Japanese firms shifting to consumer goods sector

Japanese-invested Sakura Vietnam, operator of the convenience store chain of the same name, opened its ninth store in Hanoi in late May after having achieved encouraging results in previous years.

“Since we opened our first store in the capital in January 2015, we have seen an increase of 40 per cent in the number of customers on year. For example, around 500 to 1,000 customers shop every day at our store in Thai Ha street. We also have been developing franchises in other cities and provinces,” a member of Sakura’s marketing staff told VIR.

Sakura is just one of many Japanese firms that have expanded to and within Vietnam’s consumer goods and service sectors in recent years. Other big names are Aeon, Family Mart, Tokyo Deli, Gyu-Kaku, Osaka Ohsho, and Daiso.

Aeon, a leading Japanese retailer, entered Vietnam in early 2014 and currently has four shopping malls, with a fifth already under construction. The company’s goal is to have 20 malls operating across Vietnam by 2020.

Aeon is not only focusing on investing in large-scale trade centres, however. The corporation is also co-operating with Vietnam’s leading supermarket operators – namely, Citimart and Fivimart – to grow its footprint in the lucrative local retail market, while partnering with Japan’s Sojitz Corporation to develop the Ministop brand of convenience stores.

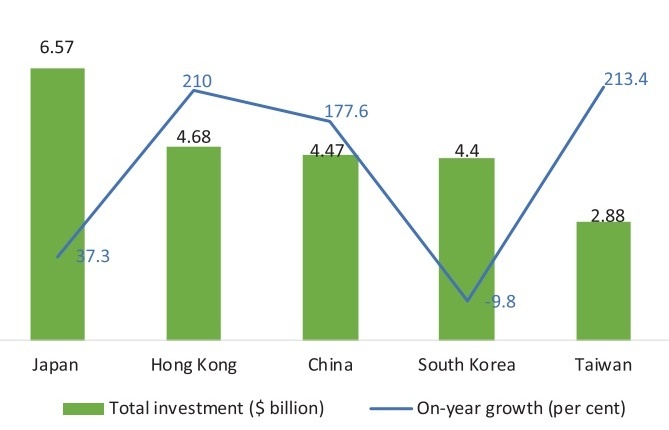

“Direct investment capital from Japan in 2016 was $2.1 billion, a 17.7 per cent increase from 2015. In the last three years, Japanese investments have focused on the consumer goods, services, and real estate sectors, reflecting the growth of Vietnamese purchasing power,” Takimoto Koji, chief representative of the Japan External Trade Organization’s (Jetro) Ho Chi Minh City Office, told VIR.

Japan is the only foreign country whose businesses operate in three retail channels in Vietnam – supermarkets, trade centres, and convenience stores – with the number of convenience stores growing strongly and expected to reach 1,000 in 2017.

This trend is reflected in Jetro’s latest annual survey on the business activities of Japan-affiliated companies in Asia and Oceania in 2016. According to the survey, the number of Japanese-invested projects in the hotel, food, and beverage industries were double that of the previous year, while distribution and retail rose by 19.2 per cent

In terms of pledged capital, $74 million worth of Japanese investment in distribution and retail were licensed during the year, up 10.45 per cent on-year.

Significant changes in manufacturing

According to Naoki Takeuchi, director of Jetro’s Hanoi Office, Japanese investment in Vietnam used to focus mainly on manufacturing, but there have been changes recently.

“Japanese investments in large-scale manufacturing seem to have reached a peak, and the stability of the cheap Yen has led to smaller investment scales for most projects,” he explained.

According to Jetro’s survey, in recent years, the number of new Japanese-invested projects in the non-manufacturing sectors has accounted for 70-80 per cent, with the majority being small and medium-sized enterprises (SMEs). Japanese firms tended to increase their investments in small projects worth less than $5 million, accounting for 90 per cent of the total number.

The trend has caused a decrease in Japan’s newly-registered capital, and the number of new projects in Vietnam’s manufacturing industry in 2016 – by 28.2 and 27.5 per cent, respectively.

“Big manufacturers like Honda, Panasonic, Yamaha, and Canon are now in stable leadership positions. Currently, SMEs come to Vietnam to supply spare parts for them,” Hiroshi Karashima, chairman of the Japan Business Association in Vietnam (JBAV), told VIR.

Meanwhile, some are still expanding in Vietnam to cash in on the growing local demand, with Nipro and Daikin being examples.

Nipro Pharma Vietnam Co., Ltd. was established in 2012 and is fully invested by Nipro Pharma Corporation, which is the biggest pharmaceutical manufacturing company in Japan. The firm is expanding to southern Vietnam with new projects, while it is still running a factory in the northern port city of Haiphong.

“In the future, we plan to expand our facility to manufacture products with more variation,” said Ken-ichiro Kuninobu, manager of Nipro Pharma Corporation’s Business Development Division.

The air conditioner giant Daikin is constructing a $100 million project in the northern province of Hung Yen, and will put it into operation in 2018 – with a capacity of 500,000 units per year.

Panasonic plans to add more lines at its Malaysian and Vietnamese plants, with costs expected to amount to around ¥1 billion ($8.98 million).

Power and real estate remain appealing

According to JBAV’s Karashima, many Japanese companies are interested in the construction of apartments and shopping centres to bring Japanese quality to Vietnam amid the rising demand.

One of the very first and most outstanding investors in the real estate sector coming from Japan is Tokyu, which is developing the $1.2 billion Tokyu Garden project in the southern province of Binh Duong, 30 kilometres from Ho Chi Minh City.

Mitsubishi Group joined the market in 2016, setting up a joint venture with domestic firm Bitexco to develop the Manor Central Park complex in Hanoi. Other big names investing in real estate are Creed Group, Kajima, Daibiru Group, and Global Group.

Seeing the potential, Karashima, who is also CEO of Sumitomo Corporation Vietnam, said that his group is also studying opportunities to invest in real estate, particularly in Ho Chi Minh City and Hanoi.

Power generation is another magnet for Japanese investors due to Vietnam’s increasing demand, driven by its economic growth. Mitsubishi and Sumitomo are among the key Japanese players in the Vietnamese power market. Many Japanese firms are also in negotiations to get licences for the three significant thermal power plants: Nghi Son II, Vung Ang II, and Van Phong I.

Future bright for bilateral ties

Japanese investors are employing the “China Plus One” strategy, which means when labour and other production costs in China are rising, investors look for additional locations to diversify their production base. The northern region of Vietnam is especially attractive for this strategy, since manufactures can establish a supply chain between Guangzhou and Hanoi.

With increased revenue and growth prospects, 66 per cent of Japanese firms stated a willingness to increase their business operations in Vietnam in 2016, up from 63.9 per cent in 2015. This rate was higher than that for the Philippines (54.4 per cent), Indonesia (51.6 per cent), Thailand (50.1 per cent), Malaysia (44.1 per cent), and China (40.1 per cent), according to the Jetro survey.

“To facilitate Japanese investments, the governments of Vietnam and Japan are co-operating to develop two specialised industrial parks with many special incentives in Haiphong and Ba Ria-Vung Tau,” said Nguyen Noi, deputy director of the Ministry of Planning and Investment’s (MPI) Foreign Investment Agency.

Vietnam is encouraging Japanese investors to focus their projects in six key areas under the Vietnam-Japan industrialisation development co-operation framework, including agro-fishery processing, electronics, automobiles and auto parts, agricultural machinery, environmental protection and energy conservation, and shipbuilding.

“We also call on Japanese investments in the form of public–private partnerships (PPP) and mergers and acquisitions in state-owned enterprises, while focusing on building policies to encourage Japanese SMEs to invest in the supporting industries as well as clean, high-tech agriculture,” Noi said.

Vietnamese and Japanese firms are also looking for more business opportunities from Prime Minister Nguyen Xuan Phuc’s upcoming visit to Japan, when a record number of co-operation deals are expected to be signed.

According to MPI, Japan is now Vietnam’s second largest foreign investor, and the country’s third biggest trade partner. As of May 20, 2017, Japan ranked second among 119 countries and territories investing in Vietnam, with an accumulated registered capital of $43.4 billion in over 3,400 projects.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Latest News

More News

- MoIT proposes scheme to boost renewable energy procurement (April 17, 2024 | 14:05)

- Disbursement delay deemed unacceptable (April 17, 2024 | 09:13)

- Planning for 30 airports to complete by 2025 (April 15, 2024 | 16:56)

- MPI calls for high-tech, green energy cooperation from Washington investors (April 10, 2024 | 15:33)

- Vietnam's economic growth expected to pick up in 2024 (April 09, 2024 | 15:16)

- European business confidence at highest since 2022 (April 08, 2024 | 09:55)

- Where is environmental governance in FDI attraction? (April 08, 2024 | 09:45)

- 2024 is expected to see fiercer competition in FMCG (April 04, 2024 | 16:53)

- Vietnamese startups bag $35.7 million in first quarter of 2024 (April 02, 2024 | 16:40)

- Investors increasingly optimistic about manufacturing sector (April 01, 2024 | 14:51)

Mobile Version

Mobile Version