M&A: Fertile land for consultancy services

|

| Animated M&As across the board provides enormous opportunities for local consulting industry |

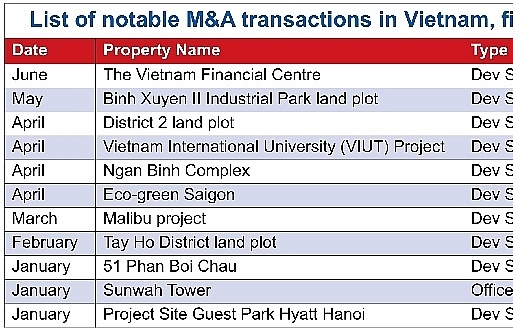

Statistics show that the Vietnamese M&A market saw an average 22 per cent jump in the number of transactions and 15 per cent hike in transaction value during 2007-2017.

The deal value stood at $5.8 billion in 2016 before touching $8 billion last year, turning Vietnam into one of the most robust M&A markets in Asia.

According to Tran Hai Ha, general director of Military Bank Securities JSC (MBS), as market intermediary entities, securities firms are seeing myriad opportunities in M&A consultancy.

Local securities firms are proactively engaging in M&A through the provision of business finance and M&A consultancy services.

Ha said that MBS is expediting several M&A deals in the fast-moving consumer goods (FMCG), petroleum, transport, seaport, hospital, food and beverage, basic materials, energy (hydropower and new energy sources), finance and insurance.

The company’s customers are not only locals, but also foreign business groups and investment funds coming to Vietnam in search for investment opportunities with local peers.

| The deal value stood at $5.8 billion in 2016 before touching $8 billion last year, turning Vietnam into one of the most robust M&A markets in Asia. |

Vietinbank Securities JSC, according to general director Khong Phan Duc, executes hundreds of consultancy contracts each year for businesses under the ministries of Industry and Trade, Construction, and Transport.

Its Japanese partner, Bank of Tokyo-Mitsubishi UFJ Limited (BTMU), is connecting with foreign investors seeking investment opportunities in Vietnam, and in such activities Vietinbank Securities plays the role as the sellers’ consultancy unit.

Since the early fourth quarter of 2017, Vietinbank Securities has been providing consultancy on0 an acquisition deal of a port project valued at more than $16 million for a local investor and the sale of a real estate project worth more than $100 million to a foreign partner.

In addition, the company has signed an authorised contract and is arranging the sale of a $50 million-plus mineral processing plant, and many other deals that are smaller in size.

Tong Minh Tuan, director of Vietcombank Securities’ Ho Chi Minh City branch, said there are multiple promising opportunities for securities firms in M&A consultancy.

Generally, firms focus on acting as consultancy units for sellers. There will be more opportunities if they actively joined hands with other domestic and foreign financial institutions in M&A consultancy.

Several securities firms that are strong in consultancy, such as Ban Viet Securities, VPBank Securities (VPBS), and Bao Viet Securities (BVSC) also said opportunities are widely open to engage in M&A consultancy.

VPBS engages in a wide range of services, such as capital arrangement, issuance guarantee, business M&A consultancy, enterprise value consultancy, debt rescheduling in a specific period, not only for deals in Vietnam, but also in international markets.

Last year, VPBS reported more than VND280 billion from financial consultancy services, a 79 per cent jump on-year.

Last year was also full of success for BVSC as it successfully consulted major deals such as the merger of Bien Hoa Sugar JSC into Thanh Thanh Cong Tay Ninh Sugar JSC with the deal value touching VND9.87 trillion ($437 million).

The most notable was the consultancy project on the capital transfer at Vietnam’s leading brewer, Sabeco, with the deal value hitting VND109.9 trillion ($4.86 billion).

This year, BVSC aims to reach a 30 per cent jump in revenue from consultancy services provision compared to last year, also higher level growth than its other segments of brokerage, self trading in securities, and depository.

Tran Hai Ha, general director of MBS, assumed that positive economic performance, reform commitments, and the economy’s market-based nature, the government’s policies and mechanisms to attract foreign capital flows, and state-owned enterprises streamlining through equitisation will underpin the M&A wave in Vietnam.

“The M&A market will continue its booming development in volume and deal size across the board in the forthcoming time,” Ha commented.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- JB Financial to take 8 per cent stake of motorbike transaction platform OKXE (April 02, 2024 | 12:40)

- M&A Vietnam: Gearing up for a new era (March 30, 2024 | 10:30)

- Vietnam-based B2B food sourcing platform KAMEREO bags $2.1 million in pre-series B funding (March 28, 2024 | 10:52)

- ScaleUP receives investment from Nextrans (March 25, 2024 | 18:01)

- Korean investors need transparency in investment conditions (March 25, 2024 | 09:54)

- Vingroup divests from Vincom Retail (March 19, 2024 | 10:47)

- Japan's NTT e-Asia invests in Vietnamese digital ads platform provider AWING (March 19, 2024 | 10:46)

- Asia Counsel becomes Kinstellar sister law firm in Vietnam (March 18, 2024 | 09:00)

- JB Securities to scoop up 3.9 per cent stake in Infina (March 08, 2024 | 14:30)

- AG&P LNG buys 49 per cent stake in Cai Mep LNG Terminal (March 08, 2024 | 11:39)

Tag:

Tag:

Mobile Version

Mobile Version