Few bank stock options for foreigners

|

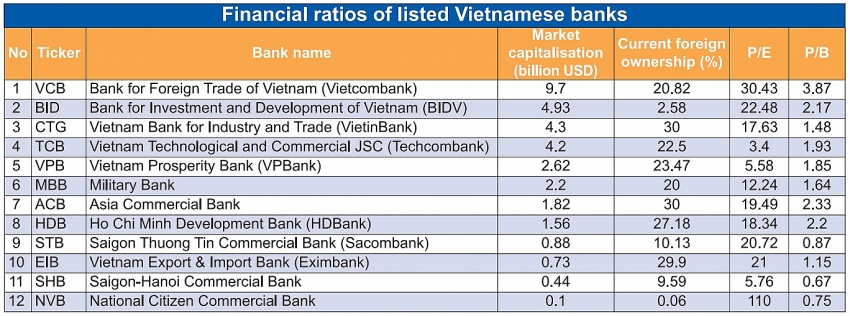

| Many Vietnamese banks have already exhausted much of their foreign ownership limit , Photo: Le Toan |

|

| (Source: Ho Chi Minh City Stock Exchange, Hanoi Stock Exchange) |

Hot stocks

The ups and downs of bank stocks tend to be closely monitored by investors and analysts in Vietnam, as these stocks take up 22 per cent of Vietnam’s listed equity market. Throughout the past quarter, bank stocks have been in a slump due to the corrective streak in the VN-Index.

Recently, however, with the bearish trend easing and the market bouncing back by 10 per cent from its July low, analysts and investors have regained their faith in the so-called “Vietnamese king stocks.”

For example, independent rating firm Moody’s upgraded its ratings for 14 Vietnamese commercial banks on August 14. The Moody’s upgrade is based on the assumption that the Vietnamese government will continue its support for banks’ asset quality and capitalisation. Indeed, as part of Decision No.986/QD-TTg released on August 11, the Vietnamese government has outlined its growth strategy for Vietnamese banks from now until 2025. This includes raising capital for three state-owned lenders and the possibility of listing them overseas.

“Such a path is, on the face of it, positive, as outside investors will be less of a minority and therefore able to exert more influence on the direction of the banks. Also, capital raising will be easier to conduct if there is a large body of outside investors,” said Long Ngo, associate director of financial institutions at Viet Capital Securities’ research team.

Meanwhile, Nguyen Thanh Lam, investment manager at Maybank Kim Eng Securities, expects net profits of listed banks to expand by 20 per cent in 2018, while returns on equity (ROE) will grow by 14 per cent. “The infrastructure is going through strong developments and consumer finance is forecast to boom from 2018 onwards. Many banks have made significant progress in solving sour loans,” said Lam.

Who can buy the shares?

The appeal of Vietnam’s bank stocks is thus very clear to both domestic and foreign investors. At first glance, it seems that foreign investors are at an advantage because they can provide domestic lenders with capital or know-how. However, there are significant challenges for foreign investors.

Firstly, the existing foreign ownership limit (FOL) at commercial banks in Vietnam is only 30 per cent, and the law stipulates that any one foreign entity can only own up to 15 per cent. One prominent example is Asia Commercial Bank (ACB), which is poised for 70 per cent net profit growth in 2018. ACB has reached the 30-per-cent FOL, which means overseas buyers can only gain a stake in this fast-growing bank if another foreign investor agrees to sell.

Similarly, last October, 3.4 million additional shares of Military Bank were made available to foreign investors, as the bank issued new shares from its employee stock ownership plan. Within 15 minutes of trading, all of those shares were devoured by foreigners and the bank quickly reached its FOL again.

Likewise, scores of investment funds and banks from around the world have joined in the initial share sales of VPBank, Techcombank, and HDBank. However, each investor bought less than 5 per cent due to the ownership cap.

“The current ownership limit at 30 per cent is quite low for investors, as they want a bigger say at the banks. This is especially true for strategic shareholders, so I would suggest relaxing this cap gradually to 49 and 51 per cent,” said economist Nguyen Tri Hieu.

Hieu added that thanks to their larger wallets, foreign investors are more likely to purchase Vietnamese bank stocks in bulk than domestic investors. “Foreigners are the ones who can easily invest $50 million or more in a Vietnamese lender,” he said.

Moreover, foreign strategic investors can offer valuable lessons on corporate governance and banking know-how to Vietnamese lenders – something domestic investors do not have. That said, Duong Nguyen, financial services and IT advisory leader at EY Vietnam, noted that foreign banks are reluctant to invest in Vietnamese banks due to the lack of Basel II standards. Specifically, she said that Vietnamese banks scored the lowest in the ASEAN Corporate Governance Scorecard. Vietnamese lenders are lagging behind their peers from Thailand, the Philippines, and Malaysia, who have already fulfilled Basel II.

As a result of these factors, experts believe that although the stocks of Vietnamese banks do have an upbeat future ahead, foreign investors will only come in droves if there is a systemic improvement in terms of FOL, corporate governance, and Basel II application.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- EU and Vietnam elevate relations to a comprehensive strategic partnership (January 29, 2026 | 15:22)

- Vietnam to lead trade growth in ASEAN (January 29, 2026 | 15:08)

- Japanese business outlook in Vietnam turns more optimistic (January 28, 2026 | 09:54)

- Foreign leaders extend congratulations to Party General Secretary To Lam (January 25, 2026 | 10:01)

- 14th National Party Congress wraps up with success (January 25, 2026 | 09:49)

- Congratulations from VFF Central Committee's int’l partners to 14th National Party Congress (January 25, 2026 | 09:46)

- 14th Party Central Committee unanimously elects To Lam as General Secretary (January 23, 2026 | 16:22)

- Worldwide congratulations underscore confidence in Vietnam’s 14th Party Congress (January 23, 2026 | 09:02)

- Political parties, organisations, int’l friends send congratulations to 14th National Party Congress (January 22, 2026 | 09:33)

- Press release on second working day of 14th National Party Congress (January 22, 2026 | 09:19)

Mobile Version

Mobile Version