DeAura scam hard case to punished?

|

| After the scandal brought out, DeAura spas have been renamed to Lily, Aphrodite Eros, Camellia, and Venus |

DeAura swindles customers to sign loan agreement

DeAura set foot in Vietnam just two years ago, during which a lot of scandals point out dishonest business practices. Dozens of customers have visited the company headquarters to ask for a refund on DeAura's skincare products.

Nguyen Thi Hoi coming from Thach That district (Hanoi) was very tired and said that after clicking “Like” on facebook by accident, she was invited to try DeAura’s beauty services and put into loan trap of VND43 million ($1,900).

After trying the product on half of her face, she was invited to buy a set of skincare products at the preferential price of VND43 million ($1,900) (the original price was VND73 million–$3,200). Hoi denied numerous times because she was unemployed at the time.

However, DeAura officers enticed her with sweet words that she should spend only VND50,000 ($2.2) a day to become more beautiful. She was offered to take the set right after trying and could return if she did not like it. DeAura gave out a series of papers to pass off as a purchase agreement.

“She did not let me read it, I could only sign without reading it and finding out that it was a loan agreement. I thought it was a present and that I only have to pay if I come to the spa and use their services. If I knew it was a nearly $2,000 loan agreement, I would not have signed. I have tried to return the brand new product set, but could not,” recounted Hoi.

Numerous DeAura customers said that they did not know that they signed a loan agreement. They only found out that each of them had just borrowed nearly $2,000 after opening the box at home.

A customer called Le Thi Nhung (Hanoi) said: “When I arrived at DeAura Spa, I was led into a private room and drank the water of the spa, then some staff came in to persuade me to sign the contract. I was disoriented and did whatever they told. When I wanted to return the products, they asked me to pay a penalty of VND7 million ($300).”

According to feedback from numerous customers, their skin looked better after the first treatment at DeAura Spa, but treatment at home (using the same products) did not bring results, some even contracted acne.

Tran Thuy Linh (Hanoi) said that her face was swollen and pimples came out all over her face for one month. She has a certificate from the hospital, but DeAura has not allowed her to return the products and asked confirmation from a doctor appointed by DeAura.

|

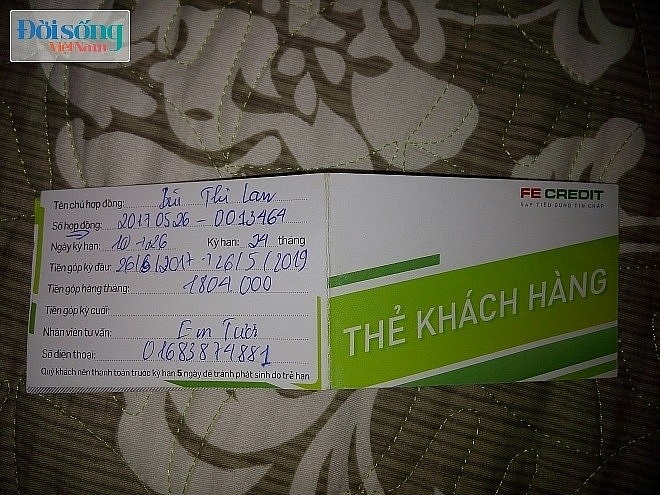

| The FE Credit card of a customer named Bui Thi Lan, who has to pay over VND1.8 million ($80) a month for 24 months to pay off her total debt of VND43 million ($2,000) |

Thousands of customers trapped

Most DeAura customers told VIR that they signed the loan agreement without understanding what it was. They also said that DeAura in collaboration with a consumer finance company misrepresented the agreement and trapped them to sign loan contracts, essentially committing fraud.

On the social networks, numerous groups named “DeAura scam” have been established with thousands of members joining. This may be one of the reasons why DeAura had to be renamed. The parent company was renamed to Venesa in last March, while its spas also took on the names Lily, Aphrodite Eros, Camellia, Freyja, and Venus.

23,000 people purchased DeAura’s products. However, many of these are unemployed, freelancers or workers with very low incomes (VND2-3 million, around $100 per month). However, in the loan contract, their incomes were noted to exceed VND10 million ($440) to meet the loan conditions.

Banking experts said that DeAura and a financial company under Vietnam Prosperity Joint Stock Commercial Bank (VPBank) have violated moral principles and Circular No.43/2016/TT-NHNN dated December 30, 2016 regulating consumer lending by finance companies.

However, according to lawyer Truong Thanh Duc, chairman of Basico, it is very hard to penalise DeAura.

“Regardless of whether DeAura and the consumer finance firm cheated or provided unclear advices, customers cannot refuse after signing the contract,” he said.

He also warned consumers to keep an eye out and educate themselves as firms like DeAura are spreading fast. State agencies also need to closely monitor business activities and alerts customers for similar cases.

Last month, the Vietnam Competition Agency (VCA) issued a penalty to DeAura Vietnam for VND400 million ($17,620) for violating regulations on cosmetics distribution and business.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Vietnamese businesses diversify amid global trade shifts (February 03, 2026 | 17:18)

- Consumer finance sector posts sharp profit growth (February 03, 2026 | 13:05)

- Vietnam and US to launch sixth trade negotiation round (January 30, 2026 | 15:19)

- NAB Innovation Centre underscores Vietnam’s appeal for tech investment (January 30, 2026 | 11:16)

- Vietnam moves towards market-based fuel management with E10 rollout (January 30, 2026 | 11:10)

- Vietnam startup funding enters a period of capital reset (January 30, 2026 | 11:06)

- Vietnam strengthens public debt management with World Bank and IMF (January 30, 2026 | 11:00)

- PM inspects APEC 2027 project progress in An Giang province (January 29, 2026 | 09:00)

- Vietnam among the world’s top 15 trading nations (January 28, 2026 | 17:12)

- Vietnam accelerates preparations for arbitration centre linked to new financial hub (January 28, 2026 | 17:09)

Tag:

Tag:

Mobile Version

Mobile Version