Landlords unfazed by higher supply

|

| Despite rising supply in the housing sector, Vietnam’s rental yields make buy-to-let property a profitable endeavour, Photo: Le Toan |

|

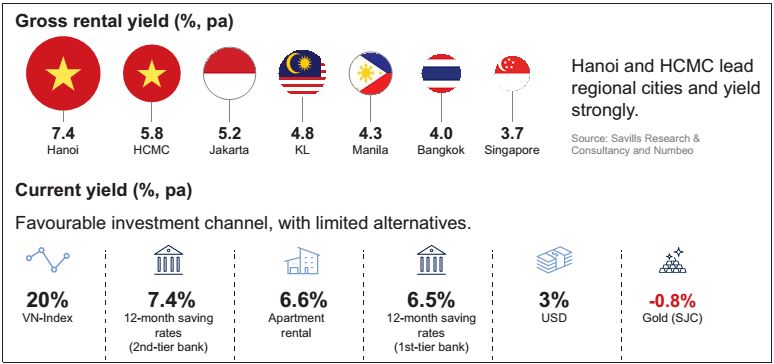

In its latest report “The Great Wave”, Savills Vietnam released new numbers, showing that the housing rental yield in Hanoi and Ho Chi Minh City is much higher than it is in Singapore.

The report said that Hanoi and Ho Chi Minh City are leading Southeast Asia in real estate leasing yield. The number reached 7.4 per cent in Hanoi and 5.8 per cent in Ho Chi Minh City. Hanoi’s numbers are double those of Singapore and 1.7 times those of Manila and Bangkok.

Considering these figures, Savills stated that the segment of housing-for-lease in Vietnam is more attractive than it is in other countries in the region.

Leading real estate developer CapitaLand Vietnam recently launched the D1MENSION, a high-potential buy-to-lease project located in District 1 of Ho Chi Minh City. Chen Lian Pang, CEO of the company, said that buyers can invest in a project with sustainable value for the mid- to long-term.

According to Nguyen Van Duc, deputy director of the Dat Lanh Real Estate Company, the real yield in Ho Chi Minh City is much higher than stated by Savills.

“There are many Hanoians charging into Ho Chi Minh City’s buy-to-let market. The reality is that these properties are in much higher demand in Ho Chi Minh City than in Hanoi, due to the increasing migration and population,” Duc said.

A 60sq.m apartment in Ba Dinh district in the heart of Hanoi can be leased for the price of VND5 million ($227) per month, said Duc. The lease for the same unit in the centre of Ho Chi Minh City could be twice as expensive.

Duc went on to say that even though housing prices in general are higher in Hanoi than in Ho Chi Minh City, yield is smaller.

“In Hanoi, many investors bought units for the sole purpose of keeping their money safe, and looked to buy-to-let properties for making profit. However, the demand for leasing is lower than in Ho Chi Minh City,” he said.

“In Ho Chi Minh City, a number of foreigners from Japan, Korea, and China are leasing units in residential projects. In some special high-end projects, foreigners make up more than 60 per cent of total leases.”

The developer said that for small and well-furnished units, the leasing yield can reach 9 per cent, while some mid-range units can reach between 7 and 8 per cent each year.

Tran Khanh Quang, general director of Viet An Hoa, commented that units in areas centred around high-end residential projects like Thao Dien in District 2, Phu My Hung in District 7, and The Manor and Saigon Pearl in Binh Thanh district are mostly bought by investors from northern provinces, who lease them out to generate income.

Apart from the high leasing yield, Quang also pointed out that apartment units for lease in Ho Chi Minh City are mostly furnished and equipped with more facilities than those in Hanoi.

According to figures from the Ministry of Labour, Invalids, and Social Affairs, more than 84,000 foreign workers and experts were living in Vietnam in the first half of 2017. Around 90 per cent of these needed housing for lease.

In Hanoi, the area around West Lake remains most attractive for leases, with occupancy around 80 per cent and leasing prices in the range of $500 - $1,500 per month per unit.

In Ho Chi Minh City, District 7 and the area along Binh Thanh district’s Nguyen Huu Canh street are most attractive, with prices from $600 to 1,000 per month per unit.

Buy-to-let is attractive to investors because it brings more stable benefits and long-term capital gains than other investment channels such as gold, securities, and even bank interest.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Latest News

More News

- Dong Nai experiences shifting expectations and new industrial cycle (January 28, 2026 | 09:00)

- An Phat 5 Industrial Park targets ESG-driven investors in Hai Phong (January 26, 2026 | 08:30)

- Decree opens incentives for green urban development (January 24, 2026 | 11:18)

- Public investment is reshaping real estate’s role in Vietnam (January 21, 2026 | 10:04)

- Ho Chi Minh City seeks investor to revive Binh Quoi–Thanh Da project (January 19, 2026 | 11:58)

- Sun Group launches construction of Rach Chiec sports complex (January 16, 2026 | 16:17)

- CEO Group breaks ground on first industrial park in Haiphong Free Trade Zone (January 15, 2026 | 15:47)

- BRIGHTPARK Entertainment Complex opens in Ninh Binh (January 12, 2026 | 14:27)

- Ho Chi Minh City's industrial parks top $5.3 billion investment in 2025 (January 06, 2026 | 08:38)

- Why Vietnam must build a global strategy for its construction industry (December 31, 2025 | 18:57)

Mobile Version

Mobile Version