Consumer loans allure Asian firms

|

Handshakes with domestic firms

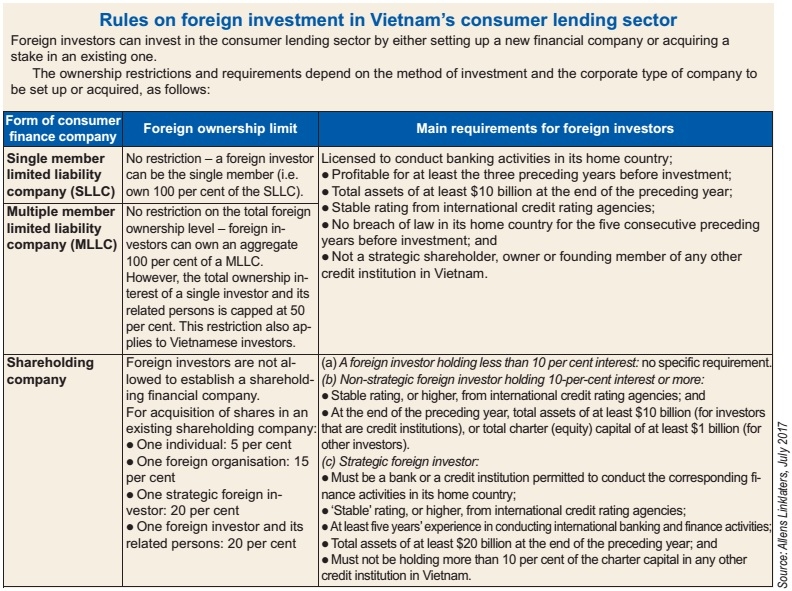

Vietnam is becoming a new battleground for overseas investors in consumer finance. These newcomers, rather than setting up their own business, prefer to acquire a dominant stake in existing Vietnam-based firms. The latest example is South Korea’s Shinhan Bank, which forked up $150.8 million for Prudential Vietnam Finance Company in January.

In the same month, South Korean firm Lotte Card finished buying out Vietnam’s Techcom Finance, closing a deal valued at approximately $75 million. Late last year, Japan’s Shinsei Bank took over a 49-per-cent stake in the consumer finance arm of Vietnam’s Military Bank, renaming the business MB Shinsei Finance Ltd.

“We’re eager to join the highly promising consumer finance market in Vietnam with Military Bank. We believe that we can offer an international network and our well-established experience to the joint venture,” said Yukio Nakamura, deputy president of Shinsei Bank. Insiders noted that this deal only took place after Shinsei had carefully studied its Vietnamese partner for six years, and decided that it was time to enter the $2.4 billion market.

Three years ago, another Japanese consumer finance business named Credit Saison partnered with Vietnamese bank HDBank for a joint venture called HD Saison. In January 2018, HD Saison beefed up its charter capital from VND800 billion ($35 million) to VND1.1 trillion ($48 million).

Besides buying shares, foreign investors are also extending long-term loans to Vietnamese consumer finance firms. In November 2017, Deutsche Bank from Germany granted a loan worth $100 million to FE Credit, the consumer finance division of VPBank and sector leader with 40 per cent of market share. This is the first time the German bank has offered a sizeable loan to a Vietnamese consumer lending business.

Earlier that same year, FE Credit received another $100 million of capital from Credit Suisse Singapore. Both loans from Deutsche Bank and Credit Suisse are secured over a portfolio of FE Credit’s consumer loans receivables.

Kalidas Ghose, CEO of FE Credit, said that the firm was able to secure “very competitive lending rates” from these foreign creditors, due to its fast growth and steady earnings.

“Loans from foreign lenders tend to be long-term, which is good for our financial health. Moreover, the loans can be the first step toward further collaborations,” he said.

|

A booming market

According to industry experts, foreign investors are lured in by the meteoric rise of consumer lending in Vietnam, a trend fuelled by the burgeoning middle class. With their rising consumption needs, Vietnamese individuals now look for a reliable source of lending, after decades of borrowing from loan sharks and pawnshops.

Nguyen Thuy Duong, financial services leader at EY Vietnam, told VIR that Vietnam’s consumer confidence index is currently at its highest in five years, topping global statistics. Vietnamese consumers, most of whom remain underbanked, are now willing to take out loans for their personal purchases.

“M&A deals in Vietnam’s consumer finance sector is expected to continue to increase in the coming years, with the participation of overseas financial giants,” said Duong.

According to research done by Viet Capital Securities, Vietnam’s consumer finance market could skyrocket by 30 per cent every year in the next two years, reaching VND1 quadrillion ($44 billion) in 2019. As consumer finance companies only take up 12 per cent of this figure, their growth potential and opportunities for foreign collaborations remain huge.

Previously, most Vietnamese banks used to treat their consumer finance arm simply as an internal division and instead prioritised corporate banking, said Do Hoai Linh, a financial expert from the National Economics University in Hanoi.

However, with the rise of consumer lending in Vietnam and keen interest from foreign investors, Linh noted that many banks are rethinking their strategy, choosing to partner up with a foreign entity to seize opportunities in this fast-growing market.

Asian giants approach

Nguyen Thuy Duong from EY highlighted that deals in Vietnam’s consumer finance market often count Asian financial giants as buyers. It is easy to see the highest level of excitement from firms in Japan and South Korea, two countries with the strongest inflow of direct investment into Vietnam.

Experts believe that after years of investing in Vietnam’s manufacturing sector, Japanese and South Korean investors are breaking into the consumer finance market as part of their umbrella strategy to capitalise on Vietnam’s booming services sector. Economic expert Nguyen Tri Hieu noted that by teaming up with domestic partners, overseas investors can enter Vietnam much more quickly and easily.

“It’s the best of both worlds, really – the domestic partners can offer local knowledge, human resources, and expertise, while the foreign investor has the financial capacity, international networks, and years of experience,” Hieu told VIR. He expert added that in the past, Japanese and South Korean banks usually focused on serving foreign-invested firms in Vietnam, but with the rise of the local consumer lending market, they realised the importance of embarking on mergers and acquisitions deals.

Jacob Won, founding partner at Locus Capital from South Korea, told VIR that he has witnessed a rise of questions from his South Korean clients about Vietnam’s financial market in recent years. As the South Korean economy is maturing with lots of consumers already in debt, businesses are looking to Vietnam for opportunities.

“For consumer finance, South Korean investors prefer to buy over 50 per cent of stakes in the business and become a strategic partner there with a long-term view,” said Won.

Insiders expect this trend to continue, especially as South Korea recently developed its New Southern Policy, tapping into Southeast Asian countries like Vietnam as their next biggest partners.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- EU and Vietnam elevate relations to a comprehensive strategic partnership (January 29, 2026 | 15:22)

- Vietnam to lead trade growth in ASEAN (January 29, 2026 | 15:08)

- Japanese business outlook in Vietnam turns more optimistic (January 28, 2026 | 09:54)

- Foreign leaders extend congratulations to Party General Secretary To Lam (January 25, 2026 | 10:01)

- 14th National Party Congress wraps up with success (January 25, 2026 | 09:49)

- Congratulations from VFF Central Committee's int’l partners to 14th National Party Congress (January 25, 2026 | 09:46)

- 14th Party Central Committee unanimously elects To Lam as General Secretary (January 23, 2026 | 16:22)

- Worldwide congratulations underscore confidence in Vietnam’s 14th Party Congress (January 23, 2026 | 09:02)

- Political parties, organisations, int’l friends send congratulations to 14th National Party Congress (January 22, 2026 | 09:33)

- Press release on second working day of 14th National Party Congress (January 22, 2026 | 09:19)

Tag:

Tag:

Mobile Version

Mobile Version