Prime Minister Nguyen Xuan Phuc calls for US investment in Vietnam

|

| Prime Minister Nguyen Xuan Phuc's state visit to the US may unlock further trade opportunities |

| RELATED CONTENTS: | |

| PM supports Nasdaq’s cooperation with Vietnamese firms | |

| PM grants interview to Bloomberg | |

| Landmark visit to leverage US ties | |

The business roundtable was held by Harbinger Capital and The Asia Group LLC, with the participation of more than 20 financial groups, funds, and big companies from the US on the occassion of PM Nguyen Xuan Phuc's official visit to the US from May 29 to 31.

The PM made the statement at the roundtable discussion with US companies on investment cooperation between Vietnam and the US on May 30 morning.

According to the PM, the Vietnamese government is trying to improve the business environment and to serve people and businesses as well as increase the productivity and competitiveness of the economy. “Vietnam highly appreciates the comprehensive partnership with the US and hopes to attract more investment in energy, infrastructure, education, and finance,” he said.

| The US is the third biggest trade partner of Vietnam, with a bilateral trade turnover of $50 billion in 2016. The US is also one of the biggest investors in Vietnam, with 835 projects with a total registered capital sum of $10.2 billion as of the end of 2016. Many US companies entered Vietnam very early and have reported big success. Some Vietnamese investors have also invested in the US. There are 30,000 Vietnamese students in the US, ranking first among Southeast Asian countries and 6th in the world. |

The PM said that now is an opportune time for financial investors in Vietnam because the Vietnamese financial market is still of a modest size and is growing very fast. The potential is big with the participation of many large-scale companies that have just been equitised. The government also wants to have more M&A in the process of equitising big state-owned enterprises (SOEs) in transport, infrastructure, food, telecommunications, agriculture, services, and tourism.

In terms of trade, the PM assessed that US exports into Vietnam are growing and the cooperation agreements that will be signed during this visit will help improve the trade balance and the two countries will take advantage of their complementary strengths. For example, the US will export equipment to Vietnam and import shrimp, fruits, and shoes in turn.

US investors said that there are more and more opportunities in Vietnam. They say Vietnam’s advantages include a growing middle class, the young population, as well as reasonably-priced labour force. GDP is also growing fast and tourism has a lot of opportunities. This makes the Vietnamese market globally competitive.

The leaders of the ministries and government agencies that escorted PM Phuc then answered the questions of the investors regarding doing business in Vietnam. The Vietnamese companies that joined the discussion expressed their hopes to become partners of US investors.

|

“Vietnam, with her attractive policies and human resources capacity as well as other potentials, will remain a gateway to an exciting ASEAN, a strategic investment destination, and an important link in the global supply chain,” the PM said in the closing speech.

“The door is always open. Vietnam always welcomes and encourages investors in fields, such as infrastructure, services, energy, manufacturing, and tourism, and the capital market where Vietnam has big demand. Now is the perfect time for US companies, with their reputation, experience, technology, and financial capacity to join deeper in the restructuring of the Vietnamese economy, especially in finance, banking, and SOE equitisation,” Phuc emphasised.

|

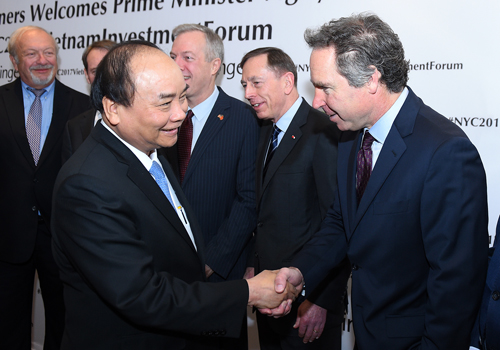

| PM Phuc and the participants of the roundtable discussion |

On the same day, the PM also met with leading US companies that have big investments in Vietnam, such as ExxonMobil, Coca Cola, Nike, and Harbinger Capital.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Latest News

More News

- Vingroup pulls out of bid to invest in North-South high-speed railway (December 26, 2025 | 11:42)

- Strengthening supply chains through trade promotions and customs reform (December 24, 2025 | 14:00)

- PM orders investment model for North–South high-speed rail (December 22, 2025 | 17:43)

- LS Eco Energy to invest in Vietnam rare earth sector (December 22, 2025 | 17:31)

- Government moves to establish International Financial Centre (December 21, 2025 | 21:00)

- Vietnam's IFC to target global investment flows (December 21, 2025 | 18:00)

- Two national hospitals expand capacity with new facilities (December 20, 2025 | 09:00)

- Ha Tinh breaks ground on major Vingroup industrial and energy projects (December 19, 2025 | 18:24)

- EVN launches major power infrastructure projects nationwide (December 19, 2025 | 18:17)

- VAL inaugurates second production line to meet domestic animal feed demand (December 19, 2025 | 16:37)

Mobile Version

Mobile Version