FiT rates heat up solar power interest

|

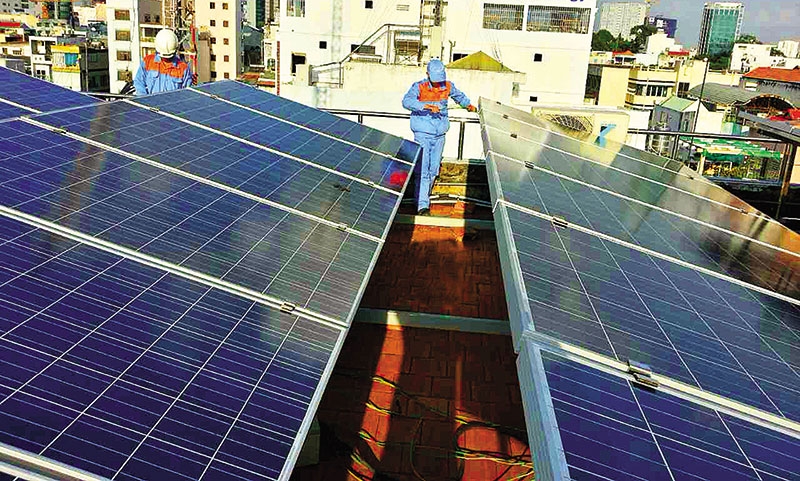

| Favourable feed-in tariff rates have created an investment frenzy in the solar industry, however long-term, stable policies are needed for sustainable growth in the sector, Photo: Le Toan |

Some people are calling it a ‘gold rush’. From Thailand to the United Arab Emirates, global players with experience in solar energy generation are sending representatives to Vietnam in search of the huge energy boom.

“Solar power in Vietnam has become hotter than ever,” remarked Rainer Brohm of the German development agency GIZ at the recent Renewable Energy Week, adding that the boom started when the Vietnamese government’s Decree No.11/2017/QD-TTg on mechanisms for encouraging the development of solar power in Vietnam was released.

Much registration, less progress

The Ministry of Industry and Trade (MoIT) recently released impressive figures, as the total output of solar power projects approved to be added to the Power Development Plan VII is quite large. The ministry approved more than 70 new projects to be put into operation before June 2019 with a total capacity of over 3,000 megawatts (MW). This amount far exceeds the estimated solar power output of 1,000MW until 2020 in the original Plan VII.

The south-central province of Ninh Thuan has the greatest potential for solar power generation, attracting about 140 projects, followed by the neighbouring provinces of Binh Thuan (around 100 projects), Daklak (13 projects), and Khanh Hoa (12 projects).

The list of renewable energy projects registered by foreign investors in Vietnam has been growing consistently, including well-known foreign names like Tata Power, Sunseap Group, InfraCo Asia Development Pte., Ltd., ACWA Power, SY Panel Group, AIN Group, Siemens Gamesa Renewable Energy, Gulf Energy Development, and more.

Local enterprises, though said to lack experience and capital, are not out of the game yet, as Thanh Thanh Cong Group has set a target of developing 20 solar power projects nationwide by 2020, with a total capacity of 1000MW, following other names.

Speaking of businesses racing to plan, committing to invest, and directly investing in the renewable energy sector, Nguyen Duc Cuong, former director of the Renewable Energy Centre’s Institute of Energy, said that the development is rooted in many factors. He stressed that the competitive feed-in-tariff (FiT) incentive and limited deadline have significantly motivated firms to enter the race in the solar power sector and increased co-operation between local and foreign firms in the field.

Currently, the FiT for solar power is set at 9.35 US cents. However, the provision of this FiT expires in June 2019, with no information on how the price will develop after that deadline.

“If you missed the window in 2017, you will find all project windows are closing in 2018. You will have to wait for the next round of FiTs, which will presumably be lower than this time,” investment advisory agency China-Neoventure warned.

However, despite all the fanfare, Vietnam still has no solar farms in operation and has no solar panels feeding into the national grid. Which prompts the question: What is taking so long?

Domestic firms kick off

Recently, the market saw positive movement by domestic firms, as they look to keep their promises to start construction on their solar power projects.

Last week, locally-invested Gelex Energy One Member Co., Ltd., a subsidiary of Vietnam Electrical Equipment JSC (Gelex), kicked off the construction of its VND1.3 trillion ($57.7 million) solar farm in Ninh Thuan, which is expected to be finished in May 2019, and to begin generating commercial power one month later, with a capacity of 82 million kilowatt-hours (kWh) per year.

Earlier this year, one of Vietnam’s leading real estate developers BIM Group started developing a 300MW solar power plant, also in Ninh Thuan. The plant is expected to generate 50 million kWh per year once it comes into operation.

According to unofficial reports, a mere four solar power projects have started construction in the year since the government released its incentives for solar energy development, all of them funded by domestic investors. However, no foreign projects have kicked off implementation.

Deputy Prime Minister Trinh Dinh Dung has urged MoIT to report the specific list of approved solar projects to be added to the national electricity generation plans nationwide, while enhancing the management of these licensed projects.

The number of solar power projects submitted to MoIT by investors is quite large. The supplementation of such projects should be considered to ensure transparency and equality in planning and management as well as to ensure the power supply and land fund for the projects.

“Some licensed companies have failed to establish the charter capital prescribed in the provincial licensing procedures. We suggest MoIT consider revoking the inclusion of a licensed company in the energy master plan if it has not shown a commitment of investment capital as defined in the investment certificate within six months of the date of inclusion in the energy master plan,” said a representative of the Vietnam Business Forum.

Blown off course

John Eric T. Francia, president and CEO of AC Energy, looking at solar power projects in Vietnam, expressed concern that the subscription to the solar FiT ends in June 2019, while he was uncertain about the deadline for the guaranteed solar tariff.

Law firm Baker and McKenzie also pointed out that Decision 11 does not give early investors any specific assurances that they will receive no less favourable treatment in respect to the basic terms and conditions of their investment agreements and especially their power purchase agreements (PPAs) than investors coming in after June 30, 2019, even if this means retroactive adjustments to the FiT.

“Where will the price go after that?” Do Duc Tuong from the United States Agency for International Development (USAID) asked, suggesting that a long-term and stable policy on solar power prices is needed to encourage investment.

In addition, a lack of provincial development plans and a circular guiding solar power purchasing agreements (PPAs) are making for unnecessary risks and red tape, according to foreign experts.

An alliance of international chambers of commerce has called on MoIT to revise its draft circular guiding solar PPAs and to adopt an international-standard bankable template to attract projects to Vietnam.

“If the draft circular and the draft PPA are not improved and the PPA template of MoIT remains non-bankable, actual development and investment in solar power projects may be [more] limited than expected or planned under the amended Power Development Plan VII, even though Vietnam holds significant potential for solar power investment,” a document sent to MoIT by the alliance stated. “Additional policies or modifications can be clarified to establish a better investment environment, creating opportunities for the solar power sector to grow in the near future. This is the best way for Vietnam to reduce its overreliance on coal-fired power – which is putting the country in a dangerous situation due to environmental concerns – and to build a sustainable and strong economy.”

“The outlook remains conservative, but an upward adjustment of the PPA would ensure that Vietnam’s solar power advantages don’t go to waste,” said Brohm of GIZ.

Both foreign and local investors are waiting for news on these bottlenecks. Even though the PPA is not yet complete and there are still some issues remaining to be solved, both it and the circular play an important role by providing the basic framework for investment within the sector.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- EU and Vietnam elevate relations to a comprehensive strategic partnership (January 29, 2026 | 15:22)

- Vietnam to lead trade growth in ASEAN (January 29, 2026 | 15:08)

- Japanese business outlook in Vietnam turns more optimistic (January 28, 2026 | 09:54)

- Foreign leaders extend congratulations to Party General Secretary To Lam (January 25, 2026 | 10:01)

- 14th National Party Congress wraps up with success (January 25, 2026 | 09:49)

- Congratulations from VFF Central Committee's int’l partners to 14th National Party Congress (January 25, 2026 | 09:46)

- 14th Party Central Committee unanimously elects To Lam as General Secretary (January 23, 2026 | 16:22)

- Worldwide congratulations underscore confidence in Vietnam’s 14th Party Congress (January 23, 2026 | 09:02)

- Political parties, organisations, int’l friends send congratulations to 14th National Party Congress (January 22, 2026 | 09:33)

- Press release on second working day of 14th National Party Congress (January 22, 2026 | 09:19)

Mobile Version

Mobile Version