HOSE and StoxPlus organise “Vietnam Stock Market: On the Way to Emerging Markets” conference

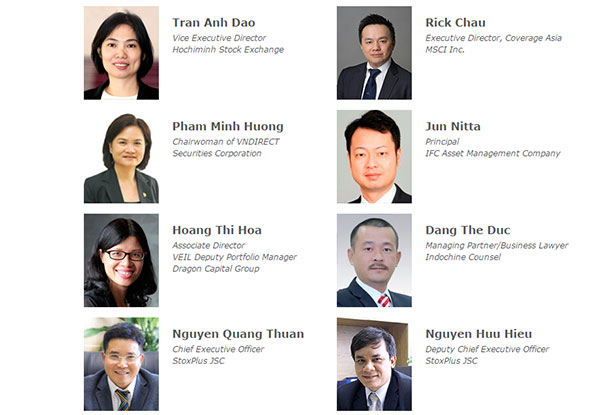

| Main Speakers and Panelists |

|

Vietnam, however, remains among few frontier markets in the MSCI category, which include Sri Lanka and Bangladesh. This has hindered Vietnam from drawing investment from big guys such as global financial institutions and asset management companies which have strategies to allocate their portfolio in global, regional or emerging markets.

Foreign investors can now have opportunities to increase up to 100 per cent of voting shares in a public company in Vietnam when companies have been in progress to change their foreign ownership limits (FOL) as allowed by current regulations. In addition to the FOL loosening, a number of other actions are now in the progress of implementation by related government agencies toward the promotion of Vietnam Stock Market to Emerging Markets (EM) classification by MSCI.

How are Vietnamese government agencies dealing with the progress? What are main constraints to loosen the FOL in Vietnamese public companies? And when can Vietnam’s stock market expected to be upgraded to EM status?

Addressing these concerns and as part of their cooperation, Ho Chi Minh Stock Exchange (HOSE) and StoxPlus have conducted a comprehensive review on FOL for listed companies under VN100 Index on HOSE.

They have also conducted a survey to obtain opinions and feedbacks from more than 100 representatives of foreign institutional investors including large asset management firms who haven’t got exposure into Vietnam and who are awaiting for the change.

In addition to sharing from MSCI’s representative, Vietnamese government’s representatives and other speakers, HOSE and StoxPlus are also pleased to bring the key findings from their joint review of FOL on HOSE Listed Companies and Foreign Institutional Investor Survey via this conference.

The event receives technical support from the State Securities Commission, IFC, Nikkei Inc., QUICK Corp and Indochine Counsel.

This is the second annual conference organised by StoxPlus and HOSE with support from Nikkei Inc. and QUICK Corp. from Japan. There will be about 250 participants including representatives from investment and financial institutions from Vietnam, Japan, Singapore, Hong Kong, Shanghai, Thailand, Malaysia, US and EU attending this conference.

The event will take place on November 4, 2016 at HOSE’s Exchange Tower, 16 Vo Van Kiet street, District 1, Ho Chi Minh City.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Latest News

More News

- Long-term capital seen as key hurdle to green growth (December 16, 2025 | 08:00)

- Gold prices swing amid tax debate and import uncertainty (December 15, 2025 | 18:04)

- Agribank frames bank credit as catalyst for green growth (December 15, 2025 | 17:59)

- Vietnam’s green transition demands collective financial action (December 15, 2025 | 12:00)

- VIR workshop highlights capital and policy for sustainable development (December 15, 2025 | 11:00)

- Promoting digital assets initiative in Vietnam (December 13, 2025 | 09:30)

- Experts flag gaps as national financial strategy under review (December 12, 2025 | 15:13)

- Global gold exchange models offer roadmap for Vietnamese market (December 12, 2025 | 11:58)

- Five million household businesses to adopt self-declared tax system (December 11, 2025 | 18:13)

- Vietnam establishes management board for crypto asset trading market (December 11, 2025 | 18:11)

Mobile Version

Mobile Version