$4.5 billion petrochemical complex looks to get back on track

|

The deadline for starting the construction has now been pushed back to “early-2017”, according to the complex's major investors - Thailand's SCG and Vietnam's PetroVietnam.

Construction of Long Son Petrochemical Complex failed to start by the end of 2016, as was earlier announced by the investors, mainly because withdrawing partner QP has not finished transferring its stake to SCG.

Qatar Petroleum (QP), which held 25 per cent in the joint venture through subsidiary Qatar Petroleum International Vietnam (QPIV), decided to withdraw from the project in 2015. A source of VIR said that SCG would take over QP’s part. Since then, the project has been pushed back multiple times.

PetroVietnam holds 29 per cent of the project. Thai Plastics and Chemicals (TPC) holds 18 per cent and SCG 28 per cent. Earlier, the Thai partners transferred a 25 per cent stake to QP.

PetroVietnam and SCG are still negotiating on other problems related to joint venture partners and documents QPIV and SCG need to sign to finish the stake transfer.

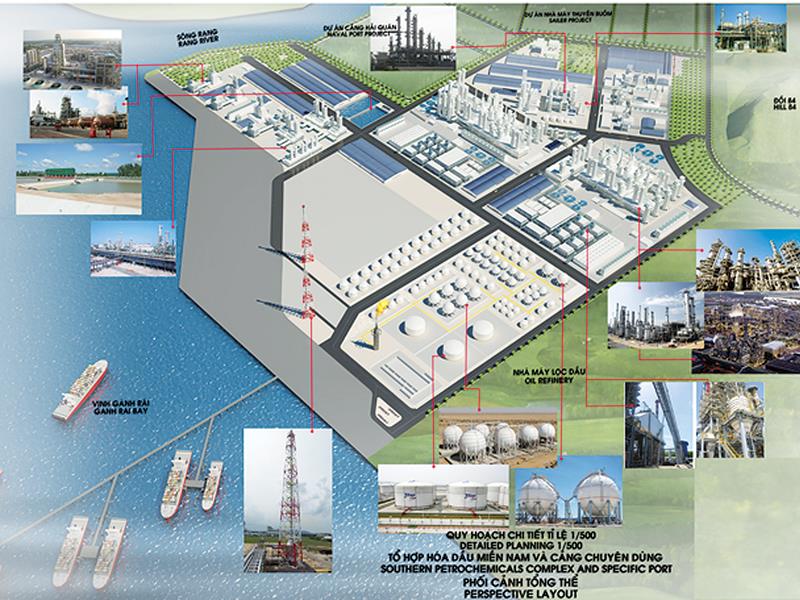

Licensed for the first time in 2008, the $4.5-billion project has an area of 460 hectares, located in Vung Tau city. Of the area, 398 hectares are for constructing factories and the remaining is for building a port. The project will produce input for many other industries, such as packaging, textile, car manufacturing, and electronics manufacturing.

SCG has earlier committed to guarantee PetroVietnam’s loans to implement the project.

According to SCG’s January 25 press release, in the financial year of 2016 SCG Cement-Building Materials unit recorded a 4 per cent drop in sales revenue on-year, to MB170,944 ($4.9 billion), as a result of strong competition. The business unit’s profit dropped 17 per cent on-year, to MB8,492 ($242.56 million), due to lower EBITDA and increased depreciation expenses.

Meanwhile, SCG Chemicals’ recorded revenue from sales reduced 6 per cent on-year to MB188,163 ($5.37 million), primarily reflecting lower chemicals prices. The business unit registered a 48 per cent increase in profit on–year, reaching MB42,084 ($1.2 billion) from the cyclical upturn of the petrochemical industry and better performance of associated companies.

SCG Packaging recorded a 5 per cent increase in its sales revenue during the 2016 financial year, to reach MB74,542 ($2.13 billion). The profit for the period registered by the business unit increased by 3 per cent on-year to MB3,565 ($101.8 million).

In Vietnam, SCG is involved in the production of building materials, packaging, and petrochemicals through the Long Son project. In 2015, Vietnam was the country with the third biggest amount of assets of SCG in the ASEAN, only preceded by Thailand and Indonesia. Vietnam was the second biggest contributor to revenue, following Thailand.

In 2015 SCG started expanding its manufacturing base for packaging paper through a capacity upgrade and expansion project at Vina Kraft Paper Co., Ltd. The move increased the company’s production capacity by 243,000 tonnes per year, enabling it to meet the fast-growing demand for packaging paper in Vietnam. The production started in late 2016, earlier than the scheduled second quarter of 2017.

| RELATED CONTENTS: | |

| $4.5 billion Long Son petrochemical complex to resume construction | |

| Land delay for Long Son complex near resolution | |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Latest News

More News

- Canada pledges $81 million for initiatives in Vietnam (January 20, 2026 | 11:41)

- KK Group opens global flagship store in Ho Chi Minh City (January 19, 2026 | 11:52)

- Gia Lai draws over $1bn in new investment so far this year (January 19, 2026 | 11:50)

- Unlocking capital flows for strategic and suitable projects (January 18, 2026 | 09:00)

- ACV begins cargo terminal construction at Danang Airport (January 17, 2026 | 15:57)

- Viettel starts construction of semiconductor chip production plant (January 16, 2026 | 21:30)

- Bel expands Vietnam production with $19.7 million investment (January 16, 2026 | 16:07)

- ASML signals long-term commitment to Vietnam (January 16, 2026 | 12:00)

- Ho Chi Minh City starts construction of four key infrastructure projects (January 15, 2026 | 17:22)

- PIDG invests with AquaOne to expand Xuan Mai’s treated water supply to Hanoi (January 15, 2026 | 11:16)

Mobile Version

Mobile Version