Fiscal discipline indispensible to close Vietnam’s budget deficit

|

| RELATED CONTENTS: | |

| Vietnamese tax incentive system woefully inadequate | |

| State budget not to be used to rescue SOEs and inefficient projects | |

| Lawmakers adopt five-year economic plan | |

On average, over the 15 years from 2001 to 2015, the average budget overspending was estimated at 5 per cent of the GDP, whereas the value of final accounts was much higher, reaching 5.4 per cent.

It is noteworthy that the deviation of the budget overspending value in final account settlements from budget estimates has been increasingly amplified. Even more alarmingly, the average budget overspending calculated in the 2011-2015 budget estimates had only been 5.04 per cent of the GDP, but final accounts reached 5.82 per cent.

This somewhat demonstrates the growing gap between commitment and performance. Fiscal security and fiscal discipline, thus, not only failed to improve, but also tended to go downhill.

Is it possible for Vietnam to cut its budget overspending? The answer depends on the government’s efforts. In order to prove this, let us first look at the possibility of Vietnam attaining its annual revenue and expenditure targets in strict accordance with the estimated plan.

According to the Ministry of Finance's state budget reports, the values in the annual final accounts have always been remarkably higher than the estimates, either in terms of revenues or expenditures.

This upsetting trend highlights major inadequacies in estimating Vietnam’s budget over the past few years. This situation, sadly, has been prolonged, showing that Vietnam has difficulties improving it. Meanwhile, estimating the budget apparently lacks practical base and reliable scientific methodologies. In general, the estimated indicators remain quite depthless.

Looking back at the budget plan estimated for each year, most of these figures are in very high units, such as hundreds of billions, or even thousands of billions. From this point, policy analysts are seemingly unable to refrain from speculating that these are solely guesstimates, rather than meticulously and reasonably calculated forecasts.

Such overly generalised figures will naturally lead to arbitrariness, creating too wide a space for government agencies to exploit their budget estimates. Current budget estimates do not include the forecast for brought forward revenues and expenditures, while these items have been on the rise in recent years.

This has made the evaluation of the balance between budget revenue and expenditures against their estimates, plus the assessment of the budget deficit in final accounts compared with estimates become less significant and meaningful.

Apparently, though the government budget is finalised before the end of the fiscal year, if the state budget is managed in a centrally-focused and systematic manner, it cannot be said that it is difficult to include the estimates of brought-forward revenues and expenditures. Removing this item from the balance of the annual state budget will limit the supervisory role of the National Assembly in overseeing its performance.

In terms of budgetary revenue, the final accounts have always been much higher than the estimates. On average, during the ten years from 2003 to 2013, the actual have been almost 20 per cent higher than the estimates.

Particularly, in a few years, the difference went up to 33 per cent (2008) and 28 per cent (2004, 2010). 2012 was probably the only exception when budget revenues failed to meet the estimated levels. The discrepancy between the budget revenues in final accounts and the annual budget estimates was not insignificant, equivalent to more than 4 per cent of GDP per annum during 2003-2013.

The situation of budget revenues always far exceeding the estimated levels is partly due to the fact that some localities deliberately make lower budget estimates than their actual capacity. They, accordingly, seek to easily achieve the assigned budget revenue targets and also get rewarded for the surplus revenue.

This incentive mechanism has instigated many localities to conceal parts of their revenues on purpose, as it is more beneficial in the evaluation of their performance. A strong piece of evidence is that actual budget revenues raised in most localities have clearly surpassed the estimated levels.

Regular excess budget revenues in comparison with planned targets suggest that Vietnam is completely able to improve its revenues and construct budget plans closer to the actual values and the capacity of each locality.

In terms of budgetary expenditure, overspending has been taking place on a regular basis, albeit at a lower rate than revenues. On average, during the ten-year period from 2003 to 2013, actual budget expenditures have always exceeded the estimates by more than 11 per cent.

On a side note, it might be also noteworthy to add that much higher final settlements against the estimate, particularly in the case of budgetary expenditures on development investments, both in absolute terms and as a proportion, is not necessarily good.

Some people say that budgetary spending on development investments might be accepted to overrun its estimate, or should even be encouraged, because it helps replenish the nation’s capital stock and generate growth for the economy.

A disturbing thought is that, apart from the issue of budget discipline, budget expenditures on development investments rising beyond the budget estimates do not inevitably help improve economic outcomes.

Instead, this situation may partly be a manifestation of the phenomenon in which a large number of public investment projects have suffered from cost overruns and thus triggered a surge in total investment. The differences between these budget disbursements against estimates are not trivial, equivalent to more than 2.9 per cent of the GDP per annum over the period 2003-2013.

Budget revenues exceeding estimates may be attributable to some localities’ intentions of hiding revenues. Overspending against estimates is also due to local attempts to cover expenditure needs, but in a reverse direction. It basically means localities want to increase their budget expenditure estimates as much as possible.

This is due to a lack of strict fiscal discipline, which we call a soft budget constraint. If it happened once, one would believe that it would happen again. Likewise, if it happened in a certain locality, other localities also think that it must be applicable in their cases as well. It is the root cause that fosters a sense of heavy reliance on others among localities as well as governments of successive terms.

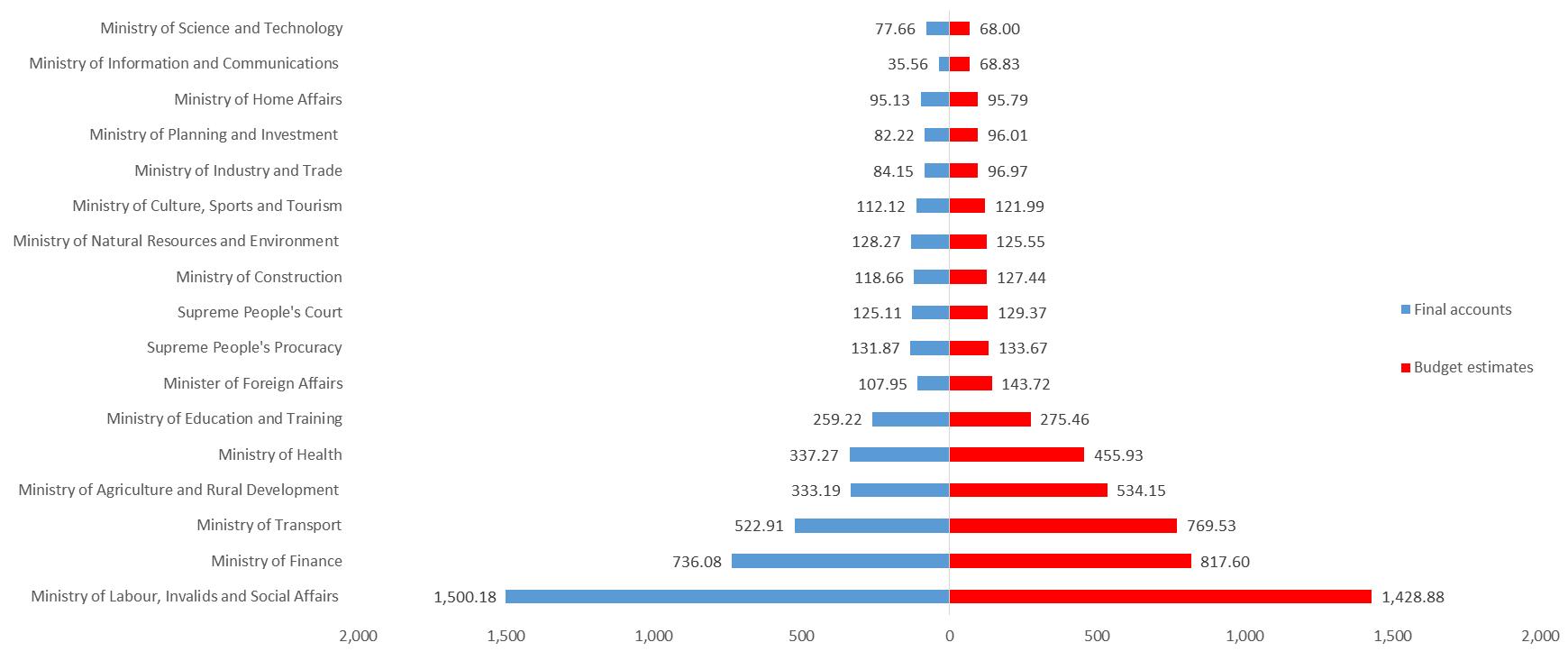

Similarly, the above tendency does not only take place locally, but also happens in ministries and central agencies that are assigned to manage more than half of the national budget. Figure below indicates that in several ministries and government bodies, the occurrence of budget overspending is very common and serious.

|

| The state of budget overspending in ministries and central agencies in 2014. Source: Data from the Ministry of Finance. Unit: USD million |

If the government, ministries, and local authorities are determined to uphold budget spending discipline in line with the approved budget estimates, while revenues are mobilised in strict accordance with the capacity of local governments, the state budget will face less severe deficits and even enjoy surpluses in some years.

If the government manages to adhere to fiscal discipline, budget overspending will be significantly cut down. In a few years, like in 2004, 2008 and 2010, Vietnam even experienced budget surpluses. This is an important policy implication and also a crucial guide for the government to curb budget deficit to committed levels set out a long time ago in Vietnam’s Financial Strategy and Strategy for Public Debt Management until 2020.

The estimated budget overspending is the amount of budget overspending approved by the National Assembly. The budget overspending calculated in budget estimates is equal to the actual amount of revenues, based on the National Assembly’s revenue estimates, minus the actual amount of expenditures, again, based on the National Assembly’s expenditure estimates.

Overspending in final accounts will be measured following the final accounts settlements of the National Assembly. This is because the calculation of budget overspending in final accounts includes accruals (accrued revenues and expenditures), residual budget revenues, and revenues from investment mobilisation, whereas the measurement of budget overspending in budget estimates does not include these items.

Another approach is to base calculations on the primary budget balance. Unlike the overall budget balance, the primary budget balance will not cover liabilities. This measurement implies that if the burden of liabilities is disregarded and the main purpose is purely to calculate the budget revenues and expenditures of some basic government activities, a country's budget balance might experience either a surplus or a deficit. According to this definition, Vietnam's primary budget balance was not so disconcerting until recent years.

My calculations demonstrated that Vietnam's budget overspending would decrease considerably, even turning into small surpluses in some particular years. Until 2011, except for a couple years with minor deficits, Vietnam’s primary budget balance gained a surplus accounting for 0.5-2 per cent of the GDP. From 2012 onwards, the situation appeared to be fairly strained as even the primary budget balance experienced severe deficits.

On average, in the 2003-2015 period, the primary budget balance only saw a deficit of roughly 0.4 per cent of the GDP, whereas the overall deficits amounted to 5.5 per cent. The point here is that: (i) public debt obligations have been occupying a significant portion of the national budget in each recent year; (ii) if Vietnam dismissed its heavy burden of liabilities at the moment, the country would be completely able to gradually narrow the budget deficit, even to achieve a balance and a slight surplus.

The implication for Vietnam is that one thing is possible to change, while the other is impossible. It is impossible to change the fact that Vietnam will still have to continue paying what was previously borrowed. It is, however, possible to change the situation, though much depends on the country’s willingness, if Vietnam can maintain its primary budget balance so as not to generate any new debt obligations. This depends on how fiscal discipline is adhered to!

Average budget overspending for each period in final accounts and budget estimates (per cent of GDP)

| 15-year period (2001-2015) | 10-year period (2006-2015) | Five-year period (2011-2015) | |

| Budget estimates | 5.05 | 5.12 | 5.04 |

| Final accounts | 5.42 | 5.71 | 5.82 |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Latest News

More News

- Development highlights in Q1 through expert’s lenses (April 08, 2024 | 16:48)

- Vietnam logs 17.1 million business cyberthreats in 2023 (April 08, 2024 | 16:34)

- Vietnam now China's top ASEAN trading partner (April 08, 2024 | 16:26)

- Vietnamese businesses grapple with surging exchange rates (April 08, 2024 | 09:59)

- PM outlines 10 socioeconomic achievements in first quarter (April 04, 2024 | 08:00)

- Implementation strategy for new power development plan approved (April 03, 2024 | 15:14)

- Wood sector sees signs of recovery (April 02, 2024 | 06:56)

- Ba Ria-Vung Tau received major investment boost in Q1 (March 29, 2024 | 17:22)

- More chinese solar-tech manufacturers enter Vietnam (March 29, 2024 | 16:10)

- Canadian businesses focus on green energy and agriculture in Vietnam (March 29, 2024 | 10:04)

Mobile Version

Mobile Version