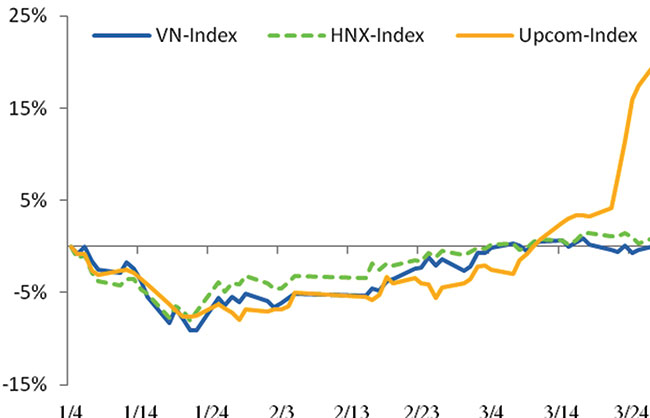

First quarter high for Upcom-index

The VN-Index began the quarter at 574 and closed the quarter at 561, equivalent to a 2.3 per cent decrease. The HNX-Index also had similar movements as it began the quarter at 79.5 and closed the quarter at 79.0, which is a slight decrease of 0.5 per cent.

While the VN-Index and HNX-Index both experienced quite gloomy movements, the UPCoM-Index, surprisingly, rose with extraordinary growth and strong improvement in liquidity. The UPCoM-Index started the quarter at 50.8 and closed at 61.4, equivalent to a 20.7 per cent increase and much higher than the growth of either the VN-Index or HNX-Index.

Foreign investors continued to withdraw capital due to fears of global financial market instability stemming from the gloomy economic outlook for China. Two major exchange-traded funds (ETF) operating in Vietnam – the VNM ETF and FTSE ETF, also contributed to the foreign outflow as they net withdrew 850,000 shares and 525,000 shares respectively in the first quarter of 2016, with a total value of more than $20 million. The capital withdrawal by foreign investors affected blue-chip stocks directly, while domestic cash flow was also slow to disburse due to the upcoming Lunar New Year Holiday. As a result, the VN-Index fell close to its long-term resistance level at 520 at the end of January.

As the market approached this support level, several large-cap stocks showed a degree of recovery, which was the beginning of an uptrend from late-January to mid-March. In this period, four major stock groups had the greatest influence on the general market.

Oil and gas stocks

In Q1/2016, this group saw the greatest fluctuations, which significantly influenced the Index as the group makes up a significant portion of Vietnam’s overall market capitalisation. In late-January and early-February, together with the rebound of international oil prices, this group also recovered strongly and experienced better growth than the general market. Leading this group was GAS, with a rally from its nadir on January 21 to a peak at VND47,300 ($2.12) per share recorded on March 7, equivalent to a 64 per cent increase (by closing price). Other stocks in this group, including PXS, PVS, PVC, and PVD, also experienced strong recoveries and supported the rallies of the indices.

Stocks with information on lifting the foreign ownership limit (FOL)

This group is led by VNM, even though the company did not officially increase its FOL. In the first quarter of 2016 it asked for shareholder approval to withdraw from seven business activities, an action which was aimed at setting the stage for VNM to expand its FOL. VNM finished the quarter with a 6.4 per cent increase in stock prices, which was relatively strong growth compared with other blue-chip stocks. Other stocks supported by news of raised FOLs include EVE, the second stock in Vietnam after SSI to raise its FOL to 100 per cent; VHC, raising its FOL to 100 per cent; BIC, raising its FOL from 21.5 per cent to 49 per cent; MBB, raising its FOL from 10 per cent to 20 per cent; and REE, raising its FOL from 43.7 per cent to 49 per cent. All experienced solid growth after the information was published. This group finished the quarter with an average increase of nine per cent in stock price, much better than the VN-Index.

SCIC divestiture stocks

We exclude VNM from this group as it is already included in the previous group. In the previous market outlook report, we mentioned a group of eight companies from which SCIC planned to divest its capital – VNM, BMI, VNR, NTP, BMP, HGM, SGC, and FPT. This time, we exclude VNM from this group as we have already considered it as part of the group raising their FOLs. Even though other stocks in this group could not sustain the significant growth of the previous quarter, they still maintained better-than-average growth in the first quarter of 2016. Within the group, two plastics industry stocks – BMP and NTP – recorded the strongest growth this quarter, at 13.3 per cent and 14.8 per cent respectively. The two companies’ business results in 2015 were solid due to low input costs in the plastics industry.

Banking stocks

Led by VCB, CTG, and BID. Going into the quarter, banking stocks were also expected to outperform the general market, with supportive news on business operation results. However, this group did not in fact meet investors’ expectations as it underperformed compared to the market.

In the first quarter of 2016, three sectors outperformed the market. Besides the energy sector, with the contribution of oil and gas stocks as mentioned earlier, the healthcare and basic materials sectors also recorded strong growth in the quarter. There were five underperforming sectors in Q1/2016: consumer, technology, financials, utilities, and industrials. Of these, the technology sector recorded the lowest growth.

By Vu Minh Duc - Research Department VPBank Securities Company

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Latest News

More News

- Ministry of Finance tightens policy delivery at start of year (February 05, 2026 | 17:26)

- Vietnam steps up market reforms as FTSE Russell reviews upgrade progress (February 05, 2026 | 17:20)

- 2025 profits mixed amid strong energy and farming results (February 05, 2026 | 17:18)

- Cashless payments hit 28 times GDP in 2025 (February 04, 2026 | 18:09)

- SSIAM and DBJ launch Japan Vietnam Capital Fund (February 04, 2026 | 15:57)

- Banks target stronger profits, credit growth in 2026 (February 04, 2026 | 15:43)

- Vietnam on path to investment-grade rating (February 03, 2026 | 13:07)

- Consumer finance sector posts sharp profit growth (February 03, 2026 | 13:05)

- Insurance market building the next chapter of protection (February 02, 2026 | 11:16)

- NAB Innovation Centre underscores Vietnam’s appeal for tech investment (January 30, 2026 | 11:16)

Mobile Version

Mobile Version