E-commerce: disrupting age-old retail habits

|

|

| Toy-retailing super giant Toys "R" Us filed for bankruptcy over losing competition to Amazon retailers, will similar events happen in Vietnam? |

As cited by CNBC, the US Commerce Department reported that retail sales—excluding automobiles, gasoline, building materials, and food services—jumped 0.6 per cent in July, a seven-month record since December 2016, doubling June’s 0.3 per cent growth. Data suggests that the economy, along with the retail sector, will gather further momentum in the latter half of the year, with major consumer holidays coming up.

Deloitte’s Retail, Wholesale, and Distribution Industry Outlook 2017 report forecasts confident consumer spending throughout 2017, citing the strengthening labour market (which added an average 181,000 jobs per month in 2016) and increasing disposable personal income (up 3.4 per cent in the year ending October) and average hourly earnings. With the broader retail market growing at 3 per cent per annum, numerous companies are looking for opportunities to expand growth and market share.

| “Many retailers are finding themselves in an uphill battle to win market share at a time when digital opportunities have opened the door to new retailers and business models that continue to splinter marketplaces.” Source: Deloitte |

However, Deloitte identifies major challenges ahead for traditional retailers, claiming that the retail, wholesale, and distribution industry has entered a period of transformation.

According to the firm, while retail spending continues to appear robust, a multitude of novel spending channels are appearing, sawing the seeds of uncertainty. Retailers must anticipate potential risks and rewards as business model disruption is ‘the new normal.’

Global market forces, the proliferation of retail purchase channels, along with the commodisation of products and pricing all contribute to elevating the expectations of customers and as such are emerging factors transforming the playing field.

According to Deloitte, firms that are not watchful enough to spot and utilise innovations are more than likely to be tripped up by them. Online retail channels, product customisation, and novel customer services are all areas to look out for, as the disruption of traditional retail methods is gaining traction.

As illustration, Deloitte cited the rise of subscription-based online ordering of tailored meals or home delivery of recipes with packaged ingredients. According to the firm, both services pose an imminent and serious threat to supermarkets and restaurants.

Additionally, Deloitte reassessed Amazon’s success as one of fragmentation, not concentration. Accordingly, the online retailing website serves as a platform for millions of tech-savvy third-party sellers who simply pay Amazon a commission to take advantage of its distribution platform and consumer reach.

|

| The first pair of Adidas shoes produced at the German Speed Factory (Source: engadget.com) |

Based on this, traditional retailers may find it difficult to keep up with new-wave, smaller-scale competitors that offer unique products and on-demand customisation and retail options.

Consumers of the US retail market are now positioned in a way that price, promotions, and product placement are inferior to the unique, “cookie” characteristics of products. This is the reason why innovators are opting to offer a seamless customer experience and product customisation instead of simply ‘going big.’

Point-in-case illustrations here could be Toys “R” Us, pretty much the world’s largest toy retailer, which recently filed for bankruptcy, citing lost market share to Amazon and other online retailers, or Adidas bringing back production to developed markets by constructing fully-automated speed factories that produce after individually customised orders.

| ||

| Albeit the startup eliciting perhaps the most heated negative public reaction through its failed PR programme, Bodega was an initiative that could have made large and small retailers sweat and by revolutionising everyday grocery shopping. Accordingly, the startup came out with unstaffed pantry boxes selling customised, non-perishable items. Payments would be automatic and electronic, and the pantry would be opened through a phone app. In addition, by electronically monitoring customer preferences in real time, each Bodega could offer what customers at the exact location would need the most: residential apartments, gyms, and even offices would offer different selections of items in the greatest demand. The difficulties of Bodega came in the face of public backlash following a statement of co-founder Paul McDonald that Bodega’s will replace bodegas—small, family-run grocery shops mainly run by vendors of Spanish origin (hence the name). To date, the success of Bodega remains questionable due to the general uproar that went unslaked by repetitive apologies and corrections. |

Vietnamese market prospects

Despite ranking as Southeast Asia’s smallest e-commerce market only three years ago, Vietnam has been making extreme headways in internet usage among the general populace, as reported by VnExpress. By statistics from Internet World Stats, the country currently ranks as the 18th in the world in terms of internet users, with about 40 per cent of the population having mobile subscriptions.

Heightened internet and mobile usage has provided ample momentum for e-commerce activities, culminating in one of the highest growth rates for the sector across the globe. In 2016, the Vietnam E-Commerce Association forecasted a bright five years ahead for online retailers, expecting that annual sales will increase to $10 billion in 2020, as reported by Thanh Nien News.

Nguyen Thanh Hung, vice chairman of the association, was reported as saying that the market is well positioned for extended growth as it has finished the first stage of development and now has the necessary technology infrastructure, legal framework, and workforce in place to initiate the second stage. According to Hung, the e-commerce sector will grow by 30 per cent on-year through 2025.

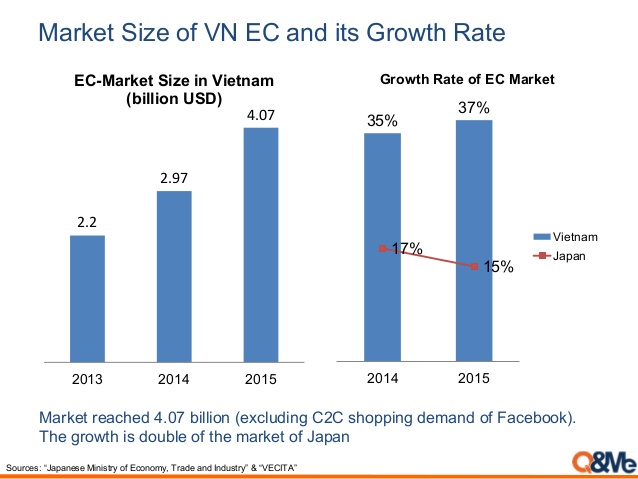

The sector is gaining increasing traction: in 2016, Thanh Nien News cited a growth rate of 25 per cent, while industry expert Duc Tam cited a current 35 per cent recently at Vietnam Online Business Forum 2017. According to Tam, this growth is 2.5 times higher than that of the Japanese e-commerce sector.

It is important to note that the growth of the Vietnamese e-commerce sector far outstrips that of the total retail market, which grew by 10.2 per cent in 2016 (still a more than respectable rate), to $118 billion, according to VnExpress, fuelled by the rising middle class and the ever-rising disposable incomes and number of internet users.

Of this, various sources quote a $4-billion share for the e-commerce sector, an equivalent of 3.39 per cent. By 2020, this ratio is forecast to hit 5 per cent, signifying a growing number of consumers increasingly opting for online retail channels to do their shopping. Indeed, according to VnExpress, potentially as much as 30 per cent of the Vietnamese population will be buying goods and services over the internet by 2020, each spending an average $350 a year.

While the rise of online retail and e-commerce may summon up concerns over the potential impact of new payment and shopping channels and disruptive retail methods akin to the US, the Vietnamese e-commerce sector is at a less developed stage at the moment. While the US already has somewhat of a tradition, or at least a general familiarity, with online retailing, Vietnamese customers and retailers alike are only starting to discover opportunities.

This can be seen in the fact that the US e-commerce market makes up 7.3 per cent of total retail sales, while the figure is only 3 per cent in Vietnam, according to figures of Q&Me. This is gap is demonstrated to be even bigger when seen in the light that the size of the Vietnamese sector is only 1 per cent of the US sector.

Additionally, Thanh Nien News reported Tran Tong Tuyen, CEO of Hanoi-based DKT which offers online technical support for around 15,000 retailers in Vietnam, as saying that Hanoi and Ho Chi Minh City alone make up 75 per cent of the domestic e-commerce market. In Tuyen’s views, once the industry expands on other locations, it will grow five times as big.

Consumption habits, as well as the immediate impacts of the rising online retail sector, are patently different precisely due to the fact that the Vietnamese sector is far less developed. This is well demonstrated by the habits of Vietnamese consumers.

|

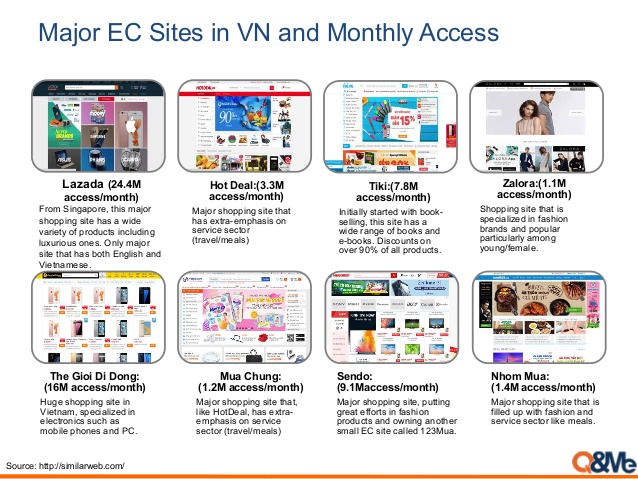

According to a market research by Q&Me, 67 per cent of respondents have tried online shopping before, and almost half of them (47 per cent) used Facebook for this. Other popular shopping sites include Lazada (54 per cent used before) and HotDeal (34 per cent), with the most popular product categories including fashion (46 per cent of respondents admitted to buying such items online), IT/mobile phones (39 per cent), and kitchen/home appliances (34 per cent).

A significant point here lies in Facebook’s strong presence as an online retail channel, far surpassing its efficacy in the US or other developed countries. The fact that it is such a favoured shopping channel testifies to Vietnamese consumers qualms about quality, as with Facebook vendors it is usually possible to try items upon delivery and deciding on the purchase then.

This is generally different from large-scale online retailers’ delivery policy. These qualms can also be seen in the fact that 85 per cent of e-commerce users opt to pay in cash on delivery, retaining the option of cancelling the order if the ordered item proves sub-par.

|

Based on these trends, it seems likely that while e-commerce and online retail is a powerfully developing trend in Vietnam, it will likely not have as much of an impact on traditional retailers as in the US, particularly due to it being used by a proportionately smaller segment and that the market is less developed at the moment.

However, these conclusions are only applicable to the immediate future, as with the expansion of the geographical coverage of online retailers as well as market development expected in the future, online retail is forecast to become a powerful retail channel by as soon as 2020, where phenomena akin to Toys “R” Us might well occur.

| Local firms dominate e-commerce in Viet Nam Local firms are demonstrating their strength in winning hearts of Vietnamese consumers in e-commerce, an interactive E-commerce study conducted by iPrice has revealed. |

| Thousands of products started from just VND9,000 at Shopee’s 9/9 Campaign Shopee aims to become the one-stop platform for Vietnamese online shoppers and sellers alike. To facilitate this goal, Shopee will launch mind-blowing hourly flash sales known as 99 Online Shopping Day on September 9. Pine Kyaw, managing director of Shopee Vietnam, shared with VIR’s Thanh Van how the e-commerce platform expands its reach among Vietnamese online shoppers. |

| Wealthy Vietnamese shoppers prefer to purchase products online In Vietnam, e-commerce has posted weak annual growth in the fast-moving consumer goods market over the past five years, said Kantar Worldpanel in a recently released report on the Asian market. |

| APEC seeks to foster e-commerce APEC’s vision is to lead the world in unleashing the potential of the digital and internet economy and support an accessible, open, interoperable and secure ICT environment for e-commerce to foster economic growth and prosperity, the APEC Electronic Commerce Steering Group (ECSG) said on Wednesday in HCM City. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Latest News

More News

- Site clearance work launched for Dung Quat refinery upgrade (February 04, 2026 | 18:06)

- Masan High-Tech Materials reports profit: a view from Nui Phao mine (February 04, 2026 | 16:13)

- Hermes joins Long Thanh cargo terminal development (February 04, 2026 | 15:59)

- SCG enhances production and distribution in Vietnam (February 04, 2026 | 08:00)

- UNIVACCO strengthens Asia expansion with Vietnam facility (February 03, 2026 | 08:00)

- Cai Mep Ha Port project wins approval with $1.95bn investment (February 02, 2026 | 16:17)

- Repositioning Vietnam in Asia’s manufacturing race (February 02, 2026 | 16:00)

- Manufacturing growth remains solid in early 2026 (February 02, 2026 | 15:28)

- Navigating venture capital trends across the continent (February 02, 2026 | 14:00)

- Motivations to achieve high growth (February 02, 2026 | 11:00)

Mobile Version

Mobile Version