Experts disagree on trade war’s effect on local GDP

|

| Experts disagree on trade war’s effect on local GDP, source: ANZ |

In the most gloomy scenario, the country could see its GDP reduced by some VND6 trillion ($265.5 million) a year in the next five years, according to the National Centre for Socio-Economic Information and Forecast (NCIF) under the Ministry of Planning and Investment.

Tran Toan Thang, director of the Department of World Economic Issues at the NCIF, said at a conference on the impacts of the US-China trade tensions on the economy last week in Hanoi that the conflict has started to take its toll on Vietnam’s economy this year and will probably have its most significant impact on the country in 2020 and 2021.

In particular, according to the NCIF’s calculations, the trade war could shrink Vietnam’s GDP by 0.03 per cent, or VND1.6 trillion ($70.79 million) in 2018, and by 0.09 per cent or VND5.1 trillion ($225.88 million) in 2019. In the period of 2020-2021, the impact on local GDP will likely peak at up to a 0.12-per-cent drop in GDP each year before slightly cooling down in 2022 with a 0.11-per-cent decrease. For the entire period of 2018-2022, the total GDP loss for Vietnam is estimated at VND29.2 trillion ($1.29 billion), or approximately $265 million a year on average.

Depending on the openness of an economy, the impact of the trade war, as Thang noted, will vary from one country to another, with Singapore, for instance, likely to suffer a loss of 0.2-0.37 per cent in GDP, some three times the effect the trade war is likely to have on Vietnam.

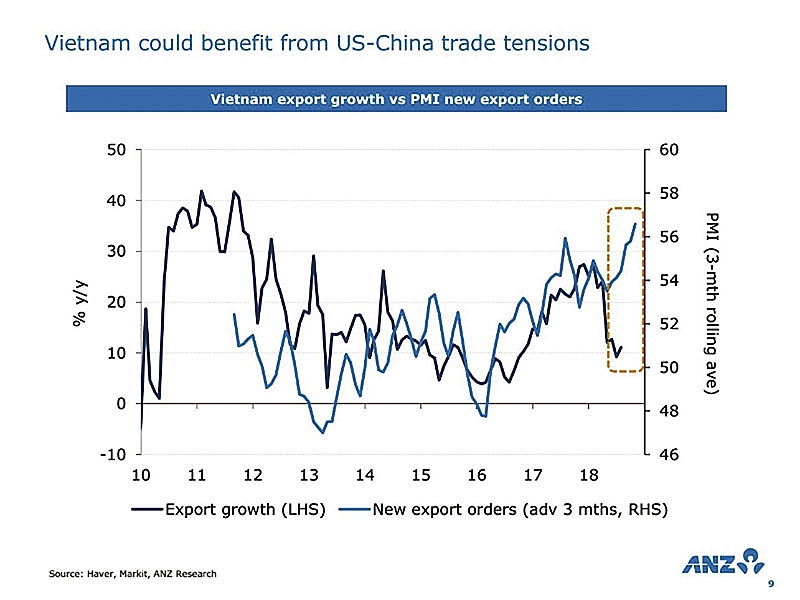

Contrary to the NCIF’s pessimistic view of the impact of the trade tensions on Vietnam, banks such as Standard Chartered and ANZ are predicting that growth will stay strong for the country in 2018 and 2019.

Standard Chartered, in particular, predicts rapid growth in 2018, with all domestic engines firing together. “Manufacturing and construction are likely to remain the fastest-growing sectors. Agriculture and mining, which have weighed on growth for the past few quarters, are likely to build on the strong start to the year, helped by a low base. Inflation, while rising, is unlikely to become a concern.

“We expect a mild trade surplus for the rest of 2018 on strong export growth and slowing import growth. The external sector now poses the biggest risk to the outlook amid rising global trade tensions,” wrote the UK-backed bank in its economic report on Vietnam last month.

“We forecast a modest trade surplus over the next 12 months; faster-than-expected import growth and declining global demand for electronics present downside risks to our forecast. Electronics exports are likely to remain robust in 2018 on strong demand for components, particularly OLED displays used in mobile devices,” the report went on to say. “We expect electronics export growth to exceed 20 per cent in 2018. However, downside risks to exports have increased recently on rising global trade tensions.”

ANZ, meanwhile, predicted strong GDP growth for the country this year and next year, at 6.8 per cent and 7 per cent, respectively, as Vietnam continues to lure foreign direct investment inflows and expand its manufacturing base.

Ignited in early July, the trade tensions began when the US imposed a 25-per-cent tariff on $34 billion worth of Chinese goods, then another 10-per-cent tariff on $200 billion worth of Chinese-made products, and China responded in kind.

“The trade tensions between China and the US will have mixed impacts on the Vietnamese market. The new tariffs that the US imposes on China and the response of China as well as other economies may have an adverse effect on global GDP growth in general and trade growth in particular, which will subsequently affect exports,” said Ngo Dang Khoa, head of global markets at HSBC Vietnam.

“The US tariffs on Chinese goods can create competitive advantages for Vietnamese assemblers to export directly to the US instead of indirectly participating in the supply chain as done previously. The price of China’s exports will now become more expensive due to the additional duties,” he added.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Vietnamese businesses diversify amid global trade shifts (February 03, 2026 | 17:18)

- Consumer finance sector posts sharp profit growth (February 03, 2026 | 13:05)

- Vietnam and US to launch sixth trade negotiation round (January 30, 2026 | 15:19)

- NAB Innovation Centre underscores Vietnam’s appeal for tech investment (January 30, 2026 | 11:16)

- Vietnam moves towards market-based fuel management with E10 rollout (January 30, 2026 | 11:10)

- Vietnam startup funding enters a period of capital reset (January 30, 2026 | 11:06)

- Vietnam strengthens public debt management with World Bank and IMF (January 30, 2026 | 11:00)

- PM inspects APEC 2027 project progress in An Giang province (January 29, 2026 | 09:00)

- Vietnam among the world’s top 15 trading nations (January 28, 2026 | 17:12)

- Vietnam accelerates preparations for arbitration centre linked to new financial hub (January 28, 2026 | 17:09)

Tag:

Tag:

Mobile Version

Mobile Version