Minh Phu due for a comeback: What will the “King of Shrimp” bring to the table?

Founded in 1992, Minh Phu Seafood Company is not only known as “the King of Shrimp” in Vietnam but also among the leading shrimp exporters in the world.

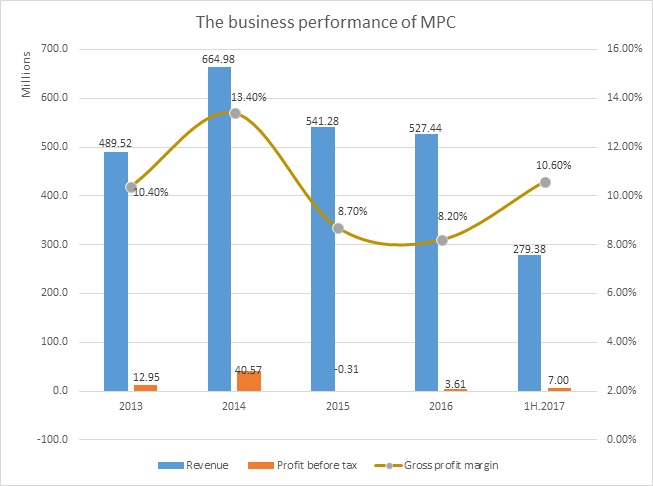

The period of 2009-2014 was MPC’s golden age, with unceasing growth in business activities. In particular, 2014 was considered the peak when the company reported VND15,094 billion ($664.93) in revenue, VND921 billion ($40.57) in after-tax profit, plus $729 million in export value, accounting for 18.8 per cent of the national shrimp export turnover, 4.24 per cent of US shrimp imports, and 5.6 per cent of Japanese shrimp imports.

Amid positive business prospects, the 2015 business plan set the ambitious target of VND19,333 billion ($851.64 million) of revenue and VND1,452 billion ($63.96 million) of after-tax profit. At the end of March 2015, MPC officially delisted from HoSE, following a decision approved by all shareholders a year earlier. The reason given by MPC was that the market value of MPC’s stock did not reflect the true value of the corporation and MPC left the stock exchange to seek strategic partners to restructure the company and secure capital sources for further development.

However, since delisting, instead of continuing to grow as expected, MPC’s business results plummeted with a host of challenges rising in the shrimp export market. In 2015, MPC only earned VND12.2 trillion ($537.44 million) from sales, meeting 63 per cent of the year’s target, while the after-tax profit was minus VND7 billion ($308,370).

In 2016, MPC set a cautious target of VND16.3 trillion ($718.06 million) in revenue and nearly VND550 billion ($24.23 million) of after-tax profit. However, by the end of the year, the company still suffered from tremendous difficulties and only generated VND11.963 trillion ($527 million) in revenue and VND82 billion ($ 3.6 million) in profit.

After two years of failing to achieve its targets, in 2017, although the market is still challenging, MPC’s Board of Directors sets the bold target of VND15.78 trillion of revenue ($695.15 million) and VND840 billion of net profit ($37 million). However, by the end of the first half of the year, the company only gained VND158.5 billion ($6.98 million) in after-tax profit.

Given the industry’s characteristics, the second half of the year brings usually better sales due to high consumption demand during major holidays. However, taking into account the corporation’s recent business results and the current situation of both the domestic and international shrimp markets, it will still be a great challenge for MPC to complete the 2017 plan.

Regarding its financial situation, MPC has not yet made any attempts to scale up the capital stock as announced before delisting. Previously, the 2015 general shareholders’ meeting had already approved another plan to raise capital by issuing 30 million shares at a price not less than VND100,000 ($4.4) apiece which could yield VND3 trillion ($132.16 million).

Thereby, one might expect the issuance would reinforce the corporation’s financial capacity and improve capital ratios. As of June 30, 2017, the owner’s equity of MPC was VND2.437 trillion ($107.35 million), of which the chartered capital amounted to VND700 billion ($30.84 million). MPC is burdened with VND5.918 trillion ($260.73 million) in liabilities, 2.43 times its owner’s equity, of which interest-bearing loans accounted for 90.8 per cent.

At the moment, the corporation’s cash flow from trading activities is plentiful, payment risks remain under control, while short-term loans are mainly executed in foreign currency (VND3.035 trillion or $133.7 million of debts and loans as of the end of June 2017). Nevertheless, big debts have always been one of the factors in MPC’s consistently plummeting profit figures.

In 2015-2016, MPC’s interest from loans was estimated at around VND218 billion per year ($9.6 million), up 30.5 per cent year-on-year, rather large compared to net profits gained from its business and operation activities.

Struggle for market share

Vietnam is currently the world leader in black tiger shrimp production and third in general shrimp production. In 2016, when Vietnamese shrimp exports reached $3.1 billion in total value—the largest turnover in seafood products—MPC contributed $532.14 million.

MPC took the first position in terms of seafood exports, accounting for 7.54 per cent of the total seafood export turnover of the whole country, 2.1 times higher than the second Vinh Hoan. According to the Vietnam Association of Seafood Exporters and Producers (VASEP), Vietnam’s shrimp export value has reached $2.3 billion in the first eight months of 2017. It is also forecast to rise to $3.4 billion throughout the whole year, increasing by about 6 per cent compared to 2016.

Despite growth in revenue, shrimp exporters, including MPC, are facing myriad challenges, especially when they have to compete with Indian, Thai, and Indonesian shrimp exporters in terms of both price and quality.

With respect to the US, MPC’s main market, data from VASEP reveals that in the first eight months of 2017, Vietnam’s shrimp export value has reached nearly $416 million, down 4.4 per cent compared to the same period last year.

This decline was due to new US policies that had a negative impact on exports to this market in general. On the other hand, in the announcement of the preliminary decision made in its 11th administrative review (POR11), the US Department of Commerce (DOC) decided to increase anti-dumping duties on shrimp products imported from Vietnam. This, so far, has reduced the competitiveness of Vietnamese shrimp products.

“Normally, the price of shrimp exported from India, Indonesia or Ecuador is about $1 per kilogramme lower than that of Vietnam on average, while the products are of a higher quality. Undeniably, Vietnamese products are facing fierce competition,” said Le Van Quang, chairman of MPC’s Board of Directors.

Statistics from VASEP also show that the average price of shrimp products (frozen shell shrimp) exported from Vietnam to New York (US) is always higher than those from other countries.

MPC has experienced two stormy years in 2015-2016 due to the scarcity of raw materials for shrimp production. As a result, factories had to continuously raise the expenses on collecting raw materials to compensate for signed contracts. At the same time, export prices failed to keep up with the trend and were even declining.

Despite its position as one of the largest shrimp exporters in the world with a relatively high share of high-end exports, given the fact that its export prices are consistently higher than the average of other domestic firms MPC’s business results over the last two years have shown that the set of measures focusing on closed cultivation process, disease-free production, and clear origins have not been effective in terms of generating a breakthrough in competitiveness against international counterparts.

In this context, MPC’s Board of Directors says that they are still seeking to expand business to new markets, such as Russia, China, and even in the domestic market. Among these potential destinations China will be play a pivotal role. However, to date, these measures still need more time to prove their effectiveness.

Debuted on the stock exchange with a P/E ratio of 25 times earnings

As stated in the announcement of the Hanoi Stock Exchange, MPC shares will be officially traded on UPCoM from October 16, 2017 with the reference price of VND79,000 per share ($3.48), equivalent to a total sum of VND5.5 trillion ($242.29 million), double the total owner’s equity at the end of the second quarter.

Although business results have improved significantly in the first half of the year, the average earnings per share (EPS) for the last four quarters was just VND3,166 (less than 0.02 cent), far behind the VND13,157 ($0.58) in 2014. Given this EPS, MPC’s price/earnings ratio (PE) is approximately 25, significantly higher than that of other stocks listed on the stock exchange, such as VHC, FMC, HVG, ANV, and AGF.

In comparison with the closing price of VND122,000 ($5.37) in the last trading session on HoSE in March 2015, MPC’s shareholders clearly suffered numerous losses during this difficult phase, skipping on dividend payments for two consecutive years. The decline in profit has also brought down MPC’s stock value.

After several rearrangements, MPC’s shareholder structure is rather concentrated with most of the shares lying in the hands of internal shareholders or investment funds who wish to build long-term commitments with the corporation. Bearing that in mind, market volatility or price fluctuation may not exert much impact on these shareholders.

Investors are mainly interested in improving MPC’s production efficiency, business performance, and competitiveness to raise the position of the shrimp brand “Minh Phu” on the world market.

|

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Latest News

More News

- State corporations poised to drive 2026 growth (February 03, 2026 | 13:58)

- Why high-tech talent will define Vietnam’s growth (February 02, 2026 | 10:47)

- FMCG resilience amid varying storms (February 02, 2026 | 10:00)

- Customs reforms strengthen business confidence, support trade growth (February 01, 2026 | 08:20)

- Vietnam and US to launch sixth trade negotiation round (January 30, 2026 | 15:19)

- Digital publishing emerges as key growth driver in Vietnam (January 30, 2026 | 10:59)

- EVN signs key contract for Tri An hydropower expansion (January 30, 2026 | 10:57)

- Vietnam to lead trade growth in ASEAN (January 29, 2026 | 15:08)

- Carlsberg Vietnam delivers Lunar New Year support in central region (January 28, 2026 | 17:19)

- TikTok penalised $35,000 in Vietnam for consumer protection violations (January 28, 2026 | 17:15)

Mobile Version

Mobile Version