Foreign-invested enterprises under VCCI microscope

|

This is the largest-scale and most professional annual survey on FIEs in Vietnam. It aims to assess the ease of doing businesses among FIEs and then make recommendations to authorised agencies, thus urging them to adjust policies in an appropriate manner so as to attract more foreign investment, while enhancing relations between FIEs and domestic companies.

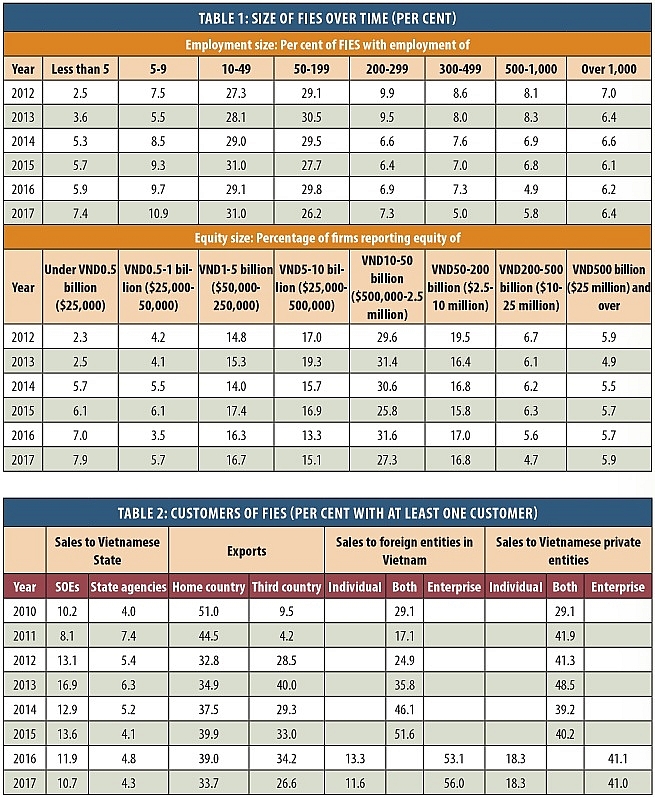

SIZE

The PCI research team has described FIEs in Vietnam as typically small, export-oriented firms that subcontract to multinational corporations. In fact, FIEs seem to be getting smaller, both in the size of their labour force and equity. As seen in Table 1, the proportion of small-scale FIEs increased. Notably, the fraction of FIEs with fewer than five employees rose from 5.9 to 7.4 per cent between 2016 and 2017. Firms with 5-9 employees grew to 10.9 per cent. There is a clear continual trend of increasing participation by smaller FIEs from these two brackets. On the other hand, there is a slight offsetting increase in the number of large-scale FIEs. The shares of firms with 1,000 and more employees and those with 500-1,000 employees are 6.4 and 5.8 per cent, respectively. These represent a slight recovery from the corresponding indicators from the years before.

The trend of smaller FIEs is consistent with data on equity. The proportion of FIEs in the four lowest brackets in the second panel of Table 1 all increased between 2016 and 2017. Among all operating FIEs in Vietnam, 7.9 per cent had equity under VND0.5 billion ($25,000), 5.7 per cent had equity of VND0.5-1 billion, and 16.7 per cent started with equity of between VND1 billion and VND5 billion. In comparison, the corresponding numbers in 2012 were 2.3, 4.2, and 14.8. This could be an indicator of an increase in the number of foreign-invested supporting service projects.

TYPES

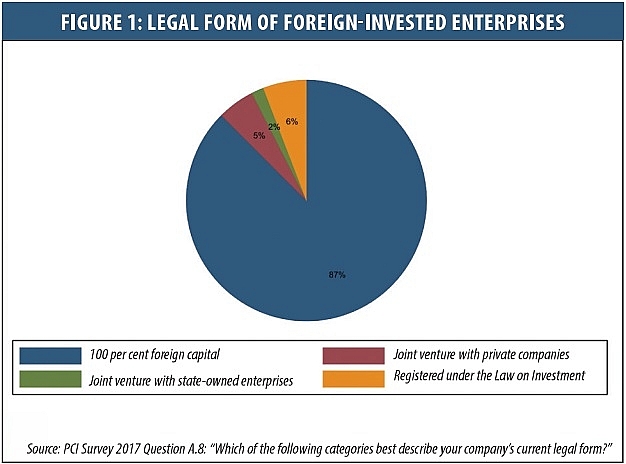

Firms with 100 per cent foreign capital accounted for 87 per cent of the surveyed FIEs in 2017, a decrease of 3 per cent from 2016. Only 7 per cent of respondents are in joint ventures with either privately-owned Vietnamese companies or state-owned enterprises (SOEs). The share of firms registered as domestic operations is about 6 per cent, as seen in Figure 1.

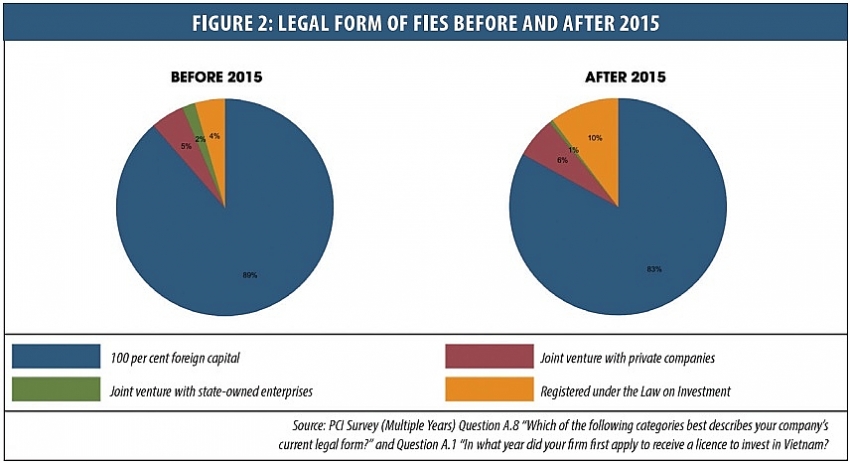

The Law on Investment 2014 defines FIEs with over 51 per cent local ownership to be domestic firms and thus does not require an investment certificate (IC). The law officially came into effect on July 1, 2015. There is evidence that foreign investors are already taking advantage of this quicker and less cumbersome system.

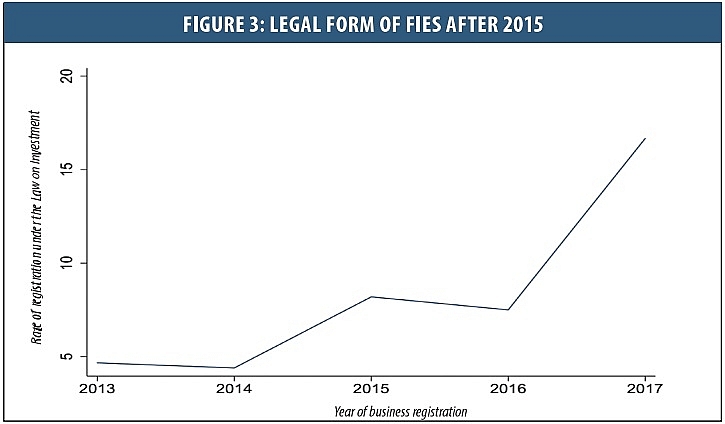

Among respondents, domestic operations accounted for only 4 per cent of firms applying for business licences before 2015, but this increased to 10 per cent after the National Assembly promulgated the Law on Investment 2014. A similar pattern emerges when looking at year-by-year changes.

The share of domestic operations was 4.4 per cent among FIEs that started in 2014, before increasing to 8.2 and 7.5 per cent in 2015 and 2016, respectively.

SECTORS

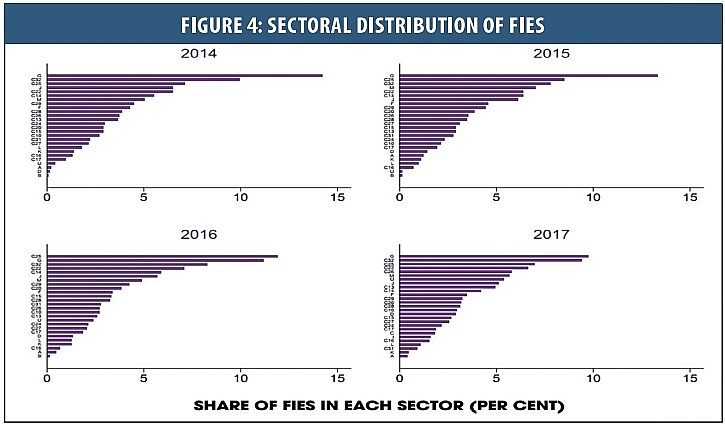

FIEs in Vietnam have shown a tendency to diversify across business sectors over time. While firms specialising in wholesale and retail trade accounted for almost 15 per cent of operations in 2014, in recent years this number has been steadily dropping, falling below 10 per cent in 2017 (Figure 4).

Manufacturing continues to be the leading sector with 66 per cent of FIEs in the 2017 PCI survey operating in this segment. Within manufacturing, the leading sub-sectors are fabricated metal products (7 per cent) and rubber and plastics products (6.7 per cent).

It is worth noting that apparel is no longer in third place, falling from 6 per cent of FIEs in 2016 to 4.2 per cent in 2017. It was displaced by the emerging computer, electronics, and optical products sector, which has seen a remarkable rise from 2.8 per cent three years ago to 5.8 per cent in 2017. This indicates a positive trend towards higher-value-added products among FIEs.

|

| Foreign-invested enterprises under VCCI microscope |

|

| Foreign-invested enterprises under VCCI microscope |

|

|

CUSTOMERS OF FIES

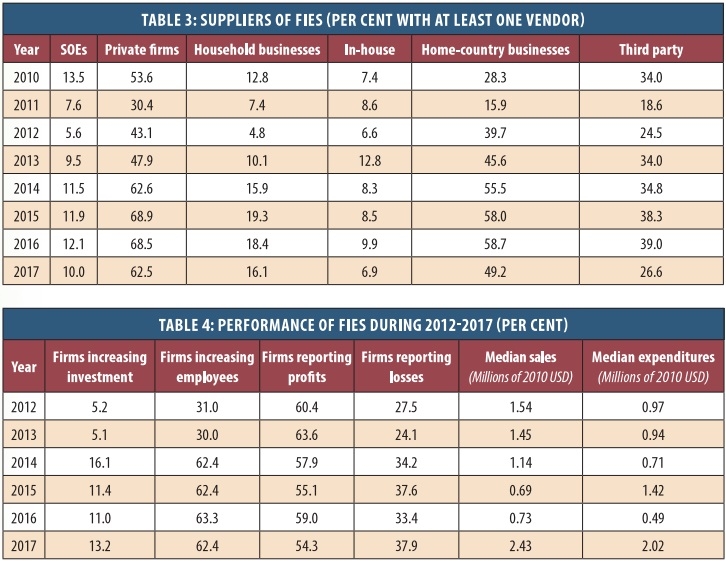

FIEs overwhelmingly serve export markets, FIEs in Vietnam, and the Vietnamese private sector. The proportions of FIEs that supply to SOEs and authorised agencies are the lowest in recent years, at 10.7 and 4.3 per cent, respectively.

The data provides evidence that most FIEs in Vietnam tend to be links in multinational supply chains. More than 60 per cent of FIEs export their products, with 33.7 per cent sending goods to their home country and 26.6 per cent selling to a third country.

A high level of international linkages generally presents the host country with an opportunity to generate productivity spillovers from FIEs into the domestic economy, as was the case with South Korea, Taiwan, Thailand, and Indonesia. Vietnam can only fully exploit this potential, however, by building vibrant supporting industries with domestic firms supplying FIEs (Table 2).

A majority of FIEs also sell to other foreign entities located in Vietnam, especially to other firms (56 per cent). While 41 per cent of FIEs serve Vietnamese firms, only 18.3 per cent supply to Vietnamese individuals. Most FIEs supply to other FIEs, with the common final destination being a foreign market.

|

SUPPLIERS OF FIES

Who provides the intermediate production inputs and services for FIEs? This question is important because, generally, the more domestic firms participate in the production chain by supplying to FIEs, the more likely it is that better technology and management techniques will be transferred from FIEs to domestic suppliers. However, FIEs rarely buy production inputs from SOEs and this trend continued in 2017, with only 10 per cent of respondents supplied by SOEs. Vietnamese household businesses do better with 16.1 per cent (Table 3).

On the other hand, the share of FIEs with at least one private Vietnamese supplier has risen greatly in recent years. Despite dropping from 68.5 per cent in 2016 to 62.8 per cent in 2017, this number still indicates a consistent improvement over the 30.4 per cent of 2011. Despite this, almost half (49.2 per cent) of FIEs still seek the supply of their necessary production inputs from businesses in their home country, while 26.6 per cent do so from third country suppliers (Table 3).

As can be seen in Table 4, median sales reached $2.43 million in 2017, more than tripling the amounts reported in each of the previous years. This revenue increase, however, went hand in hand with a median expenditure of $2.02 million, meaning that profitability suffered. The share of FIEs reporting profits decreased to 54.3 per cent—the lowest in many recent years. At the same time, 37.9 per cent of FIEs lost money, which is also a new record. It is unclear whether these numbers point to a temporary setback or indicate a longer-term trend. It is also possible that FIEs are going through an expansion phase where they invest in capital and labour, forgoing immediate profits for future growth. Indicators of business confidence, reported below, provide some evidence for the expansion stage hypothesis (Table 4).

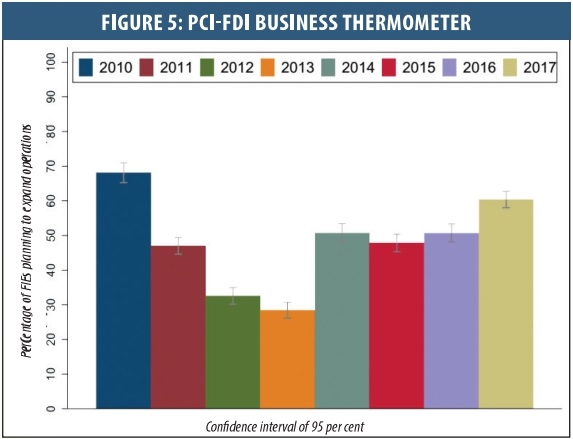

Despite this profitability drop, foreign investors exhibited increased confidence in business prospects in Vietnam.

There are two indicators showing this optimism: 13.2 per cent of FIEs reported increased investment in 2017, a slight improvement over the 11 per cent of 2016, and the share of FIEs that plan to expand business in Vietnam rose from 50 to 60 per cent. As shown in Figure 5 this is approaching a level of ambition unseen since the apex of 2011.

|

|

CONCLUDING THOUGHTS

The recent PCI surveys offered several causes for optimism. In addition to growing business confidence, FIEs also report reductions in regulatory burdens, signs of decreased corruption, and improved labour relations. Like domestic firms, FIEs saw many positive changes attributed to great anti-corruption efforts from the Party, the government’s attempts to reform administrative procedures in some areas, and drastic directions from the prime minister and leaders of ministries to improve the business climate.

There is, however, much room for improvement. There remains a gap between Vietnam and other countries in professionalism and the facilitation of administrative procedures, while unofficial payments in some areas remain. The quality of infrastructure and labour should be further improved.

What is more, links between FIEs and domestic firms remain loose, while supporting industries have yet to develop to a sufficient degree. If these problems are not solved significantly, they will discourage new sources of foreign capital, especially from developed countries. Urgently addressing these challenges will help Vietnam avoid the dreaded middle-income trap and allow the economy to realise its potential and maximise the benefits of FDI in the future.

By Vu Tien Loc, Chairman, Vietnam Chamber of Commerce and Industry

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Themes: 30 YEARS OF FDI IN VIETNAM

Related Contents

Latest News

More News

- Interest in renewables drives foreign investment surge (October 10, 2018 | 15:21)

- Bac Giang: building firm FDI foundations of industry and tourism (October 10, 2018 | 13:09)

- Vietnam’s way ahead in foreign investment and economic growth (October 10, 2018 | 11:17)

- FDI into real estate through the roof in Ho Chi Minh City (October 08, 2018 | 12:37)

- Directing FDI into large transport infrastructure projects (October 08, 2018 | 12:34)

- ESMO factory granted investment certificate (October 04, 2018 | 17:23)

- VIR awarded merits and medal for outstanding achievements in FDI attraction (October 04, 2018 | 15:36)

- Hong Kong FTA to boost investment (October 04, 2018 | 14:00)

- FDI gives wings to the banking sector (October 04, 2018 | 14:00)

- Numerous billion-dollar projects licensed at FDI conference (October 04, 2018 | 14:00)

Tag:

Tag:

Mobile Version

Mobile Version