Private label segment on the rise among local retailers

|

| Private label segment on the rise among local retailers |

At a Co.opmart in Hanoi, Vu Hong Ngoc, a mother of two children, chose to buy Co.opmart’s own brand of cooking oil and boxed tissues. It is increasingly common to find products labelled under supermarket brands, offering less expensive prices to tempt frugal shoppers like Ngoc.

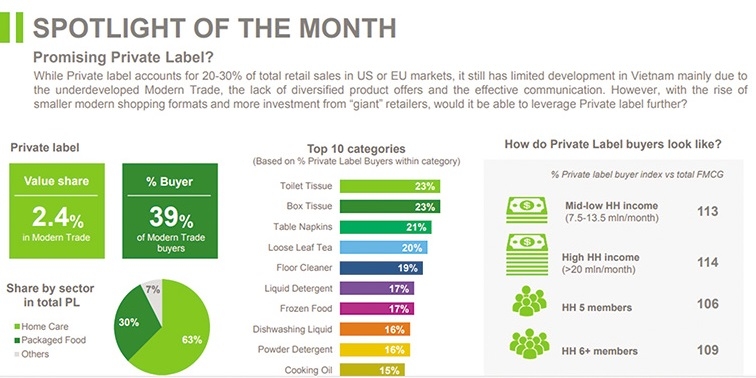

Research by Kantar Worldpanel Vietnam showed that 39 per cent of Vietnamese shoppers at modern outlets prefer private-label products. The 10 most common products are toilet paper, box tissues, table napkins, loose-leaf tea, floor cleaners, liquid detergents, frozen foods, dishwashing liquids, detergent powders, and cooking oils, according to the research.

A private label product is one that can be sourced from a manufacturer and sold under a retailer’s own brand. These products are therefore manufactured for exclusive sale by a particular retailer.

According to Kantar Worldpanel Vietnam, private labels account for only 2.4 per cent of sales at supermarkets in Vietnam, compared to 20-30 per cent in the US and the EU.

Retailers race to create own private labels

According to Co.opmart, the development of private labels is an inevitable strategy for Saigon Co.op as part of the supermarket business model, the company’s wide network, and the positioning of the brand in the heart of consumers. Since the launch of its private label in 2003, Co.opmart has continuously introduced a variety of products at competitive prices.

“Our private label is a ‘magnet’ to help Saigon Co.op in general and Co.opmart in particular increase its attractiveness to consumers and gain a competitive advantage by providing good value for money,” said Vo Hoang Anh, director of Saigon Co.op’s Private Labels Division, adding that there is huge potential for private label development in Vietnam.

On a larger scale, AEON Vietnam plans to double its private label offerings in an effort to attract the region’s growing middle class. As part of the plan, the retail group will concentrate on developing specific private label goods for each country, such as frozen foods and pet foods in Thailand, rubber products in Malaysia, and clothing and shoes in Vietnam. It will also lay the groundwork for exports to other nations in the region.

Convenience store chains such as 7-Eleven in Thailand, operated by Charoen Pokphand Group, and Indomaret in Indonesia also have many private label food products, while foreign companies in Vietnam have relatively few private brands. Such products make up about 1 per cent of all items at Big C’s 35 stores in Vietnam, operated by Thai conglomerate Central Group, and 3 per cent of products at the 13 stores operated by South Korea’s Lotte Mart.

Le Huu Tinh, marketing manager of Emart, told VIR that since its first store was launched in Vietnam in 2015, Emart has been selling its own private label products imported from South Korea, ranging from food and fashion to home appliances and sports products.

Recently, Emart developed its own branded product line in Vietnam, focusing on high-quality products including home appliances and fashion, called “Emart loves you”.

Tinh added that the purpose of the private label products is to increase choices for customers, and his company has chosen to invest further in them in the future. Currently it is co-operating with 10 local companies to make private label products.

Win-win situation

Most retailers said that developing their own brands is a necessary trend in their development, but the remaining question is how manufacturers will face this trend. It remains to be seen whether enough local manufacturers will agree to outsource their processes and staff to retailers, or will agree to a combination of outsourcing and developing their own products.

Retailers prefer to use small and medium-sized manufacturers, which helps these manufacturers attain more experience in designing packaging, meeting customer demand, and boosting production. Companies such as Vinamit, Saigon Food, VinaCacao, and Lix have adapted successfully, manufacturing products under supermarket brands to fully utilise the company’s production lines, equipment, and manpower, thereby earning more revenue.

AEON Vietnam is sourcing from local manufacturers who are capable of producing products under its Topvalu private brand. The products will not only be sold in the local market, but will also be exported to Japan and other Asian markets.

2018 is the first year in which Topvalu products are being produced in co-operation with Vietnamese companies. So far, it has engaged with 30 Vietnamese suppliers to manufacture 15 products, with the number expected to reach 100 by the end of the year.

“This provides opportunities for buyers and local manufacturers as well as retailers. Private brands also offer the opportunity to build relationships with customers in unprecedented ways, while the customers have more choice in price, and local producers will be able to survive in this saturated market because they can receive orders for their facilities as well as tests for new products,” said Dinh Thi My Loan, chairwoman of the Vietnam Retail Association.

Brand specialist Tran Anh Tuan said that a number of well-known retailers have been successful in selling private label products in areas where sustainability is a concern. Private label penetration varies by product, with low penetration in items where the consumer has a relationship with the product – for example baby foods or feminine hygiene products – and high penetration in items like ready meals or dried pasta. The market share is also the highest where products are commodity-based, and technical innovation is inexpensive.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Temporary relief for food imports as businesses urge overhaul of regulations (February 07, 2026 | 09:00)

- Opella and Long Chau join forces to enhance digestive and bone health (February 06, 2026 | 18:00)

- Vietnam-South Africa strategic partnership boosts business links (February 06, 2026 | 13:28)

- Sun PhuQuoc Airways secures AJW Group support for fleet operations (February 06, 2026 | 13:23)

- Pegasus Tech Ventures steps up Vietnam focus (February 05, 2026 | 17:25)

- The generics industry: unlocking new growth drivers (February 04, 2026 | 17:39)

- Vietnam ready to increase purchases of US goods (February 04, 2026 | 15:55)

- Steel industry faces challenges in 2026 (February 03, 2026 | 17:20)

- State corporations poised to drive 2026 growth (February 03, 2026 | 13:58)

- Why high-tech talent will define Vietnam’s growth (February 02, 2026 | 10:47)

Mobile Version

Mobile Version