Major banks accelerate listing preparations

| RELATED CONTENTS: | |

| VPBank making its debut on HoSE | |

| Higher credit growth could increase listed banks’ profits | |

| Brokerages, finance-banking firms lift stock market | |

VPBank’s stock (VPB) has been heating up on the OTC platform in preparation of the official listing. With the official listing price of VND39,000($1.72) per share, investors have been racing to buy VPB shares on the OTC market at the price VND36-38,000 ($1.58-1.67).

Since the end of 2016, VPB’s price has almost quadrupled, from VND10,000 ($0.44) to 38,000 ($1.67) per share. If the reference price of VND39,000 ($1.72) is kept when officially listed, VPB will have a capitalisation value of VND52 trillion ($2.29 billion). This makes VPB the number one bank stock in terms of price and fourth in terms of capitalisation value.

|

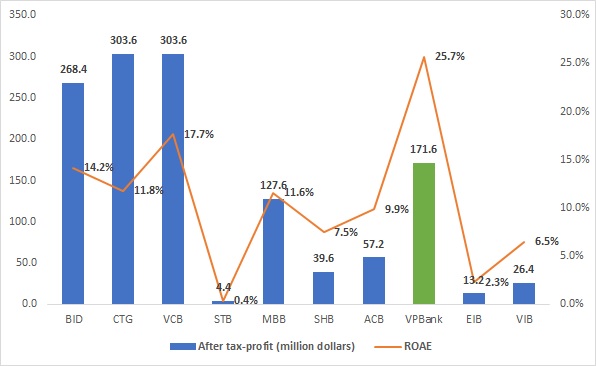

| Banking sector bussiness results in 2016 |

Recently, bank stocks have been growing well and attracted special interest from investors. Early this year, Vietnam International Commercial Joint Stock Bank (VIB) joined the stock market with a reference price of VND17,000 ($0.75) per share, which has subsequently grown to VND22,000 ($0.97).

Similarly, LienVietPostBank’s LPB also caused an uproar the moment a plan for listing was announced. LPB is currently being traded on the OTC market at VND 13-14,000 ($0.57-0.62) per share, doubling its price since 2016.

Among the bank stocks recently listed or to be listed, only KienLongBank’s KLB has remained relatively unchanged with its listing price at VND10,000 ($0.44) per share, while the rest have all been growing relatively strongly.

The growing price of bank stocks has encouraged many financial institutions to hasten their plans for public listing. Since the start of the year, VIB and KienLongBank have officially been traded on UPCoM. VPBank will officially list later this week, followed by LienVietPostBank sometime later. At least eight other banks are reported to be planning their officially listings later this year or next year.

The government has issued directions requiring all banks to list on stock exchanges to increase transparency in share transactions and financial reporting.

Being able to anticipate the listing of good banks has been quite profitable to many investors, since the OTC price of businesses usually rises sharply right before official listing. This is the reason why some bank stocks, such as VPB and LPB, among others, rose between 100 and 300 per cent in just the last eight months.

However, because of the sharp increase in prices, it is only sensible to ask whether these bank stocks might be overvalued, especially those of the soon-to-be-listed banks.

According to many securities companies, bank share prices can be assessed quite accurately based on the price-earnings ratio (P/E). For example, VPB’s shares currently have the highest price in the market, but it also has the highest earnings per share (EPS) in the banking sector, at VND4,485 ($0.2) in 2016 and VND2,525 ($0.11) in the second quarter of 2017.

VPBank’s Return on Average Equity (ROAE) was 25.7 per cent in 2016, also the highest in the market so far.

These securities companies warned that when considering bank shares, investors should consider the bank’s business situation, especially their business strategy, profitability, and bad debts.

According to experts, in the later months of 2017 and in 2018, the banking sector still has positive profit outlook, which means the price of shares will likely continue to rise.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Latest News

More News

- New rules ease foreign access to Vietnam equities (February 05, 2026 | 17:29)

- 0.1 per cent tax proposed on each transfer of digital assets (February 05, 2026 | 17:27)

- Ministry of Finance tightens policy delivery at start of year (February 05, 2026 | 17:26)

- Vietnam steps up market reforms as FTSE Russell reviews upgrade progress (February 05, 2026 | 17:20)

- 2025 profits mixed amid strong energy and farming results (February 05, 2026 | 17:18)

- Cashless payments hit 28 times GDP in 2025 (February 04, 2026 | 18:09)

- SSIAM and DBJ launch Japan Vietnam Capital Fund (February 04, 2026 | 15:57)

- Banks target stronger profits, credit growth in 2026 (February 04, 2026 | 15:43)

- Vietnam on path to investment-grade rating (February 03, 2026 | 13:07)

- Consumer finance sector posts sharp profit growth (February 03, 2026 | 13:05)

Mobile Version

Mobile Version