Kraft Heinz ravenous hunger hides shrinking margins

|

| Kraft and Heinz products in Chicago, Illinois. source: AFP file photo |

Thwarted attempt

Kraft Heinz and Unilever on February 17 announced in a joint statement their cordial agreement that the former withdraw its $143 billion takeover bid only two days after shaking the media by making the offer.

Kraft Heinz’s desire for yet another major acquisition, fuelled by key partners Warren Buffet and Brazilian investment firm 3G Capital, to build up a food and beverage overlord has been temporarily checked by firm rejection from Unilever. Despite rumours that Kraft Heinz would be willing to enter a costly public takeover, the two giants instead decided to stand aside on friendly terms.

According to the brief joint statement published on the Unilever website, “Unilever and Kraft Heinz hold each other in high regard. Kraft Heinz has the utmost respect for the culture, strategy and leadership of Unilever.”

The $143 billion deal would have made history as one of the largest takeovers in corporate history. The acquisition of flagship British-Dutch food and personal care product seller and manufacturer Unilever would have brought 13 brands with sales of €1 billion ($1.06 billion) or above, including Axe, Dove, Knorr, and Lipton, to the already strong line-up of Kraft Heinz that includes iconic brands like Heinz, Kraft, Philadelphia, and Capri Sun, among others.

Unilever’s turnover of €53.3billion ($56.36 billion) and Kraft Heinz’s net sales of $18.34 billion (as cited by the companies’ annual reports for the fiscal year of 2015) and their established presence in more than 190 countries over the world draw up the image of a titan with the world in the palm of his hand. Undoubtedly, the deal would have meant the birth of the largest food, beverage, and personal care corporation to date.

However, Kfraft Heinz’s offer met strong opposition not only from the side of Unilever, but of unions that expressed fears over the 9,000 jobs that could be affected in the UK. According to the Guardian, fears arose over the Cadbury-precedent of 2010, when Kraft took over the British chocolate-maker Cadbury for £11.5 billion ($14.29 billion). The initial pledges and promises to keep production in the UK proved false almost immediately as the firm was embedded into Mondelez International.

Union opposition led by Unite, Britain’s biggest union which represents 2,000 of the 7,500 Unilever staff in the UK as well as the Cadbury-precedent speaking expressly against the Kraft in Kraft Heinz, coupled with Unilever’s firm refusal have apparently been enough.

Nothing new

Since the merger of individual food giants Kraft and Heinz under the guiding hands of Warren Buffet and Brazilian investment fund 3G Capital, the market has braced itself in expectation of further mega-mergers to come.

Based on the fame of its two major investors, Berkshire Hathaway Inc. (Warren Buffet) and 3G Capial, market analysts have been forecasting the well-trodden scenario to repeat itself. This would entail Brazilian investment fund 3G Capital’s objective of building up a global colossus through acquisitions and by cutting margins through extreme austerity measures—both of which have come to pass, to a certain degree.

Since 2015, Kraft Heinz has made headlines with a number of speculative marriages to former Kraft confectionery arm Mondelez International, General Mills Inc., Kellogg Company, and Campbell Soup.

While there has been no explicit offer made, Kraft Heinz decided to beggar expectations by making a $143 billion offer to takeover staple British and Dutch food and personal care trader Unilever.

Regardless of the hurr-durr in the wake of the offer whereby all British stakeholders were mobilised in a unified call against a possible merger, Unilever’s stern refusal, British labour union Unite’s calling for legislation on the so-called Cadbury-rule, and legislators’ shrieking over British jobs, or even the subsequent amicable withdrawal, the offer itself is worth a closer inspection.

|

Cadbury precedent When Kraft took over British chocolate-maker Cadbury for £11.5 billion ($14.29 billion), initial pledges and promises to keep production in the UK proved were reneged almost immediately as the firm was embedded into Mondelez International. The British public, as well as legislators, were badly blindsided by Kraft’s sudden decision to close the Cadbury production factory at Somerset, firing 400 employees. |

It is public knowledge that 3G Capital prefers building up food and beverage giants and pursue large-scale takeovers. This was aptly demonstrated in their creation of AG InBev, which now brews some 30 per cent of the world’s beer, through a series of acquisitions that was finished with a takeover similar to the recent Unilever offer: 3G Capital put down $117 billion for SAB Miller in a deal previously thought impossible.

3G Capital’s strategy is relatively simple after takeover, as observed during the AG InBev restructuring post-acquisition: layoffs, constricted budgets, and (oftentimes extreme) austerity measures. “Zero-based budgeting,” under which every expense (not only new ones) have to be justified every year with a goal of reducing expenses over-year, and wide-scale cost-cutting measures ranging from selling private airplanes to switching to communal printers from personal ones have earned the Brazilian investor fame as a “profit- and margin-generating machine,” as per Harry Schumacher, editor of trade publication Beer Business Daily.

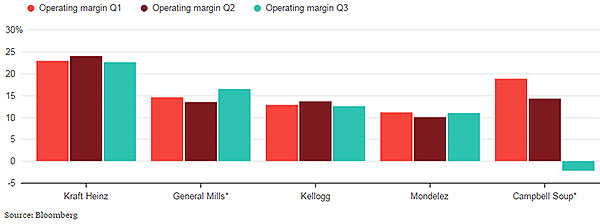

The “3G way” was observable after the Kraft Heinz acquisitions as well: the company now is one of the leanest companies with the best margins of industry giants, having improved Kraft’s and Heinz’s individual margins from 15-18 to 23 per cent.

This is why industry experts have been long speculating for the next acquisition, as there is plenty of work to be done, and profit to be made, at potential targets: the operating margins in the last financial quarter for General Mills, Kellogg, Mondelez, and Campbell Soup have been far lower at 16.5, 12.6, 11.0, and -2.2 per cent, respectively.

|

But what is fuelling this desire to grow? Is it only a drive to create a colossus of Kraft macaroni, Heinz ketchup, and Ben and Jerry’s ice-cream or are there underlying business considerations?

While acquisitive ambitions are not to be dismissed, there might be strong reasons to claim Heinz is in a do or die position: despite 3G Capital’s admirable successes at cost-cutting and pushing out margins, there has been little improvement to company revenue. On the short-term this does not bode a disaster, but as soon as we go into medium or long-term prospects, troubles arise as there is a limit to saving on expenses to streamline a company, but real headway can only be forged from revenue.

Kraft Heinz is facing little growth in revenue both in the US and over the world, according to newswire Seeking Alpha as customer preferences and behaviour are altering, which can be hardly catered for via cost-cutting and improved margins.

This marked shift towards the healthy and green has prodded the company to introduce low-calorie products without artificial ingredients and is hoping to channel some of its planned $1.7 billion savings into reigniting revenue growth. Quick note: Unilever’s range of brands and profile as a green and healthy company would have fitted this strategy rather beautifully.

Willow Street Investments, in an article published on Seeking Alpha, offered the opinion that Kraft Heinz is hard-pressed to push acquisitions to support its overpriced shares as slow growth in revenue and earnings is insufficient.

In addition, speculating on Kraft Heinz’s plans of further cost-cutting and channelling of funds to increase revenue, Willow Street Investments warns investors away from Kraft Heinz shares, bidding them to wait for the inevitable drop before the pick-up by the end of the year.

| RELATED CONTENTS: | |

| Meeting responds to World Toilet Day in Hanoi | |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Latest News

More News

- Samsung returns to top of the smartphone market: industry tracker (April 16, 2024 | 18:00)

- VitaDairy partners with KPMG Vietnam on digital transformation (April 16, 2024 | 16:38)

- Boeing says testing of 787 proves aircraft is safe (April 16, 2024 | 16:00)

- PwC rejects allegations on Evergrande audit (April 16, 2024 | 14:39)

- Vietnam’s agricultural products appeal to foreign customers (April 15, 2024 | 17:04)

- Businesses press for EPR guidelines (April 15, 2024 | 17:00)

- Planning for 30 airports to complete by 2025 (April 15, 2024 | 16:56)

- Apple announces Vietnam spending boost as CEO visits Hanoi (April 15, 2024 | 15:59)

- Norway stands ready to collaborate with Vietnam in EPR policy and practices (April 15, 2024 | 15:00)

- Accelerating Vietnam’s journey towards 5G (April 15, 2024 | 13:57)

Mobile Version

Mobile Version