Savills Vietnam releases property index in Ho Chi MInh City May 2013

The majority of projects that had price reductions still had sluggish performance.

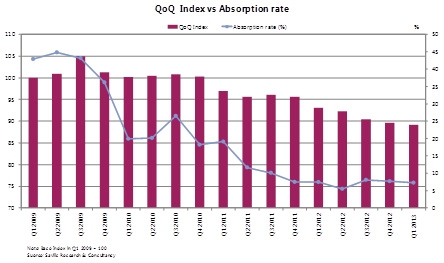

“Although there is strong supply, the absorption rate this quarter remained stable due to the improved number of sold units. The number of sold units increased 2 per cent QoQ and 25 per cent YoY. The ‘sold’ volume has been trending upward for three consecutive quarters,” it cited.

Since the base period of early 2009, the average market price including new projects has decreased by approximately -22 per cent whilst the index, which is calculated on the constant project basket only decreased by -11 index points.

“This shows that the downtrend in the average price is mainly due to the lower price of newly launched projects rather than price adjustment of existing projects,” according to Savills’ press release.

Although the downward trend of the residential price index continued this quarter, the rate is slowing. Combined with the significant improvement in transaction volume, a gradual market recovery and more stabilisation might be expected in the near term, it continued.

Figure 1: Residential QoQ Index vs Absorption rate

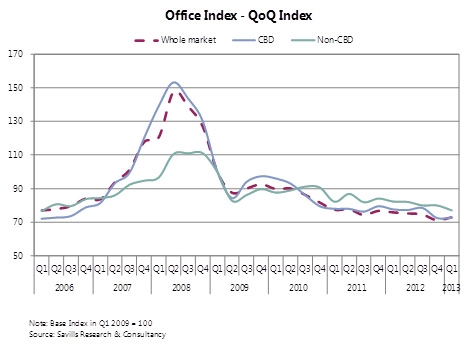

Regarding the index in office segment, the consultant said that the QoQ office index rose sharply in 2006, peaked in the second quarter of 2008 and then dropped sharply during the two latter quarters of the same year. Since 2010, the market has been in a downward trend.

The office index in the first quarter of 2013 stood at 73, an increase of 1.7 index points QoQ.

“Despite a slight decrease in average market rent, increased occupancy this quarter has helped to bring up the index,” it commented.

The CBD area performed better than the non-CBD in terms of both rent and occupancy. As a result, the CBD index rose slightly by one index point QoQ whilst non-CBD decreased by -3 index points.

Along with improvement in the index, market take-up also had substantial increase of 173 per cent QoQ and 70 per cent YoY.

“These are very positive indicators for a more stable and improving performance of the office market in the upcoming quarters,” it cited.

Figure 2: Office QoQ Index

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Latest News

More News

- Hanoi’s latest Grade A commercial project soon ready for handover (April 19, 2024 | 11:39)

- Nam Long Group gears up to capture market (April 19, 2024 | 10:57)

- Rapid law implementation may propel market fortunes (April 17, 2024 | 08:43)

- Nation urged to build on eco-IP model (April 16, 2024 | 10:22)

- Domestic steel demand expected to rebound amid warming real estate market (April 12, 2024 | 10:31)

- Implementation of new land laws must benefit investors (April 10, 2024 | 09:17)

- Apartment hikes hint at speculation return (April 09, 2024 | 10:14)

- Infrastructure focus sets stage for real estate bonanza (April 03, 2024 | 10:14)

- Nam Long Group maintains top ten position in real estate investment ranking (April 03, 2024 | 08:00)

- Hospitality and real estate sectors strive for sustainable growth (March 29, 2024 | 16:12)

Mobile Version

Mobile Version