Corporate bond issuance sees upswing in activity

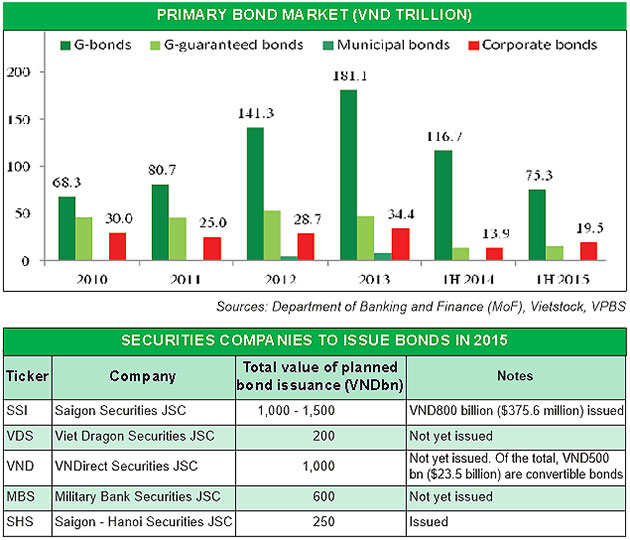

The State Treasury encountered obstacles in mobilising capital and could only issue VND75,305 billion ($3.5 billion), equal to 30.4 per cent of the total issuance value of last year. Meanwhile, although the statistics are admittedly incomplete, reports show that there were approximately VND19,515 billion ($895 million) of corporate bonds issued in this year’s first half, 1.4 times higher than issuance for the same period last year and 85.1 per cent of the total for the whole of 2014.

The largest corporate bond issuers were Masan Consumer Holdings (a subsidiary of MSN) with VND9,000 billion ($415 million), Vingroup (VIC) with VND2,000 billion ($92 million), and CII Bridges and Roads Investment Joint Stock Company (LGC) with VND1,200 billion ($55 million). Most of the bonds have less-than-five-year tenors. Since the government stopped issuing shorter-term bonds, C-bonds may have been a good alternative for investors, most of whom prefer short-term bonds.

Bond yields and lending interest rates reached their lowest values in this year’s first half and went up towards the end of June. Low bond yields were a primary factor pushing many issuers to the market.

At the same time, many firms had growing needs for capital to expand business activities as economic growth accelerated. Real estate firms were especially active in issuing corporate bonds. Total issuance from this sector contributed 27.4 per cent of the total value for the first half of the year. In addition, developers like Nam Long Investment Corp. may sell as much as $30 million in offshore bonds in 2015’s second half.

After several years of downturn, the real estate sector has shown signs of recovering from its nadir of 2014. We believe that the residential segment, the most popular real estate segment, has entered a growth phase in 2015.

The real estate market has been aided in its recovery by several expansionary monetary policies. The most noteworthy include home loan support programmes such as Resolution 02/NQ-CP (January 7, 2013), Resolution 61/NQ-CP (August 21, 2015), and a four-party lending programme in the real estate sector via Document 1668/NHNN-TD (March 19, 2015). All of these encouraged construction and real estate companies to raise funds in order to complete outstanding projects or invest in new ones.

Merger and acquisition (M&A) activity also contributed to the expansion of the bond market. M&A was strong among Vietnamese enterprises during 2015. Several acquirers issued bonds to finance their transactions, including TMT’s purchase of Vinamotor, and HVG’s purchases of Tac Van Company, FMC, and VTF.

Finally, several new regulations encouraged companies to raise capital by issuing bonds. Circular 36/2014/TT-NHNN restricted banks’ portion of credit for equity investment to no more than five per cent of charter or provided capital of a bank or branch of a foreign bank, down from the previous level of 20 per cent of charter capital for securities investment. Therefore, to partly offset the fall in banking funds for securities investment, securities companies may need to raise their equity capital, mobilise capital through bond issuance, or lower their cash dividend, in order to enhance their capacity to make margin loans which are capped at 200 per cent of the equity of broker firms per Decision 637/2011.

Circular 36 made bond investment more attractive by loosening the utilisation rate of short-term capital for long-term borrowings from 30 to 60 percent. That said, with the same structure of capital, commercial banks might increase long-term outstanding loans. Due to high demand for long-term borrowings, this should help banks increase their long-term loans via corporate bonds.

Since the beginning of 2015, many enterprises have made plans to issue corporate bonds to mobilise capital. Listed companies have announced plans to issue approximately VND10,410 billion ($478 million) of corporate bonds that have not yet been executed.

By Nguyen Bao Ngoc Research Department VP Bank Securities

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Latest News

More News

- New rules ease foreign access to Vietnam equities (February 05, 2026 | 17:29)

- 0.1 per cent tax proposed on each transfer of digital assets (February 05, 2026 | 17:27)

- Ministry of Finance tightens policy delivery at start of year (February 05, 2026 | 17:26)

- Vietnam steps up market reforms as FTSE Russell reviews upgrade progress (February 05, 2026 | 17:20)

- 2025 profits mixed amid strong energy and farming results (February 05, 2026 | 17:18)

- Cashless payments hit 28 times GDP in 2025 (February 04, 2026 | 18:09)

- SSIAM and DBJ launch Japan Vietnam Capital Fund (February 04, 2026 | 15:57)

- Banks target stronger profits, credit growth in 2026 (February 04, 2026 | 15:43)

- Vietnam on path to investment-grade rating (February 03, 2026 | 13:07)

- Consumer finance sector posts sharp profit growth (February 03, 2026 | 13:05)

Mobile Version

Mobile Version