Real estate M&As spiked in first quarter

|

| M&As are a useful way for property investors to skirt complex and time-consuming land clearance issues -Photo: Le Toan |

The deals were made by both local and overseas players looking to consolidate their presence in Vietnam.

Most recently, Singapore’s Keppel Land - through its indirect subsidiary Ibeworth - has entered into a subscription agreement with Nam Long Investment Corporation for VND500 billion ($22.7 million) in convertible bonds, which are due in 2020.

Keppel Land’s CEO Ang Wee Gee stated that its subscription of convertible bonds followed Keppel Land’s initial investment in Nam Long last year, and demonstrated its strong partnership with Nam Long, as well as Keppel Land’s commitment to continue participating in the company’s growth.

“It also underscores our confidence in the long-term investment potential of Vietnam, which is one of Keppel Land’s key growth markets,” Gee said in a statement.

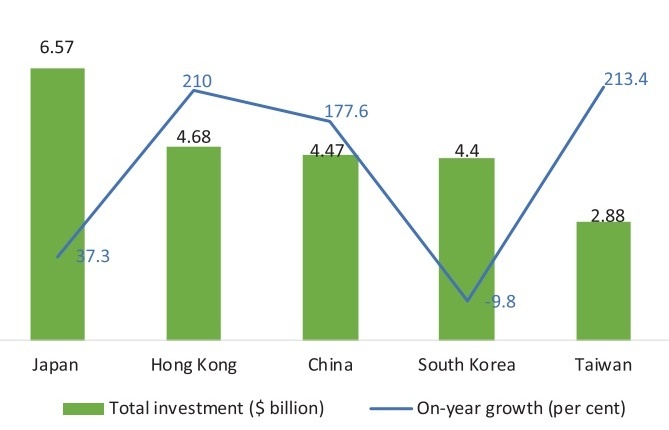

Currently, many foreign investors are entering the domestic real estate market to conduct market studies, including those from South Korea, Japan, and Singapore.

A good number of foreign investors are planning to buy office buildings in Hanoi and Ho Chi Minh City, including projects that are already completed, those currently under construction, and those scheduled for a future build date.

Phan Xuan Can, chairman of Soho Vietnam Real Estate Consulting Company, said increased mergers and acquisitions (M&A) activities in the property market had been caused by a rise of equity in the market, low interest rates on loans, and a low supply of property products relative to the demand.

In Hanoi, buyers are typically attracted to the districts of Cau Giay, Tu Liem, Thanh Xuan, and Hoang Mai. Meanwhile, in Ho Chi Minh City, the favoured destinations include districts 2 and 9, where most enterprises have set up their projects and sold some of them to restructure their company’s investments.

M&A activities among real estate companies are expected to increase, as large investors often prefer to acquire existing projects instead of applying for fresh investment licences.

Steven Chu, CEO of the Nam Long Investment Corporation, said that M&A deals would see added momentum given the opportunities arising out of free trade deals in 2016.

“Vietnam remains a magnet for foreign developers and investors. The government needs to facilitate foreign investment in real estate by increasing access to the land bank without complex land clearance burdens, and by addressing concerns over quality speculation and state property policies,” Chu said.

“Despite strong demand for property, the growth of the middle class, low inflation, and good products offered by banks, it remains difficult for investors to get good sites without complicated land clearance issues,” he added.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Latest News

More News

- Rapid law implementation may propel market fortunes (April 17, 2024 | 08:43)

- Nation urged to build on eco-IP model (April 16, 2024 | 10:22)

- Domestic steel demand expected to rebound amid warming real estate market (April 12, 2024 | 10:31)

- Implementation of new land laws must benefit investors (April 10, 2024 | 09:17)

- Apartment hikes hint at speculation return (April 09, 2024 | 10:14)

- Infrastructure focus sets stage for real estate bonanza (April 03, 2024 | 10:14)

- Nam Long Group maintains top ten position in real estate investment ranking (April 03, 2024 | 08:00)

- Hospitality and real estate sectors strive for sustainable growth (March 29, 2024 | 16:12)

- Gamuda Land starts construction of Eaton Park (March 28, 2024 | 16:40)

- New land law could entice Viet Kieu home (March 27, 2024 | 18:00)

Mobile Version

Mobile Version