influenced by short traders.

Due to the dilution from new share issuance, although the VN-Index is far from the bottom of 2009, many shares have bounced back from low level prices. Ignoring the two above factors, at least 80 per cent of the securities’ P/E ratios are presently at the range of 5.0x-7.0x, or lower.

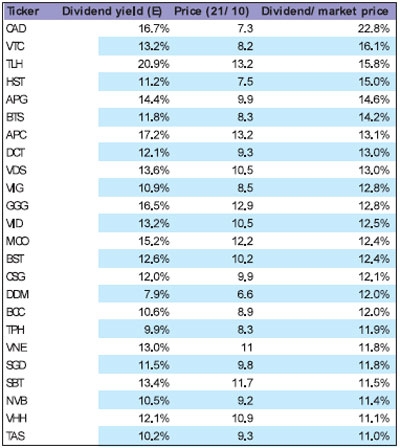

Noticeably, a number of stocks have a potential dividend/trading price larger than the bank deposit rate (11.0 per cent). If the market continues to fall, the list will get longer and the market will become more attractive.

After the European crisis cool-down, the global financial market has generally bounced back. The Dow Jones even enjoyed its best performing month in many decades and is now at 11,000 points and above. Asian indices grew more strongly.

On the other hand, Vietnam is out of the map in terms of performance and liquidity. The main reason attributed to macro economy concerns, especially the monetary policies, which discouraged cash flows into the equity market. The question is, compared to other regional markets, is Vietnam’s macro economy that worrying?

|

Monetary policies

In 2010, most regional countries tended to tighten or stabilise their monetary policies when there were signs of inflation after their economies recovered. Recently, China also increased its base cash rate after many years.

Therefore, with the tendency of loosening the local monetary policies, Vietnam’s stock market should have gained the most. Even for markets with tightening monetary policies, the indices still moved up rapidly. Therefore, it does not matter whether a country implements a loosening or tightening policy, the market can still react positively as long as the outcomes are effective.

Credit growth

By the middle of September 2010, Vietnam’s credit growth had approached 18 per cent. With a target of 25 per cent for the whole year, Vietnam’s credit growth is many times greater than other regional economies.

For example, compared to Indonesia, Vietnam’s credit growth is three times greater, but to date the former’s stock market has outperformed the VN-Index by at least 20 per cent and is getting closer towards the highs of 2007-2008.

Investors’ credit growth or cash flow worries about the equity market should be questioned, or is this purely a psychological factor?

|

Inflation status

Vietnam’s inflation has always been among the highest in the region. However, if we compare 2010’s consumer price index (CPI) with the average during the past 10 years, it has not exploded yet. If a firm grows 20 per cent of its bottom line per annum, it is still noteworthy. During the VN-Index’s previous pick-ups, inflation was not much lower, so is the market over-reacting to the expected CPI this year?

|

Lending rates

Compared to other countries, Vietnam’s lending rate is far higher. One of the reasons is high inflation. However, another more important reason should be the unreasonably wide interest spread.

While banks confirmed the impossibilities of lowering the lending rates due to the operation difficulties, they still reported very high profits. If the State Bank is tougher in enhancing the effectiveness of the monetary system, reducing rates should be within its control.

How have the lending rates impacted on the equity market? Ignoring the macroeconomic effects, high interest rates will influence the operating results of companies. However, not all listed firms use bank loans in similar fashion.

Over the past few months when the indices fell, most of stocks dropped including ones with low leveraging and positive performance such as natural rubber or IT companies. The over-reaction of investors is creating opportunities in the financial market.

Exchange rate

In October, the foreign exchange market was in chaos. The USD/VND rates went beyond the supporting VND 20,000 level many times. Three main reasons were global gold prices having increased fast, widening the gap with the local market.

Therefore, many individuals have collected US dollars to buy gold and bring into Vietnam. US dollar loans borrowed from the beginning of the year are to expire soon and the flows of ‘hot’ money have yet been to Vietnam.

If the dong’s devaluation is that negative, why did the US market strongly rise when the US dollar continuously lost its value? If we look at the exchange rate as a tool to adjust the health of an economy and the current free market rate is approaching the ‘real’ value of 20,500 in 2011 and this is a positive news for Vietnam’s trade balance in the medium and long-run.

‘Hot’ money from overseas

The lack of ‘hot’ money into Vietnam has been noticeable as the US government continuously printed US dollars. Nonetheless, if ‘hot’ money is that critical, why have the Brazilian and Thai governments attempted to restrict the flows of funds by various policies? On the other hand, if the ‘hot’ money has not targeted Vietnam due to foreign exchange risks, it should finally come to Vietnam once the exchange rate stabilise at a ‘fair’ value as mentioned above. It depends on how the State Bank changes the policies and this is a great opportunity for the local securities market.

Where to invest?

With high credit growth, cash flows will go through the economic system, directly or indirectly. Which options will bring the most potential returns to investors? Will gold, foreign currencies, real estate or stocks will deliver the best performances over the coming year?

Assuming the target return of 20 per cent within the next year, retail investors have the following choices:

Invest in the gold market as gold prices must move from $1,340/ounce to $1,600/ounce. Investing in the foreign exchange market could bring dividends as the USD/VND rate must increase from the current VND20,100 (black market) to VND24,120. Even taking into account the 5 per cent US dollar deposit rate, the exchange rate must reach VND23,115.

Real estate prices must increase by 20 per cent under the current conditions when short-trading has been fairly limited and the overall market has been frozen. On the other hand, the real estate market has a similar cycle to the equity market, so the recoveries of the two markets should be closely in line with each other.

Investing in the equity market could bring options as the VN-Index could rise to 528 points.

Any of the four possibilities could happen. For the first option, it is not easy for the gold price to reach $1,600 per ounce especially when it has shown signs of slowing down. For the second option, if we view the rate of VND20,500 as the ‘fair’ value for the dong in 2011, then the rate of VND23,115 is over-expected. For the real estate market, investors need sizeable funds under the conditions of short-trading being limited.

Therefore, the equity market implies much greater opportunities although the risk of a further pull-back has yet to disappear in the short-term. Compared to other countries in the regions, it seems investors are over-pessimistic and have over-reacted. In our view, as late as the first quarter of 2011, the VN-Index will have many upside recovery opportunities that will pay off medium and long-term investors.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Latest News

More News

- MAE names big 10 policy wins in 2025 (February 06, 2026 | 08:00)

- US firms deepen energy engagement with Vietnam (February 05, 2026 | 17:23)

- Vietnam records solid FDI performance in January (February 05, 2026 | 17:11)

- Site clearance work launched for Dung Quat refinery upgrade (February 04, 2026 | 18:06)

- Masan High-Tech Materials reports profit: a view from Nui Phao mine (February 04, 2026 | 16:13)

- Hermes joins Long Thanh cargo terminal development (February 04, 2026 | 15:59)

- SCG enhances production and distribution in Vietnam (February 04, 2026 | 08:00)

- UNIVACCO strengthens Asia expansion with Vietnam facility (February 03, 2026 | 08:00)

- Cai Mep Ha Port project wins approval with $1.95bn investment (February 02, 2026 | 16:17)

- Repositioning Vietnam in Asia’s manufacturing race (February 02, 2026 | 16:00)

Mobile Version

Mobile Version