M&A market signals a new boom

Differing from previous years when investors from Japan and Singapore played important roles in the M&A market, the last year and a half has been dominated by players from countries such as Thailand, the US and local players. Investors from Japan and Singapore, while still showing strong interest in the M&A market and having completed numerous transactions, have fallen back compared to the competition in 2014 and the first half of 2015.That being said, it is believed that they can appear again in the coming years.

Differing from previous years when investors from Japan and Singapore played important roles in the M&A market, the last year and a half has been dominated by players from countries such as Thailand, the US and local players. Investors from Japan and Singapore, while still showing strong interest in the M&A market and having completed numerous transactions, have fallen back compared to the competition in 2014 and the first half of 2015.That being said, it is believed that they can appear again in the coming years.

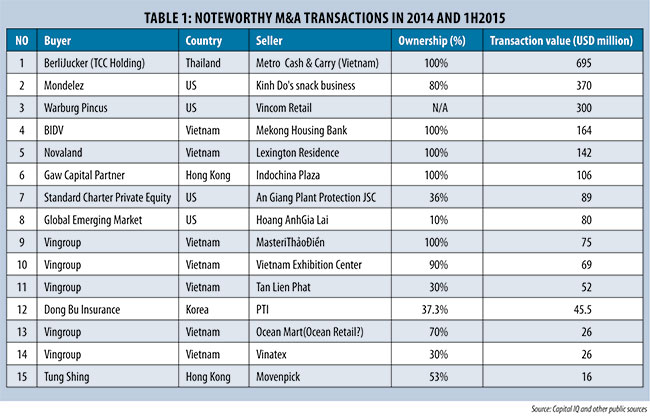

In 2014, Thai Berli Jucker Corporation (BJC), which acquired Phu Thai Group and Family Mart in 2013, took a 100 per cent equity interest in Metro Vietnam for $879 million. Central Group has acquired a 49 per cent equity interest in Nguyen Kim and possibly in Pico, a Hanoi-based electronic retail chain. Siam Cement Group (SCG), which acquired 85 per cent of Prime Group, has completed its acquisition of Tin Thanh Flexible Packaging JSC. The international opportunities available have encouraged Thai corporations to expand abroad, particularly in Vietnam with its attractive market and geographic and cultural proximity, making it a favoured destination. All Thai corporations have adopted both organic and inorganic methods for their expansion in the Vietnamese market. Aside from M&A activities, Central Group has opened the Robinson Shopping Center in both Hanoi and Ho Chi Minh City while SCG has established a number of paper packaging factories in Vietnam on its own.

During the year, Vingroup has become a dominant local M&A acquirer with a long list of transactions in real estate, retail and logistics. Its most notable additions include Masteri Thao Dien, Ocean Mart, Vinatex, Vinatexmart, the Giang Vo Trade Show Center, and Hop Nhat Express. It is widely believed that Vingroup will take part in and likely close several transactions in the coming time, giving the accelerated equitisation of several large state-owned enterprises (SOEs). To a lesser extent, Masan and FLC have also completed a number of transactions in the animal feed business (Anco and Proconco) and took over several real estate projects.

It should also be noted that many important transactions have been announced but their values have not yet been disclosed. Such deals include Central Group acquiring 49 per cent in NKT (the holding company of Nguyen Kim), Aeon from Japan successfully gaining 49 per cent in Citimart and 30 per cent in Fivimart, Lotte obtaining 50 per cent in Diamond Plaza, Japan’s Credit Saison taking a 49 per cent share of HD Consumer Finance, and Vingroup purchasing 100 per cent of Vinatexmart and 80 per cent of Hop Nhat Express.

Regarding sectors of interest, while food and beverages (F&B), the manufacturing and financial services continued to remain the most attractive M&A sectors in 2014 and the first half of 2015, a large part of noteworthy transactions have also been conducted in the real estate and retail sectors as well.

Prospects of the M&A market in 2015 and 2016

With the positive prospects of the economy, the increase in the supply/availability of quality assets through the removal of foreign ownership limit in listed companies and the accelerated equitisation of several large SOEs, the continued interest of investors from Japan, Thailand, Singapore, the US and local companies, and the participation of Vietnam to the Trans-Pacific Partnership (TPP) agreement , experts forecast a booming M&A market in 2015 and 2016.

Vietnam has witnessed dynamic M&A activities in 2014 and early 2015 with numerous significant transactions Photo: Le Toan

Decree 60, which was issued on June 20, 2015 and will enter into force on September 1, 2015, will remove the current 49 per cent maximum foreign ownership limit in a public company operating in unrestricted areas. The decree’s objective is to make it much easier for foreign investors to acquire a majority interests in public companies. We expect that many foreign investors will take advantage of this removal to acquire attractive public and private companies, especially listed ones. The only remaining limitation is that the list of restricted areas remains quite long and if a public company has a restricted business line in its enterprise registration certificate, the maximum cap of foreign ownership in that restricted business line will be applicable.

It is expected that investors from Japan, Thailand, Singapore and some local companies will continue to be active in the M&A market. Korean investors have been very selective and normally prefer direct investment to M&A and so far, only Lotte and CJ have joined the Vietnamese M&A market. However, Korean investors have been growing perceptibly more interested in the areas of pharmaceuticals, F&B and agribusiness. With the imminent accession of Vietnam to the TPP and the blooming relationship with the US, more American investors are expected to enter the M&A market. Currently, most active investors from the US are private equity firms or investment funds. However, there has been increasing interest from several large American corporations to acquire companies in Vietnam.

The accelerated equitisation of SOEs would hand several quality opportunities on a golden plate to participants on the M&A market, offering up these corporations the chance to benefit from prospects with Mobifone, Satra, SaigonTourist, Vietnam Airlines, as well as SBIC and PV Gas, both of whom are strategic investors. However, it is suspected that several SOEs only plan to divest from unattractive or losing subsidiaries in their current equitisation plans while keeping the most attractive ones to themselves.

Vietnam’s coming participation in the TPP represents a significant opportunity for a number of industries in Vietnam, such as garments, furniture, seafood and agricultural products, to grow through increasing exports to TPP members, notably the US, Japan, Australia and Canada. Foreign investors have shown increasing interest in acquiring assets in these sectors to benefit from the prospective growth brought by the TPP.

By Le Hoang - The author is a senior manager and deal advisory at M&A, KPMG Limited. The views expressed by the author here do not necessarily represent the views and opinions of KPMG Vietnam.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Latest News

More News

- KPMG launches tariff modeller in Vietnam to navigate US tariff risks (July 29, 2025 | 12:11)

- Removing hidden barriers to unlock ASEAN trade (June 29, 2025 | 11:31)

- New report charts path for Vietnam’s clinical trial growth (May 21, 2025 | 08:58)

- TTC Agris strengthens market position with investment in Bien Hoa Consumer JSC (May 19, 2025 | 10:14)

- World Bank to help SBV build shared database for banking industry (April 09, 2025 | 08:55)

- New trade alliances and investment hubs are redefining global power dynamics (April 03, 2025 | 17:00)

- ACCA and KPMG forge path for business leaders to pioneer ESG excellence (March 07, 2025 | 10:09)

- VietBank signs MoU with KPMG (February 26, 2025 | 18:47)

- Warrick Cleine MBE: an honour for services to British trade and investment in Vietnam (December 31, 2024 | 20:16)

- KPMG report offers fresh insight into leveraging AI (December 24, 2024 | 09:23)

Mobile Version

Mobile Version