Deutsche Bank says ‘sorry’ in full-page German newspaper ads

|

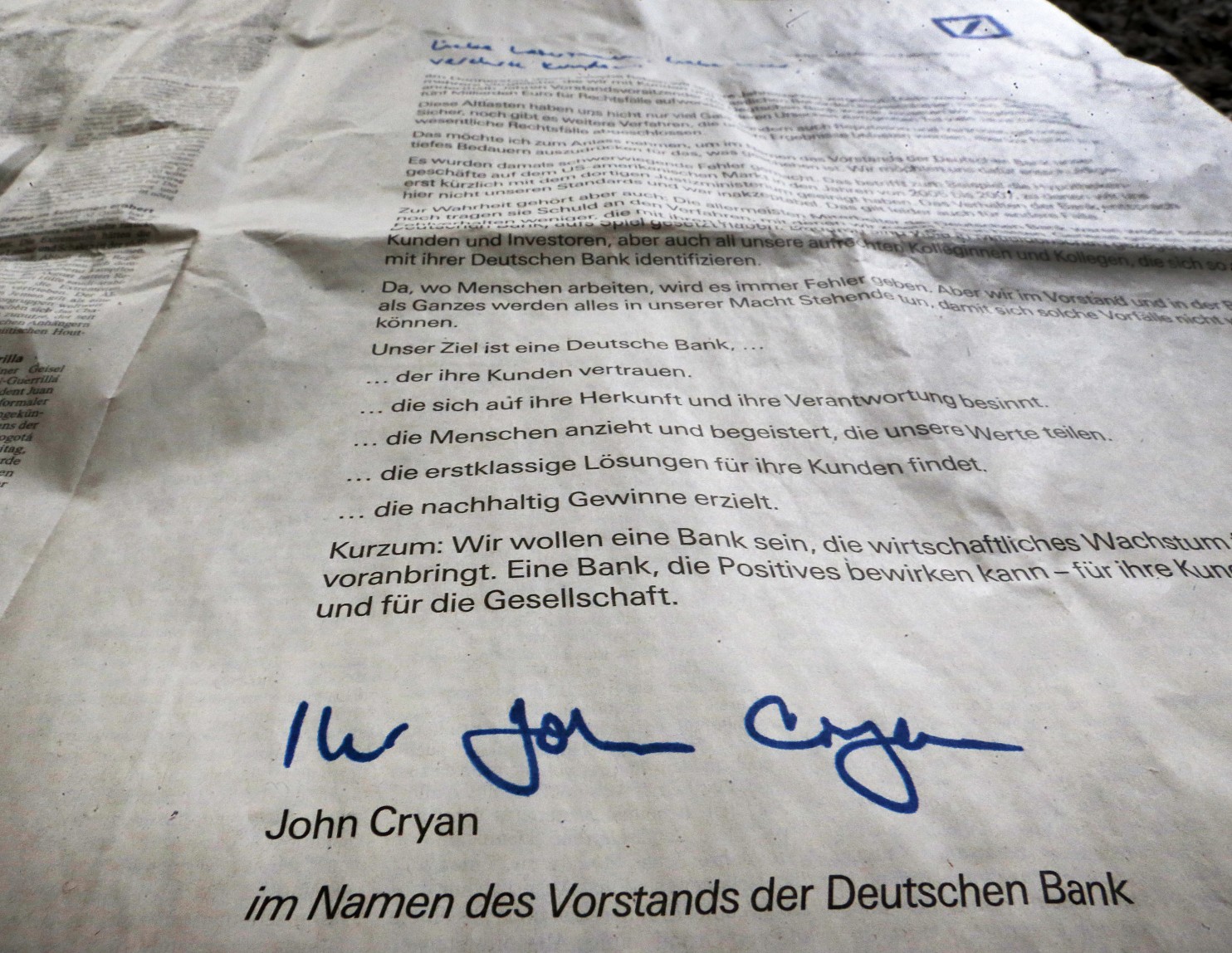

| An apology for the bank’s misbehaviours signed by the CEO of Deutsche Bank John Cryan is published as a newspaper ad in a big German paper in Frankfurt, Germany, Saturday, Feb. 4, 2017. (photo source: Michael Probst/Associated Press) |

The ad, signed by CEO John Cryan on behalf of the bank’s top management, ran Saturday in the Frankfurter Allgemeine Zeitung and the Munich-based Sueddeutsche Zeitung.

The bank said its past conduct “not only cost us money, but also our reputation and trust.”

In December, Deutsche Bank agreed to a $7.2 billion settlement with the U.S. Justice Department over its dealings in opaque bonds based on home loans in 2005-2007. Losses on such bonds packaged and sold by major banks helped start the global financial crisis.

Other misconduct cases have included rigging widely-used interest benchmarks along with other big banks and money-laundering violations involving security trades Russia.

The ad said “we in the management committee and bank leadership as a whole will do everything in our power to keep such cases from happening again.”

Cryan, who became co-CEO with Anshu Jain in 2015 and sole CEO in 2016, had to present a 1.4 billion euro ($1.5 billion) loss for the full year 2016 at the company’s annual news conference on Thursday. Costs for legal settlements have played a role in weak earnings that have undermined the bank’s share price.

Cryan also delivered an extensive apology at the news conference.

Deutsche Bank is in the midst of a wrenching restructuring, cutting costs and shedding riskier assets to meet tougher regulation aimed at preventing another financial crisis.

A news report that the mortgage-bond settlement might be as high as $14 million led to sharp falls in the bank’s share price in September and October and fed speculation the bank might need to raise more capital or seek a government bailout. It did neither.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Latest News

More News

- Standard Chartered flags global infrastructure financing gap (November 28, 2025 | 18:00)

- Ho Chi Minh City taps Ant International to strengthen fintech and IFC ambitions (November 27, 2025 | 10:00)

- Nam A Bank and GCPF partner on climate adaptation finance (November 24, 2025 | 19:00)

- Thailand’s Café Amazon exits Vietnam after five years (November 22, 2025 | 12:56)

- PVT Logistics debuts on HSX (November 21, 2025 | 14:01)

- JBIC and BIDV join forces to back Vietnam’s green transition (November 19, 2025 | 15:50)

- Vietnam’s financial sector drives $1 billion IPO surge (November 19, 2025 | 15:44)

- Bank stocks gain appeal on strong credit growth and expanding ecosystems (November 18, 2025 | 15:22)

- Banks raise deposit rates as year-end lending heats up (November 17, 2025 | 07:35)

- VNU-UEB conference highlights risk management and fintech strategies (November 16, 2025 | 16:00)

Mobile Version

Mobile Version