Greece returns to debt markets after three-year hiatus

|

| Graffiti in Athens by French street artist Goin. (Photo: AFP/Louisa Gouliamaki) |

It even managed to borrow at cheaper rates than in 2014, the last time it tapped the international bond market, HSBC, lead manager for the operation, told AFP.

The Greek treasury sold €3 billion (US$3.5 billion) worth of five-year bonds at a rate of 4.625 per cent, said Frederic Gabizon, head of European public sector debt at HSBC.

That is below the 4.95 per cent in Greece's last auction of bonds in 2014, reportedly the target the Greek government had set in the new offer.

The operation was "a complete success", the Greek government said in a statement, adding it was "a solid base on which to maintain the country's access to debt markets".

It also confirmed the "positive development of the Greek economy", it said.

OVERSUBSCRIBED

Total demand for the issue came in at €6.5 billion, HSBC's Gabizon said, making it more than twice subscribed.

Half the bonds sold were new, and half were issued to be exchanged for five-year bonds sold in 2014.

Apart from HSBC, BNP Paribas, Bank of America Merrill Lynch, Citi, Deutsche Bank and Goldman Sachs also underwrote the syndicated sale.

The government announced Monday it was attempting a comeback to the debt markets, which it considers a test of confidence.

Greece currently has no real need to draw money from the bond markets as it recently received renewed financial support at lower rates under its international bailout that should see it through until next year.

However it is a psychological milestone, demonstrating that Greece is back on the road to weaning itself off bailout aid.

It is also an opportunity for Prime Minister Alexis Tsipras to shore up support for his Syriza party.

The party, in power since January 2015, has seen its popularity plummet since doing a 180-degree turn by accepting more spending cuts and tax hikes in exchange for a third package of international bailout loans.

The Greek economy nearly collapsed in 2010 under a mountain of debt and the government had to be bailed out by its eurozone partners. While Tsipras had swept to power on pledges to end austerity and bailouts, he backed down when Greece was again on the brink of the abyss, facing a possible exit from the euro.

But the clash with borrowers killed off a nascent recovery, with the Greek economy stagnating in 2016, although it is expected to post modest growth of 2.1 per cent this year.

'PIVOTAL MOMENT'

The successful return to the markets supports the narrative that Greece is again on the road to recovery, which could provide relief to both Tsipras's government and its creditors, Greece's eurozone partners and the International Monetary Fund.

EU economy commissioner Pierre Moscovici, who was in Athens on Tuesday, called it a "pivotal moment".

He said Tuesday that Greece is making a "spectacular recovery" that should allow it to "progressively return" to the debt markets, according to a statement released by the office of Greek President Prokopis Pavlopoulos after the two met.

The return to the markets comes after tension over Greece's latest bailout programme in recent months eased.

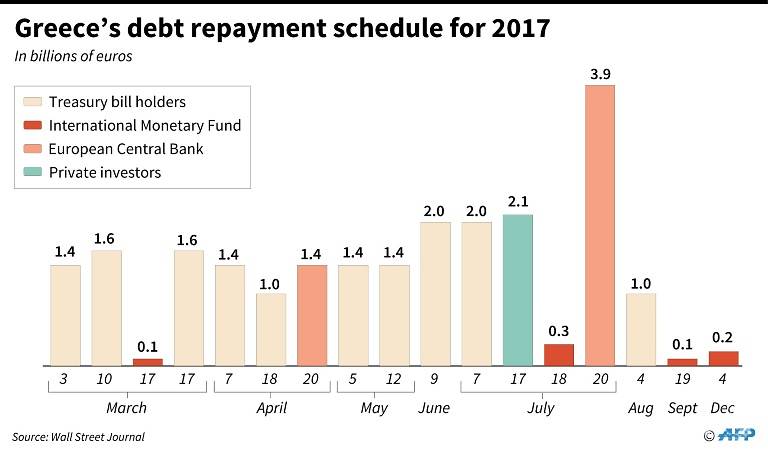

Earlier this month, eurozone finance ministers approved the latest €8.5 billion (US$9.9-billion) disbursement from a third international bailout, just in time for Athens to meet major debt repayments.

|

| Debt relief has been the major bone of contention between the Greek government of Prime Minister Alexis Tsipras and the eurozone. (Graphic: AFP/Jochen Gebauer) |

LET'S DO IT AGAIN

The European Stability Mechanism (ESM) will also keep feeding the debt-ridden country with low interest rate loans (0.8 and 1.8 per cent) until the end of the bailout programme in August 2018.

By that time, Greece expects to tap bond markets twice more to win investor confidence and "exit from crisis", Greek Finance Minister Euclid Tsakalotos said on Tuesday.

Meanwhile the IMF last week approved a one-year, US$1.8-billion loan programme for the country. This gave Athens the chance to test without major financial risks its credibility in the markets.

Moreover, the IMF funds, which are contingent on the eurozone finally reaching a deal to reduce Greece's colossal €314-billion debt burden, should keep up pressure to make the country's finances sustainable on a long-term basis.

Debt relief has been the major bone of contention between the government of Tsipras and the eurozone, which had delayed the deal to disburse the latest bailout funds.

Moscovici said Tuesday that debt relief could come once Greece successfully implements promised reforms and completes its last year under the bailout programme, although he said a decision on fresh measures may come earlier.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Latest News

More News

- Thailand urged to increase proportion of renewable power generation (April 23, 2024 | 11:53)

- World Health Summit Regional Meeting opens (April 22, 2024 | 10:38)

- Vietnam to have many opportunities from digitalisation, green transformation: IMF (April 19, 2024 | 17:45)

- Malaysia sets up clean energy exchange (April 16, 2024 | 16:59)

- Indonesia issues dengue fever warning to Bali tourists (April 16, 2024 | 16:53)

- Trade facilitation ahead with ASEAN-India deal upgrade (April 15, 2024 | 17:00)

- ASEAN strength to be built on with trade reforms (April 15, 2024 | 14:58)

- Malaysian airlines to charge carbon levy soon (April 15, 2024 | 09:21)

- Malaysia issues heatwave alert for 14 areas (April 15, 2024 | 09:12)

- China, Thailand forge alliance for moon exploration (April 15, 2024 | 08:00)

Mobile Version

Mobile Version