F&N hands in 15th registration to increase Vinamilk holding

The 15th time

|

| F&N seems adamant in its pursuit of Vinamilk |

Accordingly, F&N Dairy Investment has just registered to buy over 14.51 million Vinamilk (code: VNM) shares, equaling 1 per cent of VNM’s charter capital, on the Ho Chi Minh City Stock Exchange (HSX) from June 6 to July 5.

On June 4, VNM closed at VND175,000 ($7.7).

If the transaction is successful, the investor will spend VND2.54 trillion on 1 per cent of Vinamilk’s charter capital, raising its ownership rate from 17.31 to 18.31 per cent.

Previously, in May 2-31, F&N Dairy Investment also registered to buy more than 14.51 million shares, but at the end only bought 130,000 shares, citing “inappropriate market conditions.”

According to HSX, since 2017, F&N Dairy Investment has registered to buy VNM stocks 15 times via auction transactions, failing at each turn.

With the ownership of 19.96 per cent through its subsidiaries, F&N is the second largest shareholder of Vinamilk—the company holding the largest share in the Vietnamese milk market.

Vinamilk is F&N’s most important investment

|

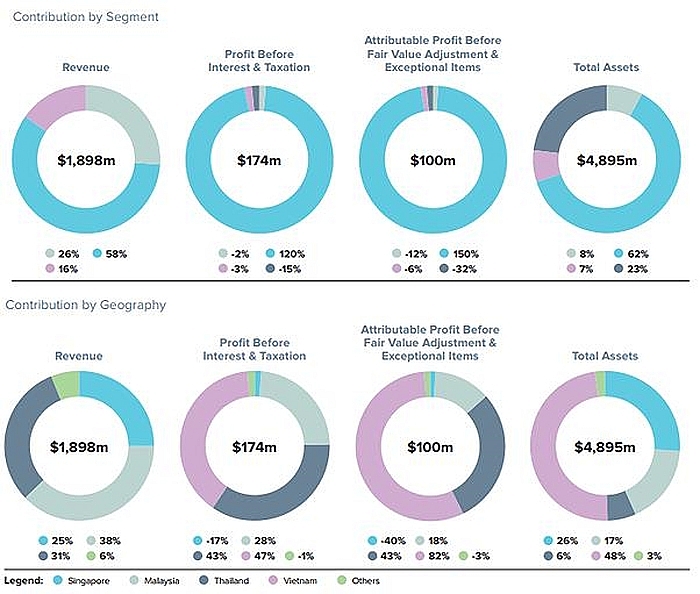

| F&N's 2017 results |

Maybe F&N (the parent company of F&N Dairy Investment)’s investment into Vinamilk help it overcome a gloomy business year.

According to viettimes.vn, in the 2017 fiscal year, F&N’s revenue dropped to $1.6 billion against—slightly less than the $1.67 billion in the previous fiscal year—due to heightened competition in its main markets and weak consumption demand.

Milk products made up 58 per cent of its revenue structure, followed by beverages (26 per cent). F&N’s profit before interest and taxation (PBIT) also showed the dominance of the dairy segment with 120 per cent of its PBIT, showing a remarkable growth against other segments.

In Vietnam, thanks to the dividend and income from milk products (from its affiliate Vinamilk), F&N also recorded a PBIT growth of 7 per cent, equaling $207 million. In addition, despite no data of its revenue in Vietnam, its subsidiaries in the country also contributed 47 per cent of F&N’s PBIT.

The Vietnamese market is supposed to help F&N to escape from its dependence on markets like Malaysia, Singapore, and Thailand (which recorded dropping revenues), according to Thai billionaire Charoen, chairman of the F&N Management Board.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Vietnamese businesses diversify amid global trade shifts (February 03, 2026 | 17:18)

- Consumer finance sector posts sharp profit growth (February 03, 2026 | 13:05)

- Vietnam and US to launch sixth trade negotiation round (January 30, 2026 | 15:19)

- NAB Innovation Centre underscores Vietnam’s appeal for tech investment (January 30, 2026 | 11:16)

- Vietnam moves towards market-based fuel management with E10 rollout (January 30, 2026 | 11:10)

- Vietnam startup funding enters a period of capital reset (January 30, 2026 | 11:06)

- Vietnam strengthens public debt management with World Bank and IMF (January 30, 2026 | 11:00)

- PM inspects APEC 2027 project progress in An Giang province (January 29, 2026 | 09:00)

- Vietnam among the world’s top 15 trading nations (January 28, 2026 | 17:12)

- Vietnam accelerates preparations for arbitration centre linked to new financial hub (January 28, 2026 | 17:09)

Tag:

Tag:

Mobile Version

Mobile Version