J.D Power publishes 2017 Vietnam Sales Satisfaction Index

|

| Toyota and Nissan finished on top of J.D. Power's customer satisfaction survey |

Nearly two-thirds of new-vehicle buyers say they seriously considered another model while shopping for their new vehicle, with shoppers also visiting more brand dealerships, compared with 2016. On average, new-vehicle shoppers use seven different sources of information to gather preliminary data and feedback about the models they are considering.

The internet is the primary media used, with 99 per cent of new-vehicle owners saying they used online sources while shopping. Browsing specialised websites and social networks has increased notably from last year at the expense of OEM/ dealer websites, which have been used less frequently in 2017.

“As competition in the Vietnamese automotive market grows in advance of the scheduled tax cuts in 2018, authorised dealers are actively trying to entice shoppers and boost sales through aggressive discounts and incentives, thereby increasing competition between brands,” said Loïc Péan, senior manager at J.D. Power.

“Unfortunately, this sometimes has the adverse effect of increasing expectations with respect to the final vehicle’s price, and dealer staff neglecting or expediting certain aspects of the new-vehicle sales and delivery process—both having a negative effect on customer satisfaction,” Loïc Péan added.

The study finds that the number of sales standards experienced by new-vehicle buyers has dropped considerably to 19.6 standards in 2017 from 20.6 in 2016 (out of 22 critical standards evaluated in the study).

Specifically, interactions with customers are less pertinent than last year, as more customers indicate that their salesperson was not entirely focused on them (-13 percentage points); they did not receive a comprehensive explanation of the features and benefits of the vehicle while shopping (-10 percentage points); and/or they were not kept informed about the delivery status of their vehicle (-8 percentage points). Additionally, only 77 per cent say the salesperson used an actual vehicle on display for the demonstration, down from 90 per cent in 2016.

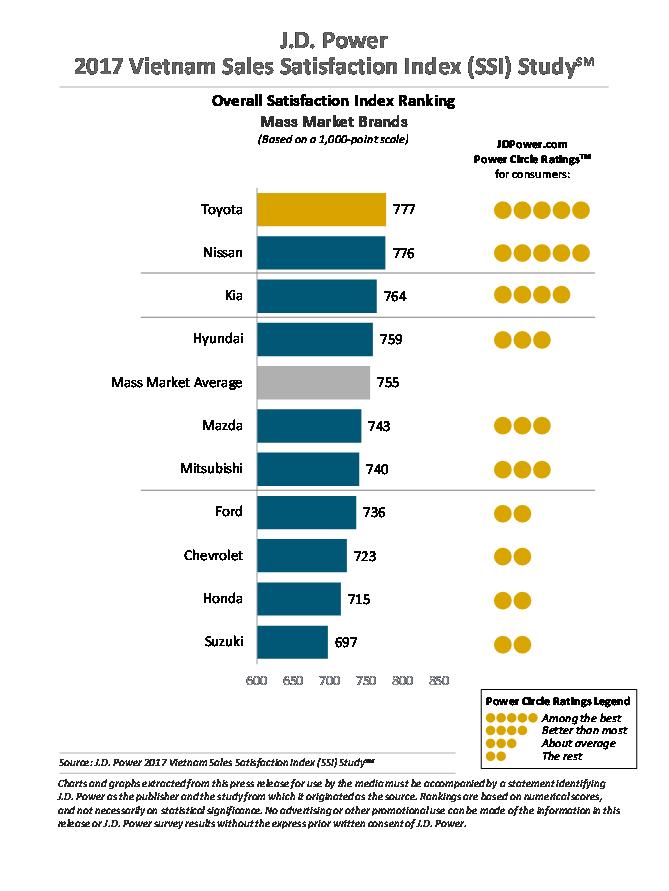

There are three key findings in the study. The first is the drop in overall sales satisfaction. Overall satisfaction with the sales and delivery process decreased to 755 (on a 1,000-point scale) in 2017, down from 793 in 2016.

|

The second is that new-vehicle buyers are driving an increasingly harder bargain, as 60 per cent say they negotiated the deal, up from 35 per cent in 2016. Additionally, two-thirds received discounts and 98 per cent received additional freebies from their dealers. Despite receiving more discounts and freebies, however, 27 per cent of new-vehicle owners say they paid more than expected for their vehicle, a sharp increase from the 12 per cent in 2016.

The third is that dealer loyalty and advocacy stagnate and remain low. Notably, among new-vehicle owners, 42 per cent said they “definitely would” recommend their purchase dealer and 22 said they “definitely would” repurchase from the same dealer in the future, up slightly from 39 and 14 per cent in 2016, respectively. However, fewer owners say they “definitely would” service their car at the same dealer (51 per cent n 2017 and 66 per cent in 2016).

Regarding the study rankings, Toyota ranks highest in overall sales satisfaction for the third consecutive year, with a score of 777. Toyota performs particularly well in the sales initiation, dealer facility, and delivery process factors. Nissan (776) ranks second, followed by Kia (764).

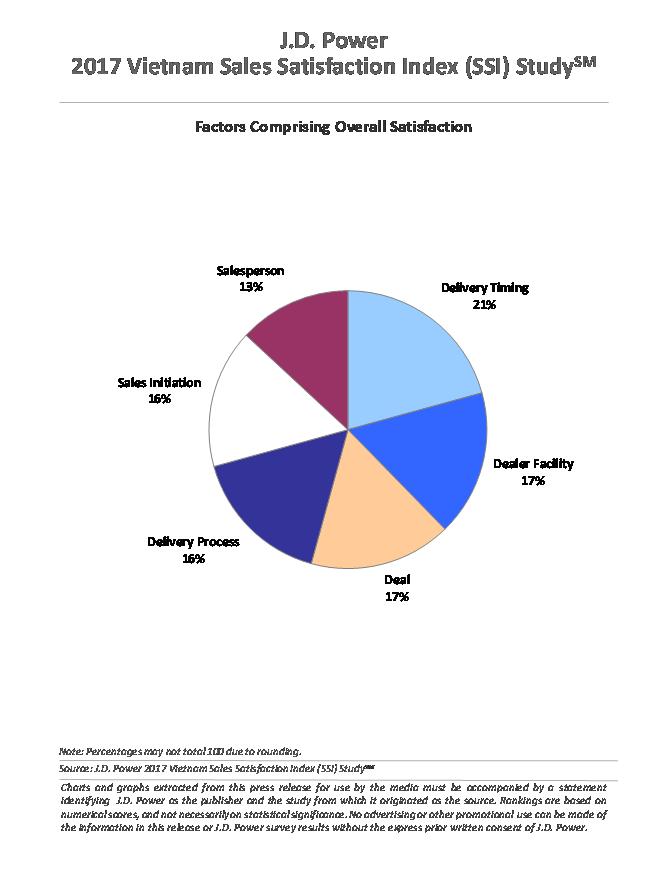

The 2017 Vietnam Sales Satisfaction Index (SSI) Study examines sales satisfaction in the mass market segment using six factors that contribute to overall customer satisfaction with the new-vehicle purchase experience (in order of importance): delivery timing (22 per cent), dealer facility (17 per cent), deal (17 per cent), delivery process (16 per cent), sales initiation (16 per cent), and salesperson (13 per cent).

The study, now in its ninth year, is based on responses from 1,734 new-vehicle owners who purchased their vehicles from January through October 2017. The study was fielded online from August through October 2017.

J.D. Power is a portfolio company of XIO Group, a global alternative investments and private equity firm headquartered in London, and is led by its four founders, namely Athene Li, Joseph Pacini, Murphy Qiao, and Carsten Geyer.

J.D. Power has offices in Singapore, Bangkok, Beijing, Shanghai, and Tokyo that conduct customer satisfaction research and provide consultancy services in the automotive, information technology, and finance industries in the Asia-Pacific region. Together, the five offices bring the language of customer satisfaction to consumers and businesses in Australia, China, India, Indonesia, Japan, Malaysia, Philippines, Taiwan, Thailand, and Vietnam.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Latest News

More News

- Opella and Long Chau join forces to enhance digestive and bone health (February 06, 2026 | 18:00)

- Vietnam-South Africa strategic partnership boosts business links (February 06, 2026 | 13:28)

- Sun PhuQuoc Airways secures AJW Group support for fleet operations (February 06, 2026 | 13:23)

- Pegasus Tech Ventures steps up Vietnam focus (February 05, 2026 | 17:25)

- The generics industry: unlocking new growth drivers (February 04, 2026 | 17:39)

- Vietnam ready to increase purchases of US goods (February 04, 2026 | 15:55)

- Steel industry faces challenges in 2026 (February 03, 2026 | 17:20)

- State corporations poised to drive 2026 growth (February 03, 2026 | 13:58)

- Why high-tech talent will define Vietnam’s growth (February 02, 2026 | 10:47)

- FMCG resilience amid varying storms (February 02, 2026 | 10:00)

Mobile Version

Mobile Version