Global economic events cause CDS spread spikes

Source: Bloomberg, VPBS collected

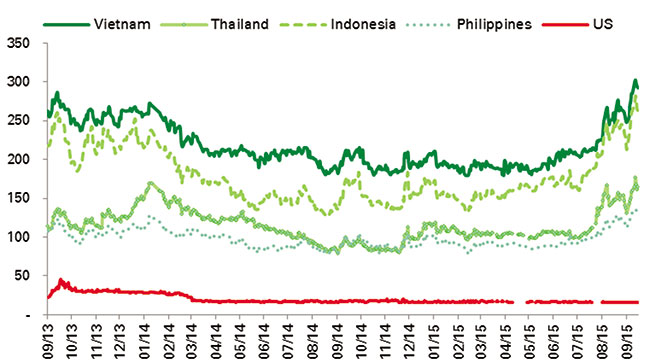

The higher CDS spreads, the riskier investing in the country is. Whereas in the first half of the year, the CDS of Southeast Asian emerging countries fluctuated in a marginal band, during the third quarter the CDS of these countries increased sharply mainly due to the impacts from global events such as the Chinese economic slowdown and the US Federal Reserve’s (the Fed) likely upcoming decision to raise interest rates.

By the end of the third quarter, Vietnam’s CDS spreads had risen by 93 basis points (bps) (note that one basis point equals 1/100 of one per cent) compared to the previous quarter, reaching 297.5. Vietnam’s CDS seemed to move upward throughout the quarter and sometimes surged by 20 to 30 bps per week, especially on September 29, 2015 when Vietnam CDS reached their two-year high. However, these increases were not as high as those recorded by Vietnam’s neighbouring countries. Indonesia’s CDS climbed 101.5 bps compared to the second quarter. Meanwhile, the CDS of Thailand and Philippines each increased by 62.5 and 41.5 from the previous week.

During the third quarter, the worldwide economy witnessed many geopolitical and economic events that significantly impacted emerging markets, not just amongst the Association of Southeast Asian Nations (ASEAN) but globally. Those events had negative effects on emerging countries, resulting in a strong increase in their CDS spreads in the third quarter and a huge sell-off by global investors out of these nations.

The first event that affected emerging countries was speculation that the Fed might raise the US borrowing cost for the first time in a decade at its September Federal Open Market Committee meeting. A US interest rate hike would considerably impact emerging economies worldwide. A higher interest rate would attract investors to invest in the US market, which is viewed as a safer investment destination than emerging countries. The worry that global investors might divert their funds from emerging markets to the US markets, caused a huge-sell off in the stock and bond markets of emerging countries. As a consequence, this led CDS spreads of emerging markets to surge sharply, whereas the US CDS remained stable or even tightened somewhat. Speculation over the Fed’s decision of an interest rate hike was a topic that has attracted much concern by investors around the world since the beginning of the year. However in the third quarter, positive economic data on the US labour market and business fixed investment strengthened expectations of investors who believed in a September interest rate hike, which therefore caused significant impacts on emerging markets.

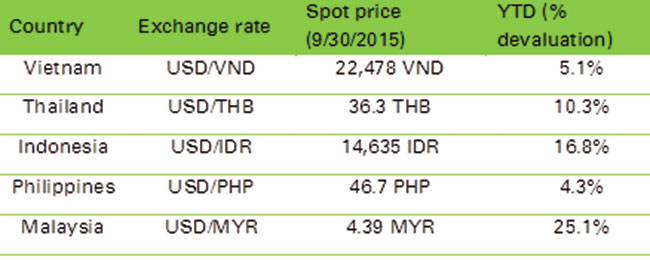

Moreover, because of the expectations for a US interest rate hike the dollar gained significant strength. Its strong appreciation put pressure on the CDS spreads of emerging countries, as the value of dollar-denominated sovereign debts also rose along with value of the dollar. The exchange rates of many Southeast Asian countries’ currencies against the dollar surged in the third quarter, in which the ringgit of Malaysia devalued the most among ASEAN currencies, following by the Indonesian rupiah, and the Thai baht.

Besides the economic events in the US, China had a significant impact on Southeast Asian countries. A slowdown in China was the culprit for the declining growth of the whole region, the depreciation of Asian currencies and trade activities. This also affected the CDS spreads of countries, leading emerging markets’ CDS to rise continuously.

A series of downbeat economic data, the crash of the Chinese stock market, and the deterioration of the real estate market required the Chinese government to devalue the yuan by a total of more than five per cent over three consecutive days. To ensure their competitive advantages in the export market, countries in the region had to react by devaluing their currencies. Right after a surprise Chinese devaluation, many other currencies of emerging markets both in Southeast Asia and worldwide were devalued, which raised concerns of global investors about a currency war.

A slowdown in the Chinese economy also negatively affected the export and import activities of emerging markets to China. Both the Asian Development Bank (ADB) and the World Bank cut off the growth forecast of Southeast Asian countries because of the Chinese economy. According to the ADB, a potential one percentage point slowdown in Chinese GDP growth would probably lead to a 0.7 per cent point drop in collective GDP growth for a group of five commodity-exporting nations. More particularly, the Chinese slowdown caused a deep tumble in crude oil prices in the third quarter as a result of low demand exceeding supply, which lowered export values of oil-exporting countries including Vietnam and thus the state budget of these countries. In Vietnam, state revenues, including from crude oil exports, decreased by VND63,000 billion ($2.8 billion), with crude oil exports falling by VND32,000 billion ($1.4 billion), according to the report of the Chairman of the Committee of Finance and Budget of the Congress.

Besides major factors such as currency devaluations and the Fed’s decision, the growth of CDS spreads was also driven by the intrinsic economic factors of each country. In Thailand, at the end of August there was a bomb attack in the centre of Bangkok impacting significantly the tourism industry, which is the driver of the Thai economy. Export and GDP growth of Indonesia and Thailand were also not strong during the third quarter. Meanwhile, GDP growth of Vietnam seemed to be more positive than other peers, but Vietnam faced pressure from sovereign debt and trade deficit. The sovereign debt of Vietnam accounted for 59.6 per cent of GDP, below the allowed level of 65 per cent, but still very high. Meanwhile, in the third quarter, Vietnam imported $124.5 billion. This is another reason why Vietnam’s CDS surged strongly in the third quarter of 2015.

By Nguyen Thi Ngoc Anh Research Department VPBank Securities

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Latest News

More News

- 0.1 per cent tax proposed on each transfer of digital assets (February 05, 2026 | 17:27)

- Ministry of Finance tightens policy delivery at start of year (February 05, 2026 | 17:26)

- Vietnam steps up market reforms as FTSE Russell reviews upgrade progress (February 05, 2026 | 17:20)

- 2025 profits mixed amid strong energy and farming results (February 05, 2026 | 17:18)

- Cashless payments hit 28 times GDP in 2025 (February 04, 2026 | 18:09)

- SSIAM and DBJ launch Japan Vietnam Capital Fund (February 04, 2026 | 15:57)

- Banks target stronger profits, credit growth in 2026 (February 04, 2026 | 15:43)

- Vietnam on path to investment-grade rating (February 03, 2026 | 13:07)

- Consumer finance sector posts sharp profit growth (February 03, 2026 | 13:05)

- Insurance market building the next chapter of protection (February 02, 2026 | 11:16)

Mobile Version

Mobile Version