Bond issuance dips make for a disappointing second quarter

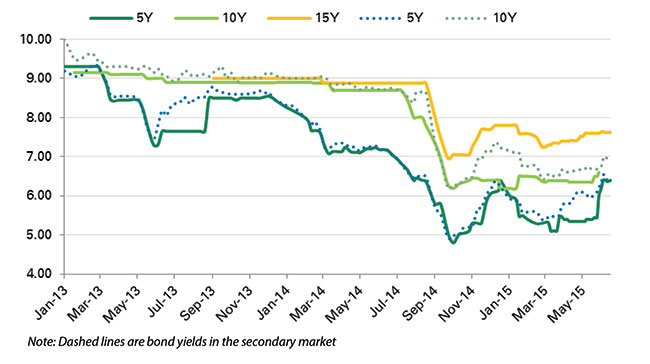

Winning bond yields, which had declined significantly in the first quarter, rose considerably across all tenors during the second quarter. There were three main factors causing the yields to rise during the Q2/2015: strong credit growth, rising inflation, and low demand for purchasing bonds in the primary market. The winning rate of the second quarter as a whole stood at just 32.7 per cent, remarkably lower than the level of 73.5 per cent of the previous quarter. In the second half of the year, both credit growth and inflation are expected to grow at a faster pace, therefore bond yields will likely increase further.

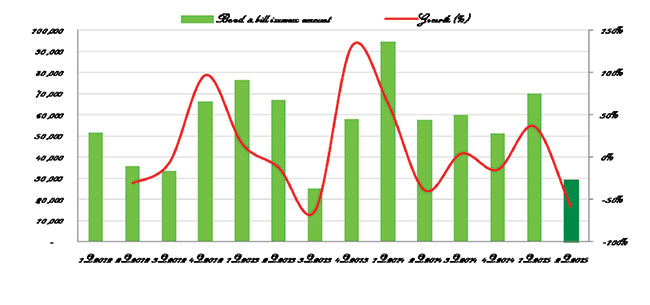

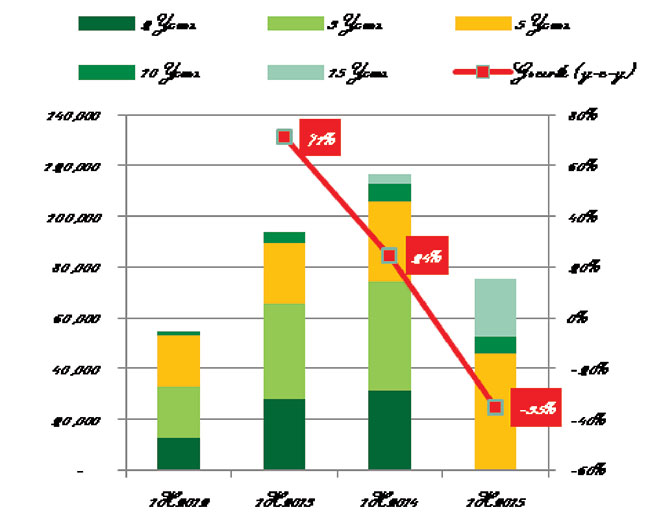

During the second quarter, the government successfully mobilised just VND29.373 trillion ($1.34 billion) of bonds and bills in the primary market, completing 26 per cent of the Q2/2015 issuance plan. Overall in the first six months of 2015, the total issuance value of government bonds and bills reached VND99.314 trillion ($4.54 billion), down 28.6 per cent compared to the same period last year. Government bonds and government guaranteed bonds made up VND90.564 trillion ($4.15 billion), down by 31 per cent year-on-year as of June 30.

Bonds issued by the State Treasury (ST) in the first half of the year totalled VND75.305 trillion ($3.45 billion), completing only 30 per cent of its yearly issuance plan. The Vietnam Bank for Social Policies and the Vietnam Development Bank issued VND6.259 trillion ($286 million) and VND9 trillion ($412 million) respectively in H1/2015. The main causes for this low issuance amount were Decision No78/2014/QH13, which prohibited the ST from offering less-than-five-year bonds, and the fact that banks are lowering the investments in bonds in order to increase their lending activities. In addition, in the beginning of April 2015, bond issuers pushed yields below investor expectations. This was reflected by the huge spreads in mid-May of 40 to 80 basis points (bps) between the nominal offered yields and lowest yields investors were willing to receive before nominal yields were raised in June.

Additionally, in the last two weeks of June, within just two auctions, the ST successfully mobilised VND8.75 trillion ($400 million) of 13-week and 26-week bills. The ST’s bills seemed to attract significant attention from investors, demonstrated by a high volume of investors participating in those two auctions. To investors, T-bills have high liquidity and nearly no credit risks thanks to their short maturities. These successful bill actions then enhanced the total issuance amount in the primary market.

Due to low demand for purchasing bonds in the primary market, winning bond yields at the end of the second quarter rose dramatically compared to the end of last quarter. By the end of June, five-year bond yields reached 6.4 per cent per annum, up 130 bps from March 31. Similarly, ten- and fifteen-year bond yields rose 21 bps and 27 bps respectively, compared to the end of last quarter, to 6.6 and 7.62 per cent per annum. Increases in inflation due to rising oil and electricity prices also contributed to investor requirements for higher bond yields. Moreover, the primary market seemed to be less attractive than trading in the secondary market, where investors could earn much higher yields. There was a huge gap between primary and secondary market bond yields for all tenors during the second quarter. For instance, the gap for five-year bonds ranged from 41 to 74 bps during April and May, while the gap for ten-year bond yields ranged from 26 to 35 bps.

By Nguyen Thi Ngoc Anh Research Department VPBank Securities

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Latest News

More News

- Cashless payments hit 28 times GDP in 2025 (February 04, 2026 | 18:09)

- SSIAM and DBJ launch Japan Vietnam Capital Fund (February 04, 2026 | 15:57)

- Banks target stronger profits, credit growth in 2026 (February 04, 2026 | 15:43)

- Vietnam on path to investment-grade rating (February 03, 2026 | 13:07)

- Consumer finance sector posts sharp profit growth (February 03, 2026 | 13:05)

- Insurance market building the next chapter of protection (February 02, 2026 | 11:16)

- NAB Innovation Centre underscores Vietnam’s appeal for tech investment (January 30, 2026 | 11:16)

- Vietnam strengthens public debt management with World Bank and IMF (January 30, 2026 | 11:00)

- Corporate bond market poised for stronger growth cycle (January 28, 2026 | 17:13)

- Vietnam's IPO market on recovery trajectory (January 28, 2026 | 17:04)

Mobile Version

Mobile Version