Mekong Capital's corporate culture realises retention ambition

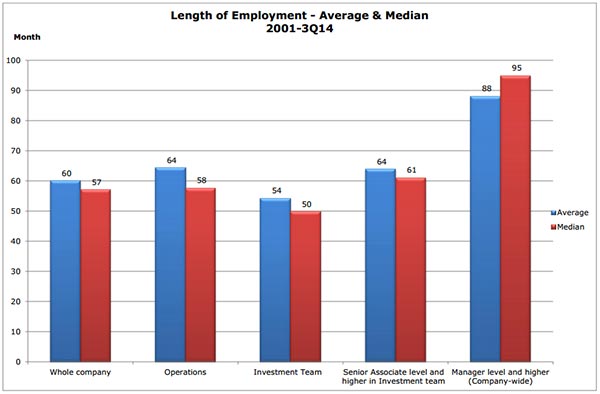

On September 30 the firm announced it had reached an important milestone – its team’s average length of employment reached five years. The average length of employment at the management level and above is seven years.

“We have also enjoyed a zero turnover rate in 2014,” the company added in an announcement.

These statistics indicate that Mekong Capital has a positive working environment and corporate culture, where employees feel a strong attachment to the company. This has helped position Mekong Capital as one of the most successful private equity fund managers in Vietnam.

This could also be a good case study for other companies to follow in building their own corporate cultures for sustainable growth.

Established in 2001 by Chris Freund, who was previously vice president and portfolio manager at Templeton Asset Management, and he is now the firm’s partner, Mekong Capital succeeded in raising funds and selecting investments in well-regarded private Vietnamese companies.

By late 2007 Mekong Capital had grown into a mature private equity fund manager, with $168 million in committed capital and a portfolio of 18 companies across Vietnam. It benefited largely from the country’s fast economic growth and firmly established itself as one of the leading players in the local private equity industry.

While returns seemed solid, by the end of 2007 Freund knew that much of the value stemmed from the fast gains made by listed companies on the Ho Chi Minh Stock Exchange, which were used to benchmark the value of the portfolio. This concerned him because while the stocks were gaining, they were not truly reflecting the actual value of the companies.

Freund became aware that the root of the problem was corporate culture – indirect communication. It also had become increasingly clear to Freund that any improvement in the performance of Mekong Capital’s investments would require a profound transformation. Freund believed their problem was not due to a lack of technical knowledge, but was rather a consequence of imperfect internal management and corporate culture.

Since, Mekong Capital has evolved its corporate culture to be able to deliver fully on its potential.

The transformation of corporate culture began by identifying, exposing and handling persistent complaints and excuses within the company, and by getting people to take responsibility for them so they were no longer in the way of success. The second stage of the process involved transforming corporate culture around a shared set of values and developing a new investment framework which could lead to improved business results.

One of the consequences of this process was that many people left the companyy. “I intially was unable to inspire people to be accountable for producing results, or to not make excuses or take points-of-view that stood in the way of results,” said Freund. “Some employees were simply passive aggressive, not actively resisting but also not supporting the firm's change in culture.”

Mekong Capital’s total staff dropped from a high of 52 at the end of 2008 to just 37 a year later. While the streamlined organisational structure justified the reduction, the overall turnover was much higher than expected. As of December 2009, average staff tenure at Mekong was only about two years, only a few Deal Leaders had more than three years at the firm. While the bulk of the staff had been indoctrinated for private equity and had already embraced Mekong’s core values, the team members were relatively inexperienced.

Nonetheless, Freund and the management team constantly took actions to cause employees to be committed to a long-term future at Mekong Capital, and dealing powerfully with the facts rather than disempowering interpretations. When the process was completed, Mekong Capital shifted focus on identifying the measurements or key performance indicators that were most relevant to implementation milestones.

“The current team is very much the result of the actions we were taking in 2008-2010,” said Freund.

Nguyen Thi Minh Giang, Mekong Capital’s HR consulting manager, who is responsible for providing the leadership to inspire the team to embrace the core values and fostering extraordinary levels of commitment by the employees to the organisation and to each other, added “Our corporate culture is the source of effectiveness. We have invested extensively in developing a team that lives our core values. At Mekong Capital, we all understand that this is not only the foundation for us to produce results but also for the companies in which our funds invest.”

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Latest News

More News

- AstraZeneca profit up on strong sales of cancer drugs (April 25, 2024 | 17:37)

- Call to arms for semiconductor roles (April 25, 2024 | 17:00)

- SABECO outlines growth plans for 2024 (April 25, 2024 | 16:15)

- A strengthened high-tech workforce for semiconductors (April 25, 2024 | 15:00)

- Vietnam commits $1.08 billion to train 50,000 semiconductor engineers by 2030 (April 25, 2024 | 14:51)

- Localities on first step towards training microchip labour force (April 25, 2024 | 13:00)

- Agricultural produce seeks to conquer e-commerce market (April 25, 2024 | 10:15)

- Hai Long Construction's successful 25-year journey (April 25, 2024 | 08:00)

- E-commerce platforms help to spread agricultural value (April 25, 2024 | 07:30)

- Standard Chartered revises down Vietnam's 2024 GDP growth forecast to 6 per cent (April 24, 2024 | 15:04)

Mobile Version

Mobile Version